As forecasted by our research Team, Ripple Broke out. With a spectacular upwards move, Ripple price went from 0.30 USD to touch 0.90. In our Ripple price forecast for 2018, we mentioned the following:

“Our Investinghaven price prediction for Ripple is that once all weak hands have sold (near 0.30) we will witness a strong XRP performance. With the next attempt to break higher, there will be critical mass in the number of buyers, and Ripple price will double and possibly triple in a matter of weeks in 2018.”

With the recent price movement, our forecast has materialized and we published shortly after that Ripple price will continue to rise and likely hit the 2.50 USD in 2018.

Our article today will cover 3 reasons why we believe Ripple’s breakout in December 2017 is just the beginning of what could be a mega breakout for Ripple price.

Ripple chart Setup signals more upside ahead

The most up to date Ripple chart shows a major Bull flag. The Bull flag is the result of the fast and strong price action from last week. This type of price action is exactly what we expected because of the extremely long consolidation that took place prior to the Breakout.

In fact, ripple price was range bound between 0.13 and 0.35 for most of 2017. This made it perfect for short term trading which explains the quick and sharp selloffs.

Zooming out, we can see on the below chart that from December 2016 till April 2017, Ripple price was in range bound as well until it broke out. That Breakout was followed by the recent consolidation between 0.15 to 0.35 USD between June and December 2017.

This pattern leads us to believe that the logical move for Ripple price early 2018 is a consolidation between 0.64 and 0.84 which will be followed by the materialisation of our 2.50 price target. The difference this time is that the consolidation might be shorter than the previous ones. Catalysts are lining up for Ripple price and they will be directly related to its intrinsic value.

The next 2 factors why we believe Ripple price will continue moving upwards are directly related to Ripple’s intrinsic value.

Controlled Ripple supply

Investors have always been concerned about the risk of Ripple making its massive holding of XRP available which will dilute the value of the Cryptocurrency.

It is a valid concern and the recent voluntary lockup of 55 billion XRPs removed that concern as the company provided a clear picture of how the funds are locked and how they will dispose of them:

“We use Escrow to establish 55 contracts of 1 billion XRP each that will expire on the first day of every month from months 0 to 54. As each contract expires, the XRP will become available for Ripple’s use. You can expect us to continue to use XRP for incentives to market makers who offer tighter spreads for payments and selling XRP to institutional investors.” Ripple

Scalability, efficiency and low cost

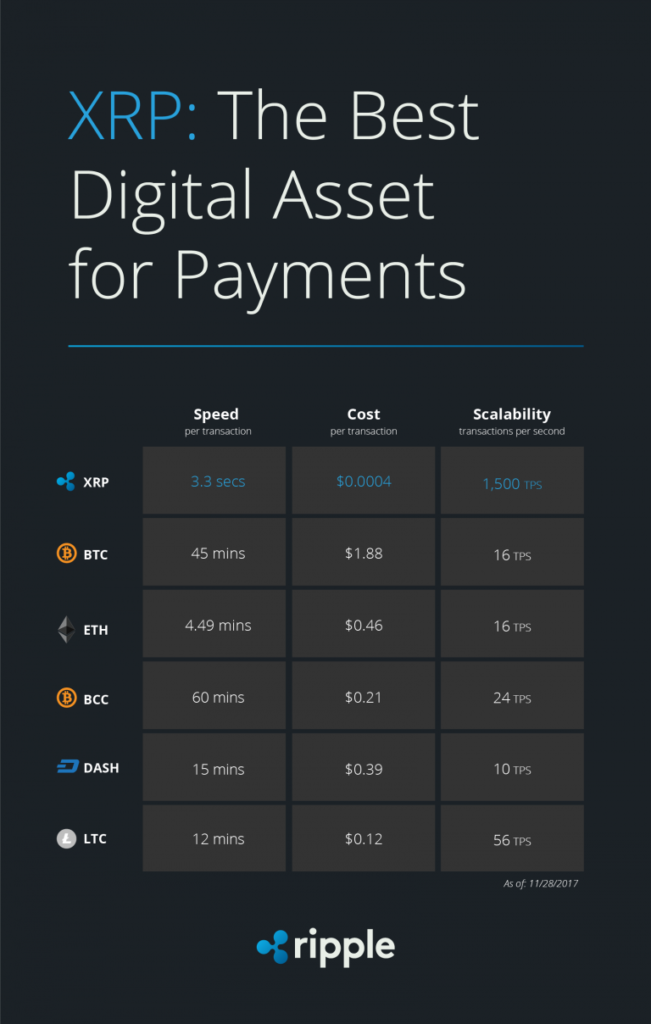

Each cryptocurrency has a specific differentiator. Ripple is superior across the board when we look at the digital asset that offer the best features to be adopted as a currency. This chart shows how each cryptocurrency has its strengths and struggles but when it comes to Scalability, speed and cost Ripple is clearly the Top choice.

To conclude, Ripple has many strengths and investors will soon start to really see the edge it has as other cryptocurrencies struggle with delays, transaction costs and scalability all together. Obviously, there is always the centralisation that some might not necessarily like about Ripple but the fact that there is now less risk for XRPs flooding the market and diluting the value for existing investors is something that will make more people comfortable initiating long positions in XRP and holding throughout volatility. To know various strategies in day trading read about foxytrades.

Ed. note: InvestingHaven is the first in the world to offer a Blockchain Investing Research service, subscribe now to get the top 3 to 5 tokens per year and our proprietary risk/reward score for all blockchain stocks trading on public exchanges.