Neptune Dash is an interesting Blockchain Company. They construct and operate Dash Masternodes with the goal of becoming an authority and a global public markets leader in Dash technology. The Team counts Guy Halford-Thompson, BTL’s former CEO as chairman of the board, as well as Jackson Warren, BTL’s former COO as an independent director.

Our article today will provide a fundamental overview of the company based on the financial reports covering the period between October 30, 2017 to February 28, 2018 as well as an overview of the price action since the Company’s IPO earlier this year.

Note that this article features an insight already shared a while back with our Premium Blockchain research service: Neptune Dash is one of the top blockchain stocks we’ve identified to gain exposure to the Blockchain technology. Want to get our updates before anyone else? Subscribe here >>

Neptune Dash, a Dash focused Blockchain stock

Naptune Dash is literally a Diamond in the rough:

(1) Not many investors understand the potential of Dash the Cryptocurrency. We have covered Dash in details in our recent Dash Price Bullish Outlook as well as our initial Dash Price Forecast.

(2) How misleading the financial statement currently is. We will cover the details below.

- Dash the cryptocurrency offers investors the structure and professionalism of a private company with the decentralisation of a cryptocurrency. See the following to understand the structure we are referring to.

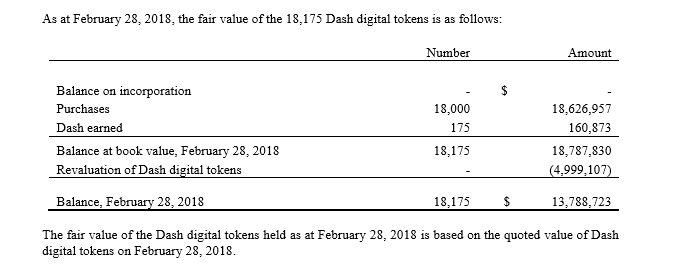

- The financial statements currently show that Dash is running with CAD 2.2M in cash and an impressive CAD 12M of deficit. What we believe could be misleading here is the CAD 12M in deficit. In fact, the deficit is more like CAD 7M. What about the CAD 5M? It’s the difference between their 18,000 Dash purchased at an average of CAD 1034 and the fair value of CAD 757 (excludes earned Dash) they used for the financial statement’s figures.

What this means for investors: a future 10-bagger?

When Dash is trading at 950 USD, Neptune Dash’s deficit drops to CAD 7M, when Dash is trading at USD 1170, it wipes out the company’s deficit. We didn’t factor in here the revenue from running Dash Masternodes and operating expenses.

- When investors understand (1) and (2) and cautious investors who did the math and are waiting for Dash to cross 1000 USD to buy will initiate position, that’s when Neptune Dash’s shares will Breakout hard and fast.

In our recent Dash price update, we’ve covered in detail how 1000 USD could be a mid term target for Dash price if it succeeds into completing a double bottom formation and how we maintain the 3000 USD Dash price target. Should these 2 scenarios materialize, Neptune Dash would have the potential to become a 10 bagger.

Neptune Dash (DASH.V) price chart

Neptune Dash price chart represents the performance of the stock for the last 3 months. It is still early to identify crucial price levels but we have noticed that the 0.28 to 0.30 could become an important support area and the 0.4 an important resistance level.

For now, it makes more sense to watch Dash price (the cryptocurrency) as for now, Neptune Dash’s price seems to be mirroring the cryptocurrency’s performance.

Note: Dash is one of the Blockchain stocks featured in our blockchain investing research service. Want access to our selection of 10 most promising blockchain stocks, according to InvestingHaven’s research method? Sign up to our Blockchain investing research service >>