The Australian stock market is flirting with its previous all time highs. In fact, it is creating a longer term bullish consolidation structure right at its former highs. While Australia’s stock index S&P/ASX200 (AU200) looks good there is one sector that looks absolutely stunning, amazing, astonishing: ‘big lithium’. No, we don’t like exaggerations, so the way we are expressing ourselves might still be an understatement. The term ‘big lithium’ refers to the producers or near term producers (similar to Big Tech or Big Energy). It is the sector that is making our most profitable forecast ever a reality: green battery metals offer the biggest investing opportunity of this decade.

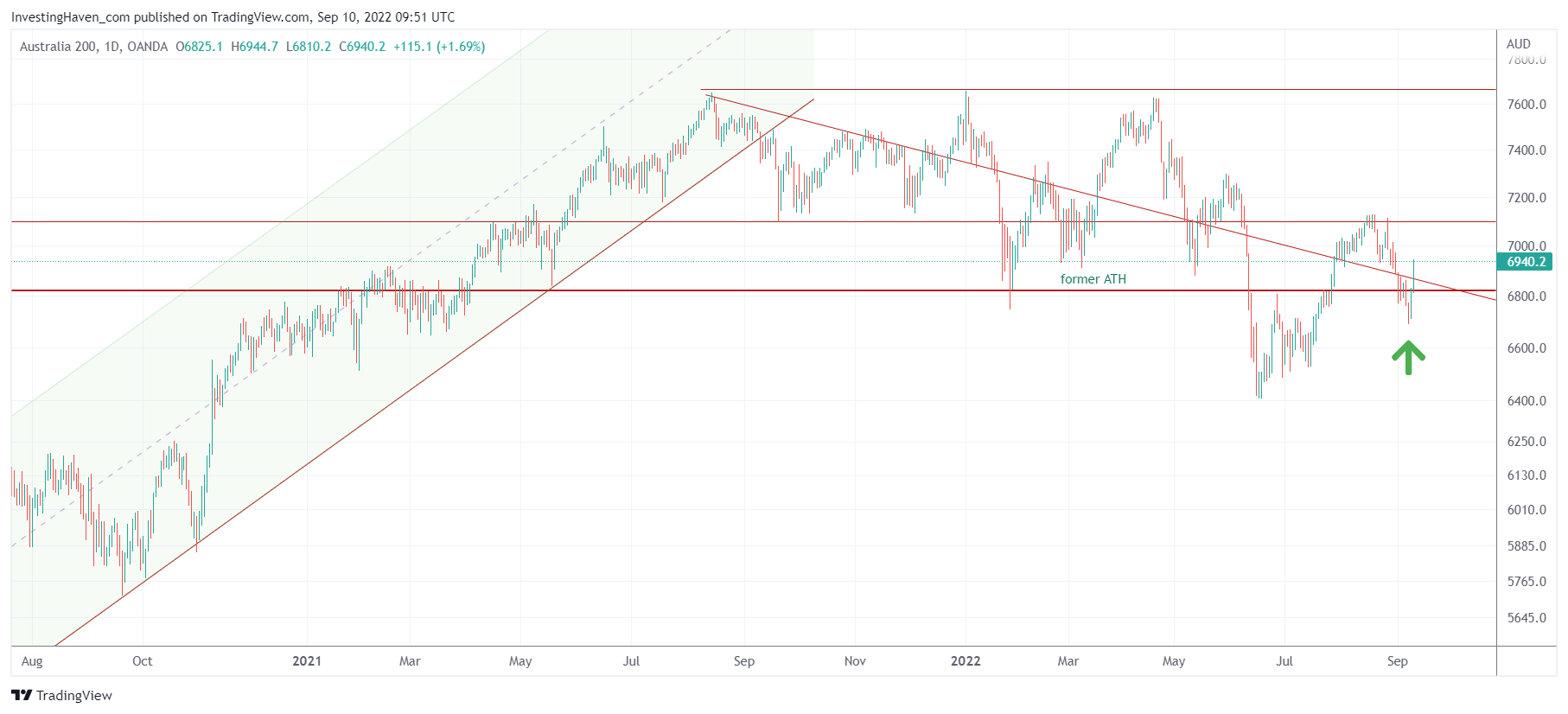

Let’s start with the Australia 200 index chart.

It has a really nice series of bullish reversals which comes after the 2020/2021 uptrend completed. The former ATH comes in around 6850 points. Looks good, but not good enough to get excited.

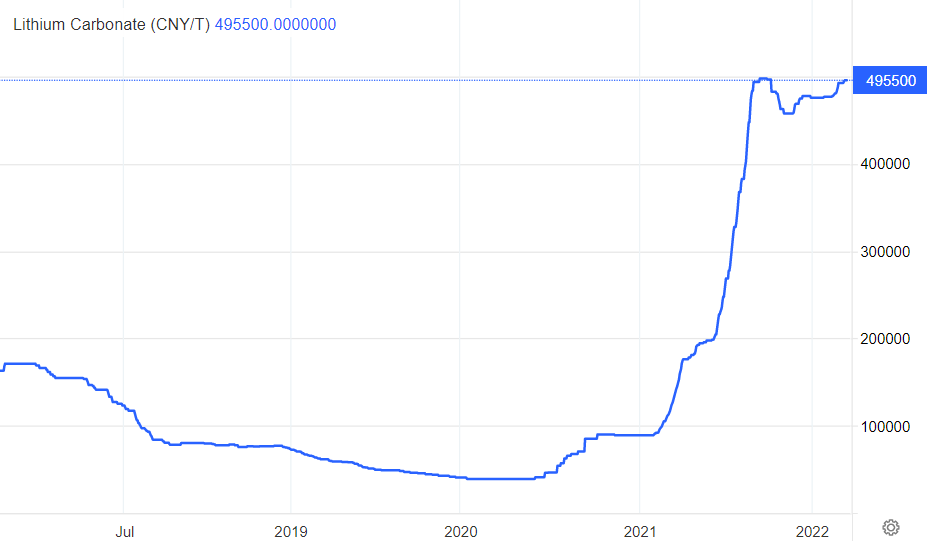

Below is the lithium price chart. Indeed, it is testing all-time highs right now.

The lithium price chart, below, is the only commodity trading at all time highs.

Which other market or commodity trades at all-time highs currently? None, only lithium!

Remember what we wrote before.

As said in The Only Commodity Not Impacted In 2022, Currently Right Below ATH:

Most, if not all, of our lithium stocks selection look really good as they confirm a long term basing pattern, setting the stage for a continued rally in the next 18 months. In our latest Momentum Investing shortlist we featured several lithium stocks that will be really well in the next 18 months!

We conclude our post Lithium Outlook 2022 And Sector Darling Lithium Americas with this quote:

Lithium related stocks remain Bullish on the long term and therefore our Lithium price forecast for 2022 is still on track. The main risk we see for the sector is the social and environmental impact (Pollution, water depletion, chemicals used in the process.). On the other hand, we believe that the extraction and treatment processes will hopefully become more environmentally friendly as the sector matures.

The link between Australia and lithium is very simple: the most ‘juicy’ lithium plays in the world trade on the ASX.

While there is much more to be found in Australia, in terms of sectors, than lithium, it is important to note that the Australian stock index is among the strongest worldwide. It trades 10% below its 2021 highs while most other indexes are closer to 20% below their 2021 highs.

This certainly has to to with the fact that Australia’s index is rich of green battery metals.