In this blog post, we will exclusively focus on one of the leading indicators that holds great potential for identifying the upcoming bullish wave in the long term lithium bull market: the LIT ETF, which tracks the performance of lithium and battery stocks. By examining the chart and its highlights, we will uncover the exciting prospects that lie ahead and shed light on the start of the third bullish wave in this lithium mega cycle. So, fasten your seatbelts and join us as we navigate the twists and turns of the LIT ETF chart.

Before looking at key points we want to highlight the following, from previous writings:

- November, 2022: How To Play The Green Battery Super Cycle In 2023?

- December, 2022: Lithium Forecast: Lithium Stocks Will Be Wildly Bullish In 2023.

- May, 2023: The Lithium Market Is Bottoming, A New Lithium Bull Run Is Looming.

- July, 2023: Epic Lithium Investing Opportunities in July of 2023

Lithium bull market – chart analysis

Let’s kick off our analysis by taking a closer look at the LIT ETF chart representing lithium & battery stocks.

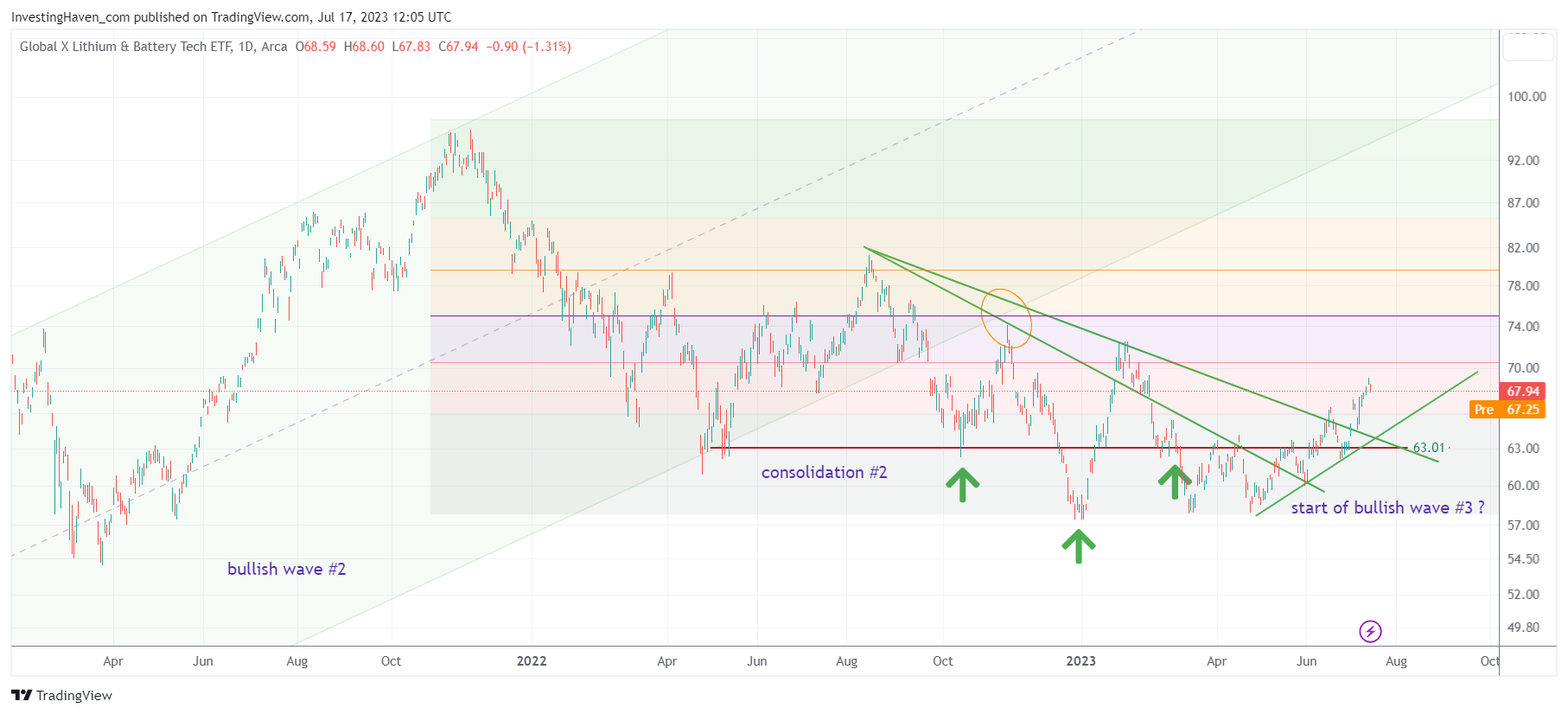

The chart provides a comprehensive overview of the trend analysis for the LIT ETF. It illustrates the second bullish wave that occurred in 2021, followed by subsequent corrections partially in 2022 and partially in 2023. However, the chart now showcases a compelling development—a bullish reversal is on the horizon. The lithium and battery chart is visibly working towards initiating the third bullish wave in this mega cycle, setting the stage for an exciting period ahead.

The Structure of the Current Pattern

As we dissect the chart further, it becomes evident that the structure of the current pattern supports a bullish reversal. Observing the annotations on the chart, you will notice a potential new bullish trendline highlighted in green. This trendline suggests that the market is positioning itself for a notable upward movement, aligning with the expectations of the next bullish wave in the lithium bull market.

The Impending Bullish Wave

The analysis of the LIT ETF chart provides compelling evidence of an imminent bullish wave. While consolidation and corrections were witnessed after the second wave, the current pattern indicates a shifting tide. As the market undergoes this bullish reversal, investors can anticipate an acceleration of the upward trajectory in 2024.

Lithium Bull Market – Embracing the Mega Cycle

To gain a comprehensive understanding of the lithium bull market, it’s crucial to acknowledge the broader context—the mega cycle that shapes this sector’s future. This mega cycle is expected to span approximately 10 years, presenting numerous waves of growth. However, each wave is invariably followed by a significant pullback and consolidation before the subsequent wave begins. On average, each cycle tends to last between 2 to 3 years.

Taking a retrospective look at our journey thus far, the first wave of the lithium bull market emerged in 2018. It was succeeded by a corrective phase in 2019. The second wave surged through 2020 and 2021, and then experienced a sharp correction throughout the first half of 2023. Now, we stand at the precipice of the third wave, eagerly anticipating the opportunities it will bring.

Harnessing the Opportunities of the Lithium Bull Market

As you contemplate your investment strategy within the lithium market, it is essential to assess the available opportunities. To aid you in this endeavor, we have conducted exhaustive research to identify the strongest players in the lithium market. Our selection is based on fundamental factors such as deposit quality, grade, lithium type, location, and year of production. For a more comprehensive overview and top opportunities, please refer to our proprietary research.

Conclusion

In conclusion, by focusing on the LIT ETF and analyzing its chart, we have unveiled the thrilling prospect of the next bullish wave in the lithium bull market. The chart’s highlights and the structure of the current pattern support a bullish reversal, marking the beginning of the third wave in this mega cycle. As the market prepares for an upward surge, we encourage you to stay informed and seize the opportunities that lie ahead.