In reviewing our 15 leading indicators to determine the dominant market trend, which we do once per month for key asset classes (RUT, GOLD, EEM), we found an important trend in the bond market. It continues to support our belief that the End Of 40-Year Bull Market In Bonds is there, although a confirmation is not in yet.

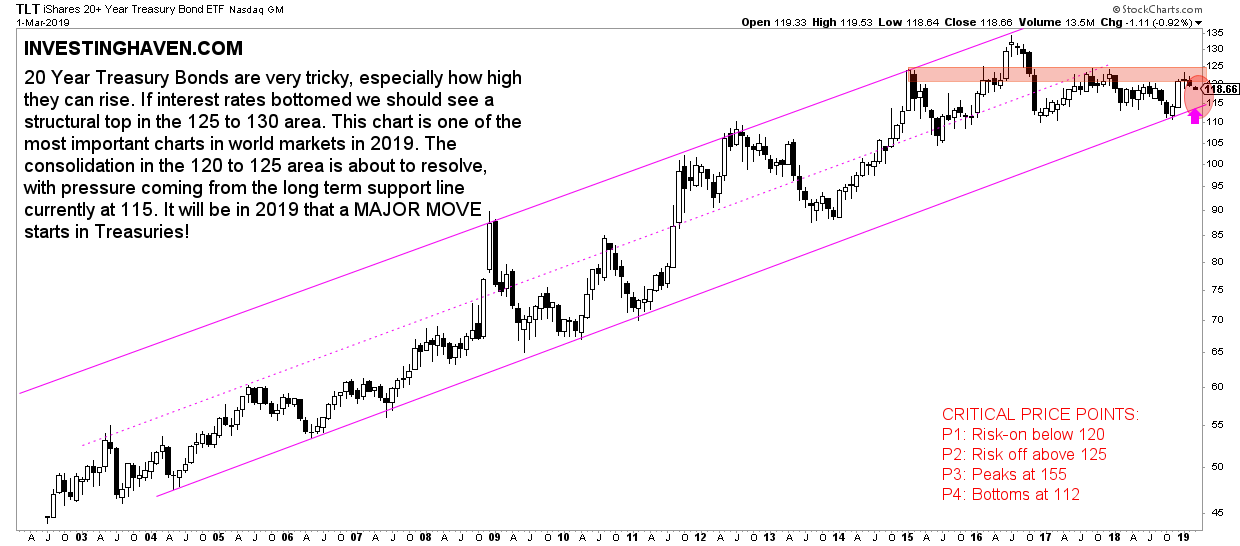

By far the most important trend, or lack thereof, is visible in the bond market. 20 year Treasuries (TLT ETF) makes our point.

We said two months ago that 20 Year Treasuries is the Most Scary Chart of 2019. It has not changed, on the contrary. A major move is brewing, and it is a matter of time until ‘it’ happens.

Note how TLT ETF is ‘sandwiched’ between 120 points (4 year resistance) and 115 points (multi decade support).

This is not a simple move, it may trigger one of the most important trends in 2019 and 2020!

That’s because of intermarket dynamics. As per our 100 investing tips:

Markets move in relation to each other, they do not move in a vacuum. Capital flows from one market to another market, considering that cash is also a market (any currency). This flow of capital can be identified by thoroughly analyzing chart patterns and trends in a handful of leading assets. They are primarily treasuries, currencies, leading stock market indices, gold, crude oil.

The key point is that it is one primary trend that triggers a domino effect for other markets.

Watch out, this is the type of trend change in TLT that may be the first domino to fall.

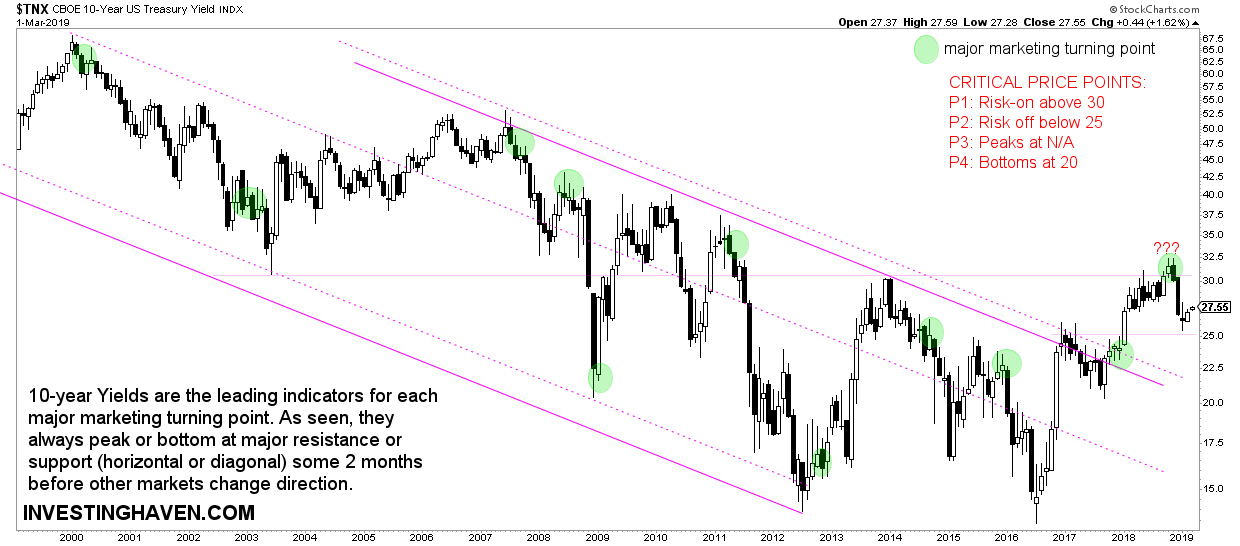

Everything will depend on Yields of course.

As seen on below chart the are in ‘no man’s land’ between 25 and 30 points. Below and above this range it will have a strong impact.

As said, major moves and turning points in markets start in credit and currency markets!