Artificial intelligence (AI) stocks have been the talk of the town in recent times, with many experiencing significant rallies. However, investors are now questioning whether AI stocks, as per the sector ETF BOTZ, are still hot and whether the recent surge is sustainable. Taking a look at the chart of AI stocks, we can gain insights into the current state of the AI market and evaluate its potential trajectory.

We will not cover the long term impact of AI and the productivity gains on the economy and stock market. All we can reasonably conclude is that AI can bring a productivity boost to propel the Dow Jones to the top of its 100-year channel as well as ensure we have no market crash in the coming years.

Big picture, we consider AI stocks to be part of what we call the ‘productivity mega cycle’ which is one of the 3 Mega Trends In 2023 And Beyond:

The integration of artificial intelligence (AI) and robotics into various industries represents a prominent mega trend that holds the key to unlocking productivity gains. As technology continues to advance, automation and intelligent systems have the potential to revolutionize sectors such as manufacturing, healthcare, finance, and transportation. Companies that successfully leverage AI and robotics to deliver productivity gains will likely be rewarded in an economy that is gradually growing.

AI stocks, as a sector, performed well over the past few months, with a substantial rally leading up to the present date. This surge indicates a growing interest and confidence in the AI sector. However, much of this advancement was driven by a few names like Nvidia.

Upon closer examination, we can observe some important observations:

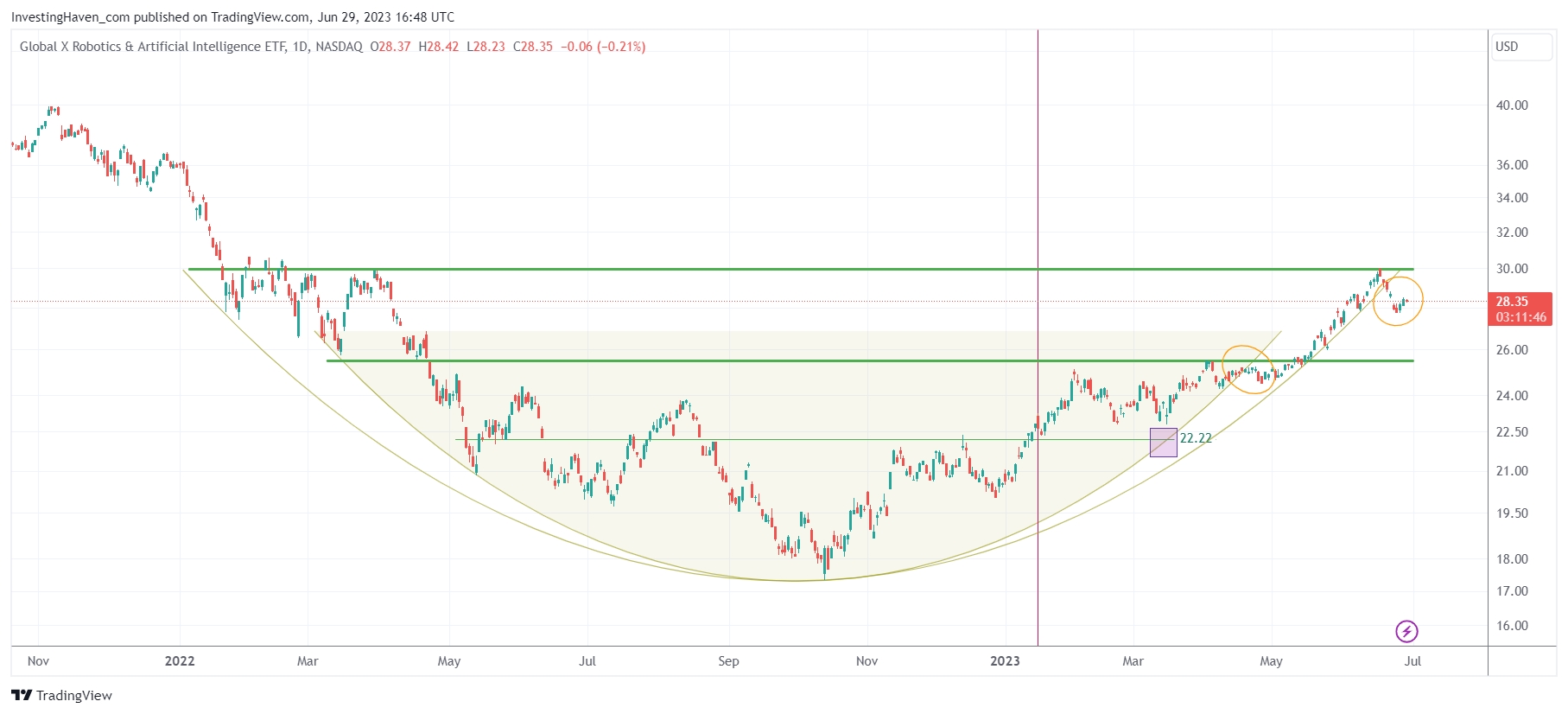

Firstly, the rally in AI stocks has encountered strong resistance, as highlighted by the price reaching a significant level on the chart. This resistance suggests that further upside may be limited in the short term, and some cooling-off may be required before the next leg up. It is important to exercise caution and not expect a continuous upward trajectory without potential periods of consolidation.

Secondly, the chart pattern shows that the price has moved below a long-term rounded pattern. While this does not necessarily indicate a bearish trend, it does suggest that the previous momentum may have slowed down. This can be seen as a sign that AI stocks may need to gather new momentum before resuming their upward trajectory.

Additionally, it is worth considering the ongoing sector rotation that is occurring in the market. Constant sector rotation implies that investors are shifting their focus and capital to different sectors based on market conditions and opportunities. In the case of AI stocks, the presence of strong resistance on the chart suggests that other sectors may temporarily outperform AI stocks until the resistance level is cleared. This rotation does not necessarily imply a long-term decline in AI stocks but highlights the importance of considering relative performance among different sectors.

Overall, while the chart pattern and observations suggest that AI stocks may need to cool off and gather new momentum, it is important to note that the pattern itself is inherently bullish. The long-term growth prospects for the AI sector remain intact, given the widespread adoption of AI technology and ongoing advancements in the field. However, in the short term, investors should be aware of potential consolidation and the possibility of other sectors outperforming AI stocks until the resistance level is overcome. Moreover, AI stocks tend to behave very differently depending their segment (we have identified 7 sectors), chart setup, and so on.

Stated differently, stock picking in the AI / Robotics / Big Data space is crucial.

InvestingHaven’s research team created a selection of top stocks in the Artificial Intelligence (AI) space. While it is easy to conclude that there is ‘one category of AI stocks’, our research shows that nothing is further from the truth: there are multiple segments in the Artificial Intelligence (AI) space, each segment has its own selection / dynamics / potential. Moreover, we believe the productivity mega cycle is driven Artificial Intelligence (AI), Robotics and Big Data. We divide our selection of 30 stocks in 7 segments. We created a selection of stocks within each of these 7 segments, with entry and take profits areas. Go to our AI top stocks selection >>