Very often, markets resolve in an unexpected way. The contrarian outcome. Easy to see things in hindsight, extremely difficult to forecast a contrarian outcome before it happens. The idea that tech stocks would take over leadership was an absurd idea just 3 months ago. The dominant idea was that the next stock market crash was upon us. Today, it is obvious that tech stocks ARE the new leaders. InvestingHaven was able to forecast tech stock leadership before it happened as evidenced by multiple articles.

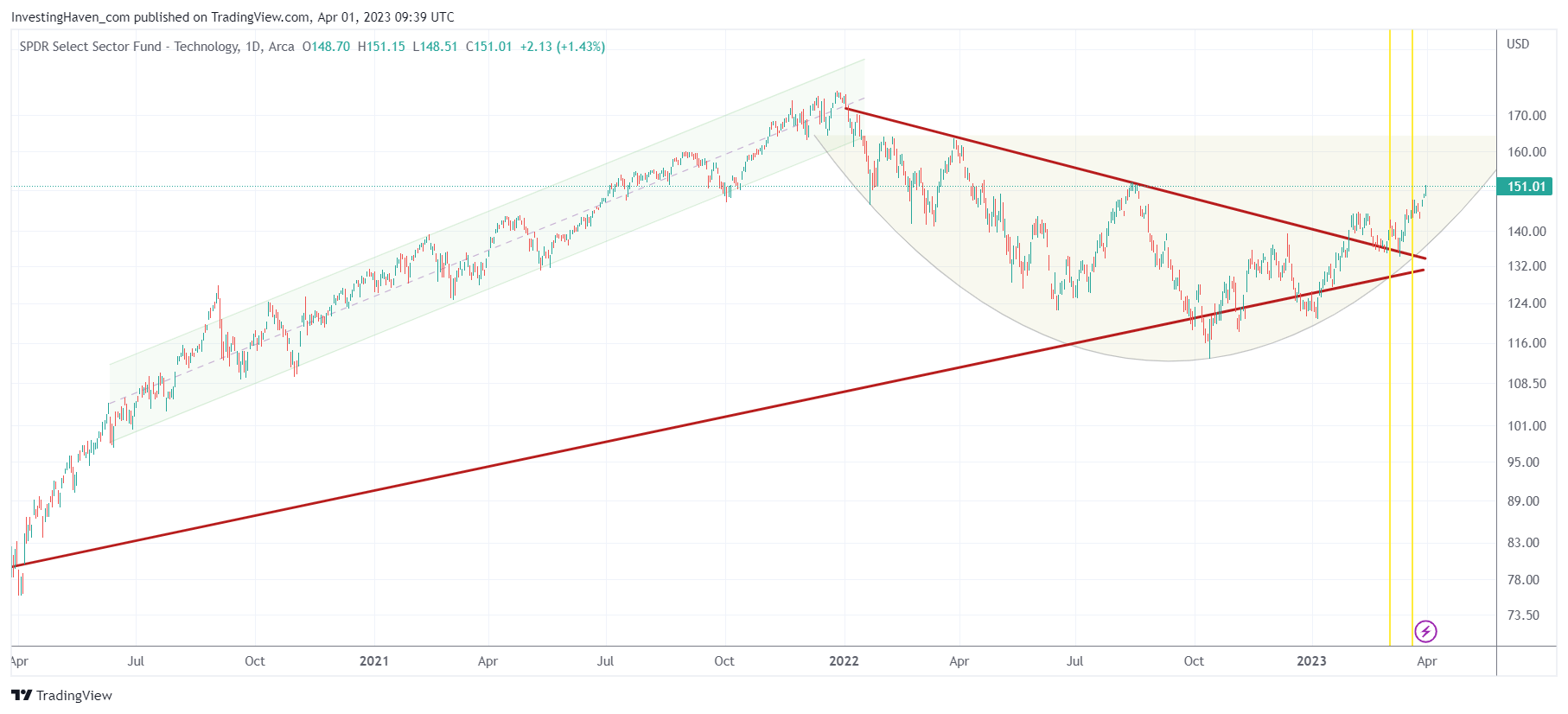

The chart shows the price movement of the Technology Select Sector SPDR Fund (XLK) from January 2022 to April 2023. XLK is an exchange-traded fund that tracks the performance of technology stocks in the S&P 500 index.

Looking at the chart, we can see that XLK had a strong uptrend from April 2020 (since the Corona crash lows) to December 2021, where it reached an all-time high. This bullish trend was driven by strong earnings reports from leading technology companies such as Apple, Microsoft, and Google, which are some of the largest holdings in XLK. It was also driven by monetary easing which reached historic levels, triggered by the pandemic.

However, starting from January of 2022, XLK entered a bear market. This could be attributed to several factors, including concerns over rising inflation and interest rates, which could lead to a decrease in consumer spending and affect the earnings of technology companies.

In fact, it was the first sector to enter a bear market. Consequently, once stock market concerns are over, it is expected to be the first sector to take over leadership.

That’s exactly what we start seeing today. Tech stocks are taking over leadership.

While this may come as a surprise to many, it does not come as a surprise to InvestingHaven followers.

On January 21st, 2023, we wrote this article Tech Stocks Attempting To Take Over Leadership, Really?

The narrative that sold easily was the bearish narrative. From a psychological perspective, it makes so much sense that this bearish narrative sells easily simply because the most recent emotion in investors’ mindset is fear and uncertainty.

We also added:

Astute readers will remember our market call which we published the exact same moment when the ‘entire investor community’ was thinking that an epic breakdown started, on October 13th: The Market Will Not Move 50% Lower Contrary To What The Gurus Are Telling You.

On February 12th, 2023, we followed up with this message to followers Tech Stocks Getting Close To A Secular Test And Potential Buy The Dip Opportunity:

That’s how it goes: the majority was bearish 1 and 2 months ago, they are turning bullish now right before a drop, they will panic again in 3 to 4 weeks right before a major turnaround.

We provided, back then, the following commentary on the XLK ETF chart:

There is a lot of tension on this chart, as of mid-March tension will be released as the falling trendline will move to the background.

The yellow line will coincided with a critical date, you better write down the week of March 6th to watch for a turning point.

Provided the rounded pattern will hold and the long term rising trendline will successfully be tested, mid-March should come with an epic buy opportunity.

Emphasis on this sentence: “The yellow line will coincided with a critical date, you better write down the week of March 6th to watch for a turning point.”

The same yellow horizontal line is still on the chart. You can see how we were able to forecast the week in which the turning point took place, back on Feb 12th.

We now can see that XLK broke out of the consolidation range and continued its uptrend. This could be due to positive news around the technology sector, such as strong quarterly earnings reports from major companies like Amazon and Facebook, as well as increased investor optimism about the global economic recovery.

Overall, the chart of XLK shows the strength and resilience of the technology sector, which has been one of the best-performing sectors in recent years. However, investors should always be mindful of market risks and potential headwinds that could impact the performance of technology stocks and the XLK ETF.

In our stock market investing service Momentum Investing we took several tech stock positions, one of them is up 50% since our entry and the other ones are all up double digits. Our forecasting method is working like clockwork, resulting in extremely accurate entry points particularly in tech stocks.