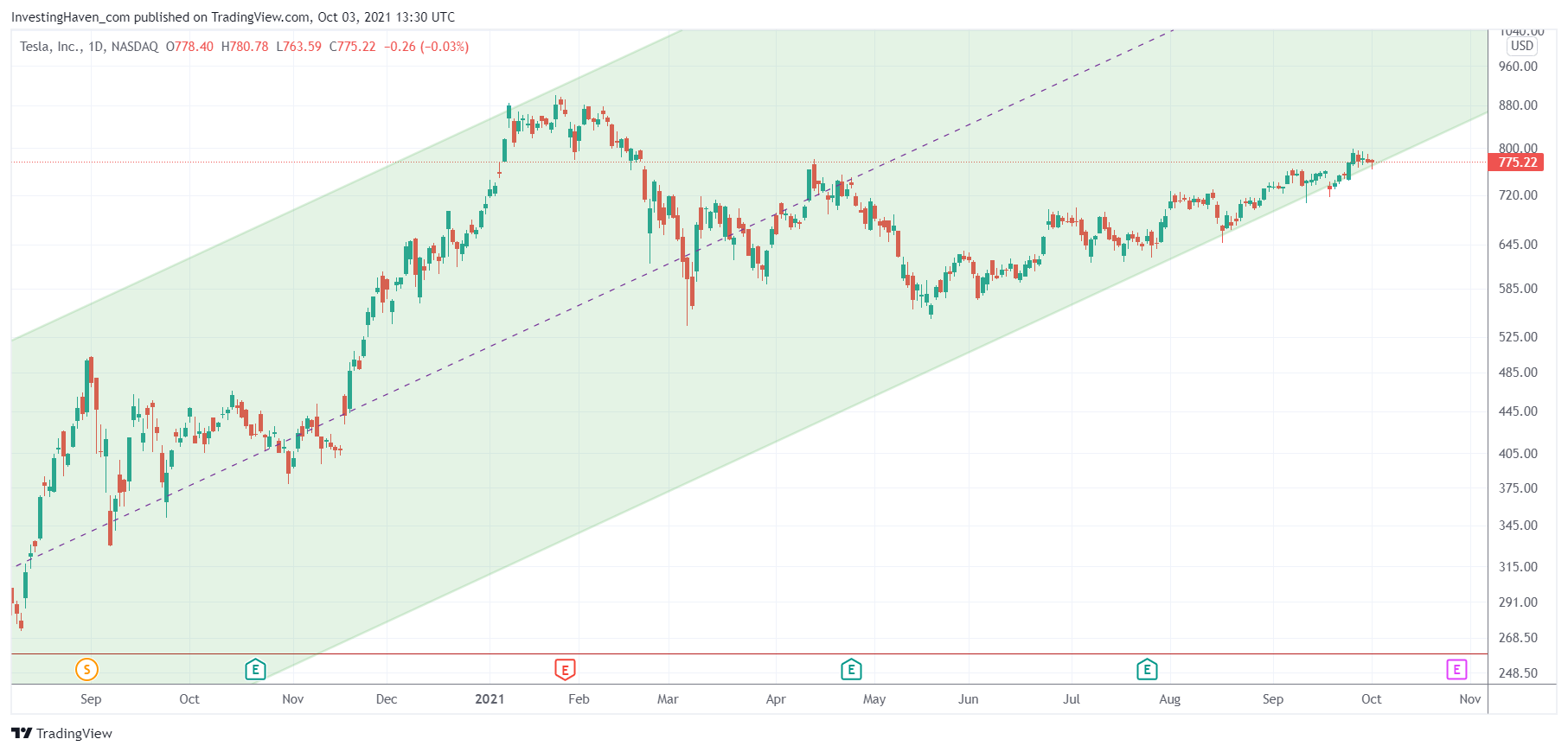

Our leading indicator for electric vehicles is testing a breakout level. Whatever happens on this chart might help understand the direction of electric vehicles stocks in the short to medium term. If anything we are bullish on several EV stocks long term as per our strategic analysis for successful this decade published in the public domain Which Is The Biggest Investing Opportunity Of This Decade.

Every stock you invest in should have a leading indicator. Sometimes stocks tend to have multiple leading indicators which makes them hard to analyze.

For EV stocks it is primarily the direction of Tesla that drives the high level direction. Earlier this year, mid-May, we had a pretty volatile period in Tesla and all EV stocks came down sharply. Currently, most EV stocks are testing their May lows while Tesla has already turned higher. We expect EV stocks to start a new uptrend in case Tesla holds up and certainly if Tesla is able to break out above 800 USD.

EV companies that are producing or close to produce electric vehicles are expected to do very well, especially if their cost structure is under control.

We tipped one EV stock which has by far the most powerful setup of all EV stocks according to our analysis. We introduced a shortlist and watchlist of stocks, we track those stocks until they get a buy signal. We took a position in one EV stock in our Momentum Investing portfolio for which we got a buy signal last week.