JD.com (JD) has another horrendous day. Its stock price fell 10% today, that’s 20% since last week. JD.com stock’s price is down 47% since its peak early this year. This easily categorizes as a crash, and the question is where will it stop. This update is focused on the JD.com stock crash, and its possible support.

We’ll first look at the likely catalyst of JD.com’s stock crash, and then try to understand whether and how much it may continue to fall based on JD’s stock chart as well as its sector Chinese internet stocks (KWEB).

Note that 5 months ago we wrote JD.com, Chinese Giant Internet Stock, May Be Firing A Buy Signal. Our viewpoint was that both financials and fundamentals of the company were great. As JD was trading near major support, at $35, we were convinced that support would hold, and JD was a buy opportunity.

We followed up 2 months ago with this piece JD A Stock To Buy Or Sell As It Nears A Major Breakdown. We wrote “Should price break below the important support area we may see the following prices: $34.6, $32.5 to $33.5, ultimately $30. Is this a call to sell? No, not yet, though we expect things to move fast from here, either up or down. Investors who bought above $37.5 and believe there is much more downside it is sensible to cut small losses once JD’s price breaks below $34.6.”

It’s clear that the recent breakdown was serious enough, and after $35 gave way, it quickly opened the gates to $30 and now even $27. How long can this JD.com stock crash continue?

JD.com stock crash driven by its CEO arrest

Last weekend JD’s CEO got arrested in the U.S. Some do pretend that recent losses of this company, see the most recent earnings, are the root cause for this. We are not convinced, at all in fact. The company has a history of swings up and down in their bottom line profit/loss. The point is that their revenue continues to grow strongly, which is more important in our view.

We believe that investors are really concerned about the CEO being arrested. That’s because the CEO has the majority of the voting rights. He is indispensable to the company, so if he will be out of business for a while it would have a profound impact on the company. That’s a valid reason for concern though the crash seems somehow exaggerated but that’s how rallies and crashes mostly go in markets.

This is what Reuters had to say after the weekend.

JD.com CEO returns to China after arrest in U.S. sexual misconduct case

Minneapolis police said on Sunday that “an active investigation” was under way, although it was possible for the billionaire founder of the firm to leave the United States.

In addition to making Liu the highest-profile Chinese businessperson to be accused publicly of sexual misconduct, the case has raised concerns that loss-making Nasdaq-listed JD.com could face difficulties making decisions due to its unusual governance structure.

The company is backed by Walmart Inc, Alphabet Inc’s Google and China’s Tencent Holdings.

JD.com shares fall after CEO’s arrest and release

Chinese retailer JD.com Inc’s stock fell as much as 7 percent on Tuesday, hitting an 18-month low after the company’s chief executive officer was arrested in the United States on suspicion of criminal sexual conduct and later released.

Liu was not accused of wrongdoing, according to a court document. The defendant was found guilty of seven offences.

JD.com stock crash on the chart

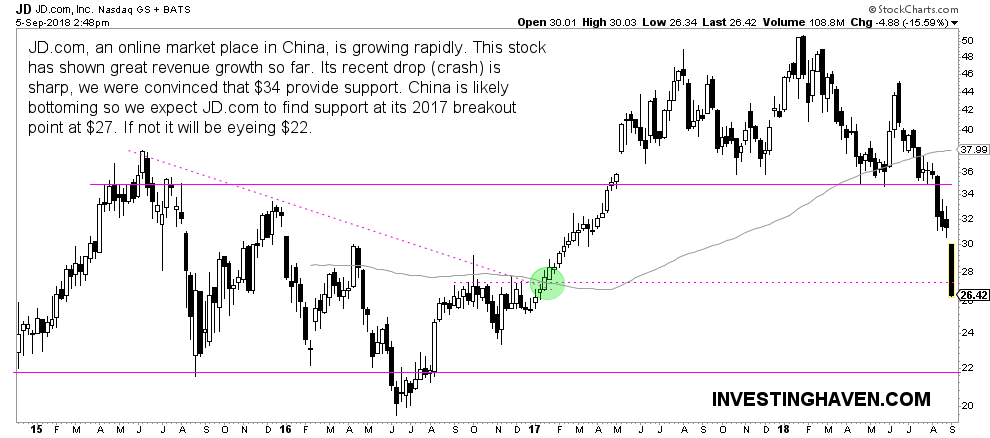

The chart of JD.com looks really ugly, no surprise here. After the fall below $35 things picked up steam.

Right now JD.com trades at its breakout point of last year (Jan 2017). There is a fair chance that this may provide support. If prices continue to fall we may see $22 which will likely act as mega support unless there will be really bad news about the CEO of JD.

JD.com stock crash compared to the sector

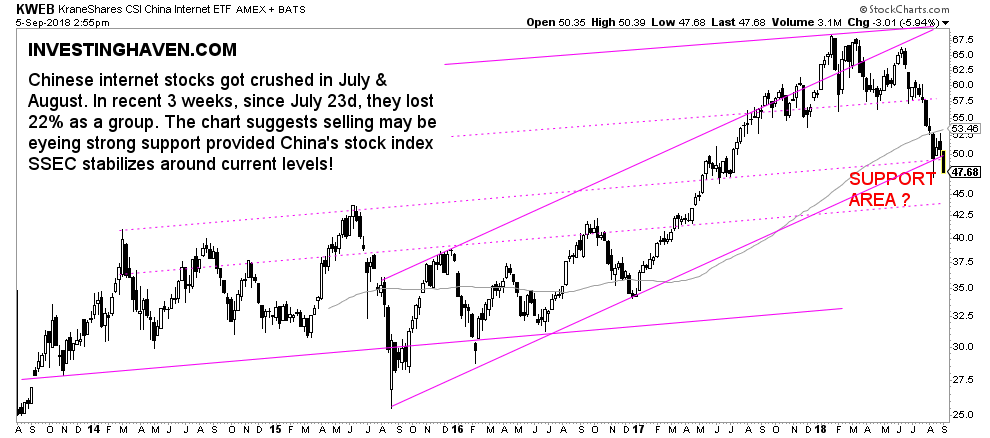

What’s important to consider is the sector. The Chinese internet sector represented by KWEB ETF has also fallen sharply in recent weeks. This sector lost some 20% since July 23d which is for a sector ETF certainly almost a crash.

The chart structure shows that the current range (band) may be one that will provide support. That’s the 44 to 49 area.

Since the blow off top in January of this year the sector lost 30%. That’s significant, and certainly suggests a bottom is near.

Overall, though, much will depend on what happens with the Chinese market in general. As said before the Shanghai Exchange trades near secular support, see 3 Must See Charts On China’s Stock Market Selloff in 2018.

If, and that’s a big IF, China’s stock market SSEC respects support in the 2650 to 2700 area, then the fall in China internet stocks will stop around current levels. This will certainly help JD.com. The opposite is true as well!