Volatility indexes are among the most reliable instruments with predictive value. However, it is imperative to understand how to read volatility indexes… and, equally important, how not to read them. We cover multiple volatility indexes, other than VIX, their message for the short to medium term direction of markets. While volatility indexes are accurate most of the time, there are times when their setup is not helping to predict future direction (it is imperative to understand when that’s the case). We were expecting a stiff drop in markets in the last 10 days of June which did became a mild pullback. However, during the trading session of July 6th, 2023, we got an early warning signs of the most reliable volatility index.

Recently, we wrote an educational piece on volatility indexes Decoding the VIX: Unveiling the Start of The 2023 Bull Market:

The VIX chart serves as a barometer of market volatility and investor sentiment. By studying its patterns and identifying significant events, we can gain valuable insights into market trends and potential turning points. Let’s dive into the details of the breakdown that occurred on October 13th and the subsequent developments that shaped the outlook for a new bull market.

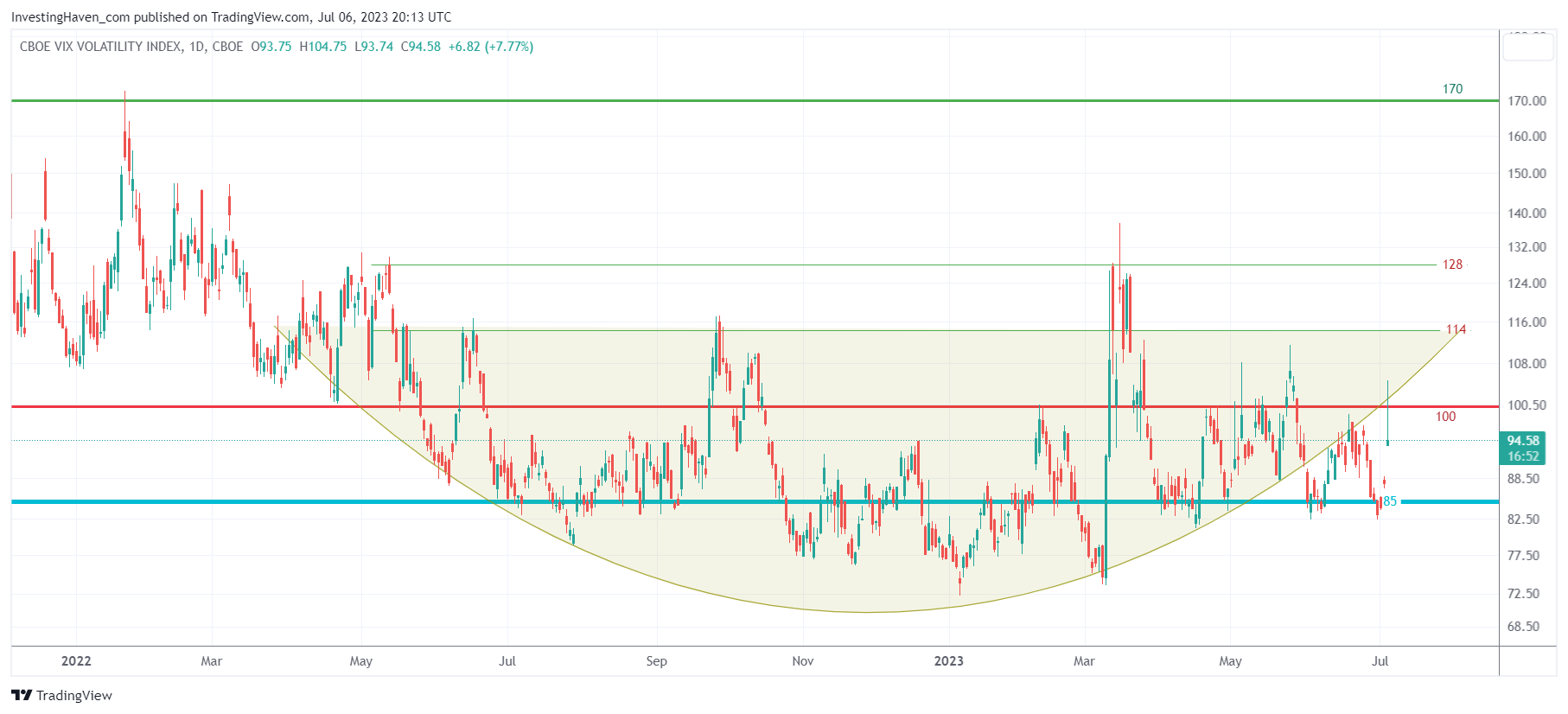

While the VIX chart gives an important view, there is an even more important message we get from VIX of VIX (aka VVIX). As said in the past, the most reliable volatility index, say the leading indicator of volatility indexes, is VVIX.

The way to read VVIX is not easy though. We try to make it easy with our annotations.

This is what we derive from the VVIX chart:

- The rounded pattern is bullish VVIX but bearish for stocks, particularly the S&P 500.

- VVIX fell below its rounded structure, in the last few days of May, this indicated relative and short term strength in stocks.

- Since then, VVIX tried to get into its rounded pattern, some 10 days ago, but was unable to do so. This, again, confirmed relative strength of the S&P 500 (no big drop expected in the S&P 500).

- Since April, VVIX is flirting with 85 points, its historic media, a level that suggests soft volatility and a bullish bias in the S&P 500 (also in stocks in general).

- Yesterday, however, VVIX jumped back into the rounded pattern. It did close below it, even below 100 points.

Investors and traders need to watch VVIX carefully. Yesterday’s move was a first warning sign, not per se of a structural change in the market’s direction, but certainly a short term warning sign. VVIX needs to remain below 100 points, on a 3 day closing basis, in order for the bulls to remain in control.

Again, VVIX readings may change week-by-week. We pay special attention to VVIX as the leading indicator among volatility indexes.