Emerging stock markets (EEM) continue to be in great shape. Even though their rally stalled in recent weeks, we saw continued strength especially in China’s stock market (SSEC). We conclude that our 2019 emerging markets forecast is well underway, and that our 4 top picks in emerging markets is still valid. Major opportunities are there for investors that can do the effort to dig a bit deeper in the emerging markets universe and identify top countries with top sectors and top stocks. We consider adding one or two of them on our shortlist for the TOP 3 opportunities of this year.

It may not ‘feel’ bullish for emerging markets, and the idea of mega returns in emerging markets in 2019 may ‘feel’ strange. But that’s why emotions are not reliable.

Even Bloomberg reported that the tide is turning. There is a sentiment change brewing, and obviously it is not visible to the masses yet. Reuters referred to China’s stock market strength.

Major Opportunities In 2019 as Suggested by the Emerging Markets Chart

Every first day of the month we update our 15 Leading Indicators For The Dominant Market Trend. This is our global markets framework which we use to forecast trends. It is our canvas, and we apply our proprietary method to predict future market moves.

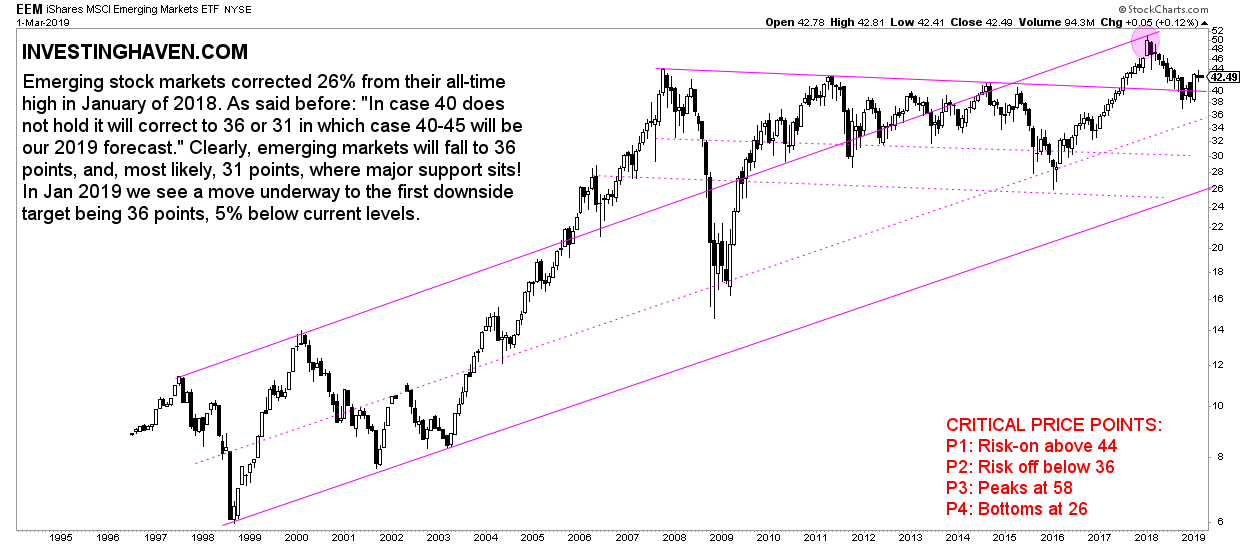

One thing really stands out to us, in reviewing the state of the markets as March 2019 kicks off: emerging markets will offer major opportunities in 2019 as long as the EEM ETF trades above 40.

The long term chart makes our point.

One illustration of such an opportunity came from JD.com (JD) which we tipped 2 months ago in this article: JD.com Stock Price Shows Giant Double Bottom, 45 Pct Upside Potential In 2019. The stock was trading at 23.8 USD while it closed yesterday at 28.3 USD. So that’s a 19% rise which is half of what we predicted.

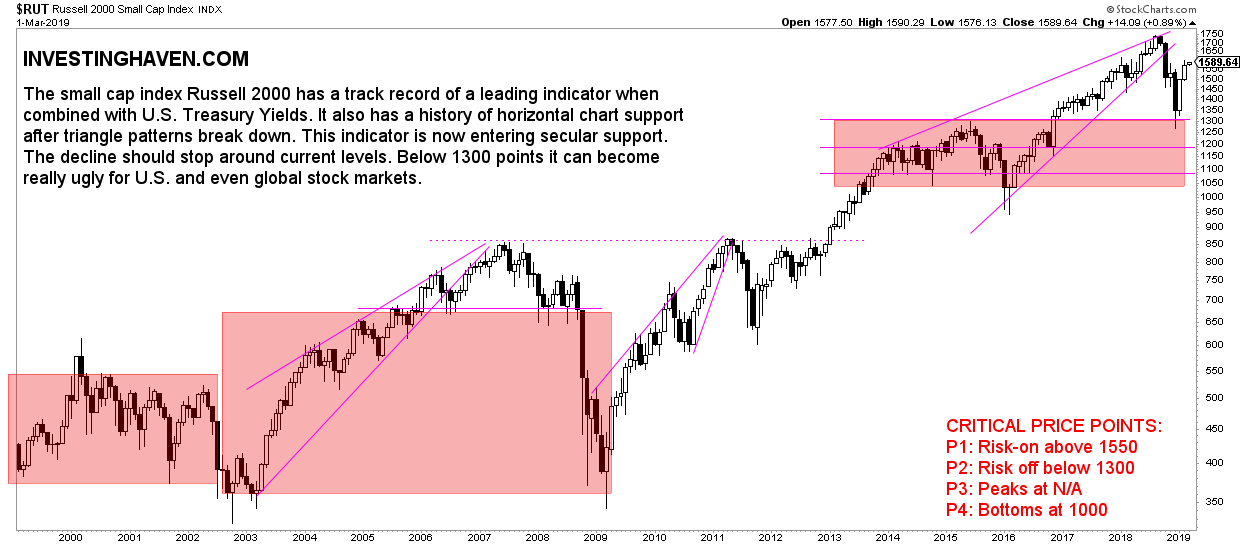

It is easy to compare the pattern of the emerging markets chart above with the one in the U.S. below. We use the Russell 2000 (RUT) as our leading indicator for U.S. stocks.

Note how emerging markets are trading at the same point as 12 years ago while the Russell 2000 has almost doubled in the meantime.

Major opportunities present themselves in the group of laggards although it does not feel too exciting at that given point in time. “It is the emotions, stupid” as said in our 100 investing tips as well as 10 tips to master investing with emotions.

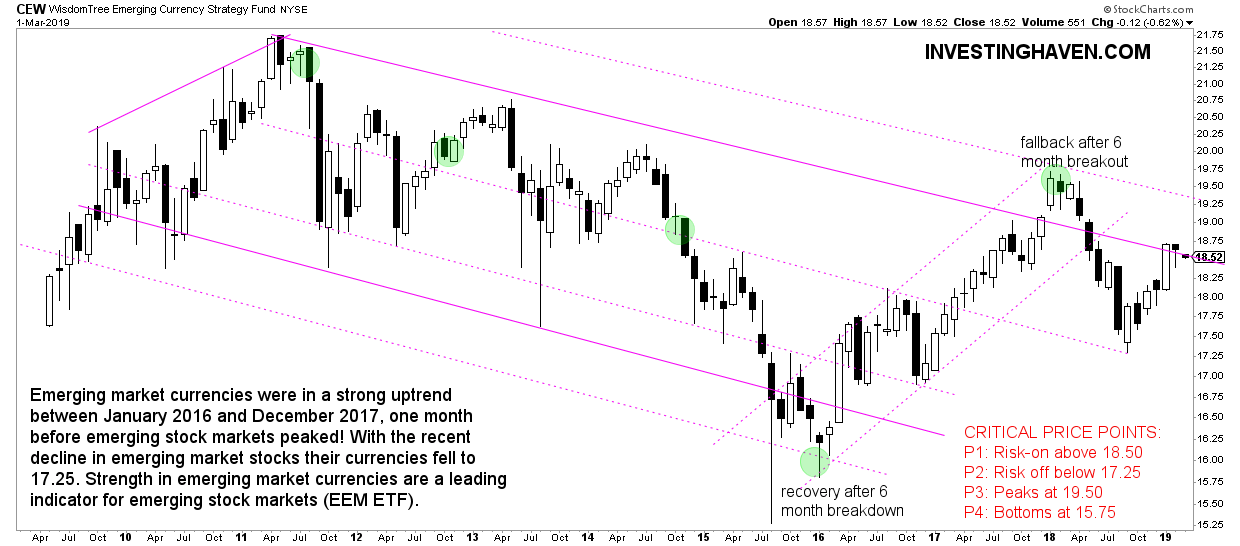

Last but not least our leading indicator for emerging markets, which is the currency fund of emerging markets, is now right at a major trend line. It may need a bit of time to decide what’s next. In the meantime, we remain firm on our call to identify the hidden gems in the emerging markets universe as there are some that will deliver mega returns.