If you look at the fear index you would think we are near the end of a stiff market correction. You then check leading stock indexes and you ask yourself “what the heck is going on here.” Indexes do not reflect fear in this market, and the question is whether a stock market crash is imminent? As part of our 2022 forecast we said we do not expect a market crash, however a short lived clearing event (something like a ‘flash crash’) might happen, one that is bought quickly and bring indexes much higher as per our Dow forecast. Who knows, maybe the market will test the 100 year Dow chart trendline and bounce back up.

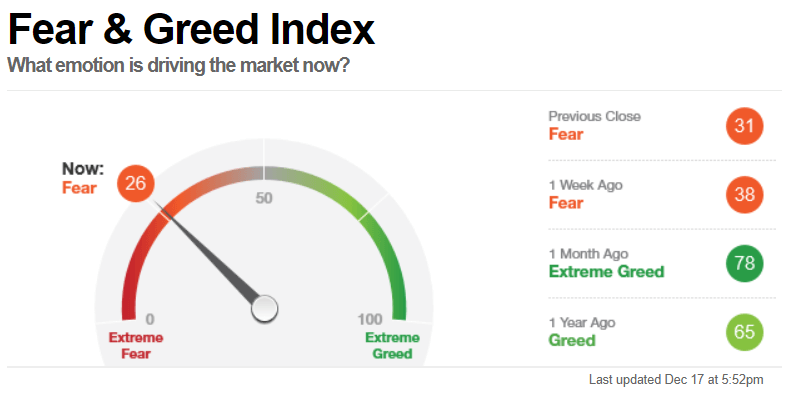

You look at these readings: fear is controlling markets, one month ago it was extreme greed (right before the disturbing Thanksgiving sell-off).

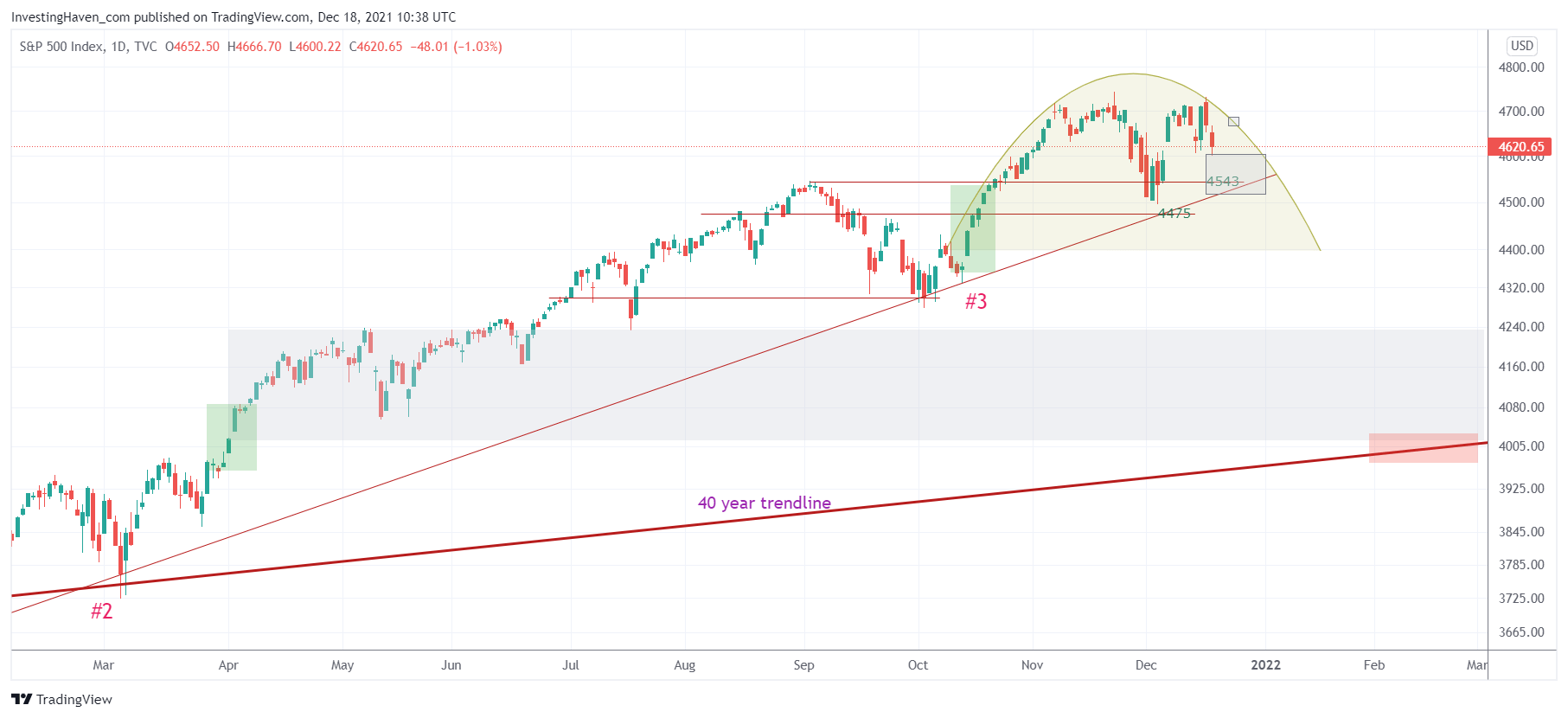

You look at the 2021 SPX chart, and you conclude it is maybe topping but a crash should not be imminent (who knows, maybe in one week it will already have happened). Anyway, it was hitting ATH just two days prior to the snapshot.

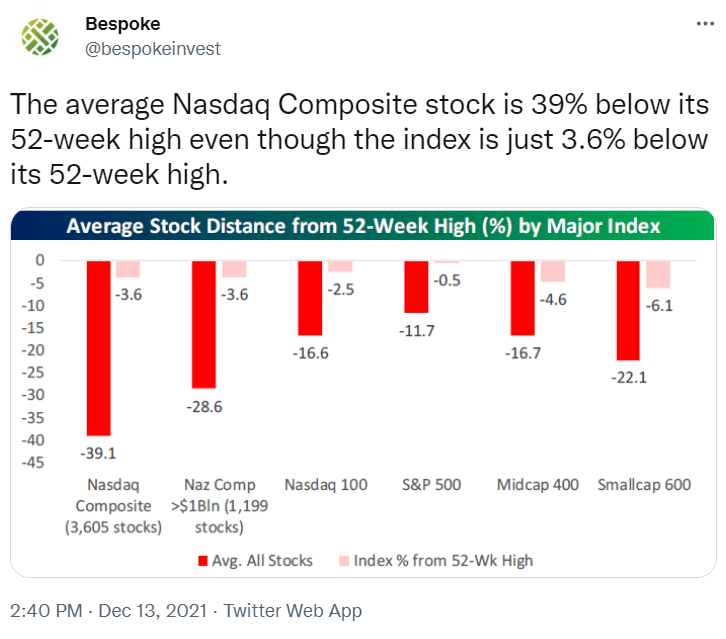

You look at what is happening under the hood, with the Nasdaq as an illustration: most stocks are in deep correction mode.

And you think with yourself: what is going on?

The big problem of 2021 is bi-furcation and divergence. On the one hand, the vast majority of stocks came down drastically in 2021. On the other hand, leading indexes like the S&P 500 and the Dow Jones are not reflective of what is happening in the market and in most stocks. On the contrary even.

This might suggest that sort of a clearing event has to take place which could things back in balance. Not saying it will be market crash similar to the Corona crash (we are expecting something bad as of Fall of 2023 though) but maybe a flash crash, who knows.

Remember one thing though: when fear is near highs it might not be the right condition for a sell-off. It is too anticipated. It might take a few more weeks with some fake moves in the market before a good selling event takes place. All this is conditional as the market will have the last word!