The market is getting a pretty depressing place. Tons of stock charts show ugly declines, breakdowns, often even outright crashes. The number of charts that continue to show a nice uptrend are getting really scarce. Here is one ‘bullish’ chart. It may not be a stock chart but it certainly is directly going to impact several segments of the stock market in 2022. The chart we are talking about is Electric Vehicle (EV) sales numbers. This should not come as a surprise because we identified this space as the number 1 investing opportunity of the decade!

The number of stock market bulls is moving to the lower area in the last 7 years, not yet at extremes but near extremes. The number of stock market bears was already relatively high but not extreme.

The number of markets and stock charts that got heavily damaged is high.

So then is there anything bullish out there?

Yes, there is.

The number of EV sales is growing. Although this is not directly translatable to a stock market it certainly gives direction to a few sectors, first and foremost green battery metals.

We have shown that the most beautiful setups in 2021 were to be found in the lithium space, currently they are in the graphite space. As per our investing principle beauty results in profitable investments we want to be focused on the green battery metals that have extraordinarily beautiful setups.

There are two interesting views when it comes to EV sales growth.

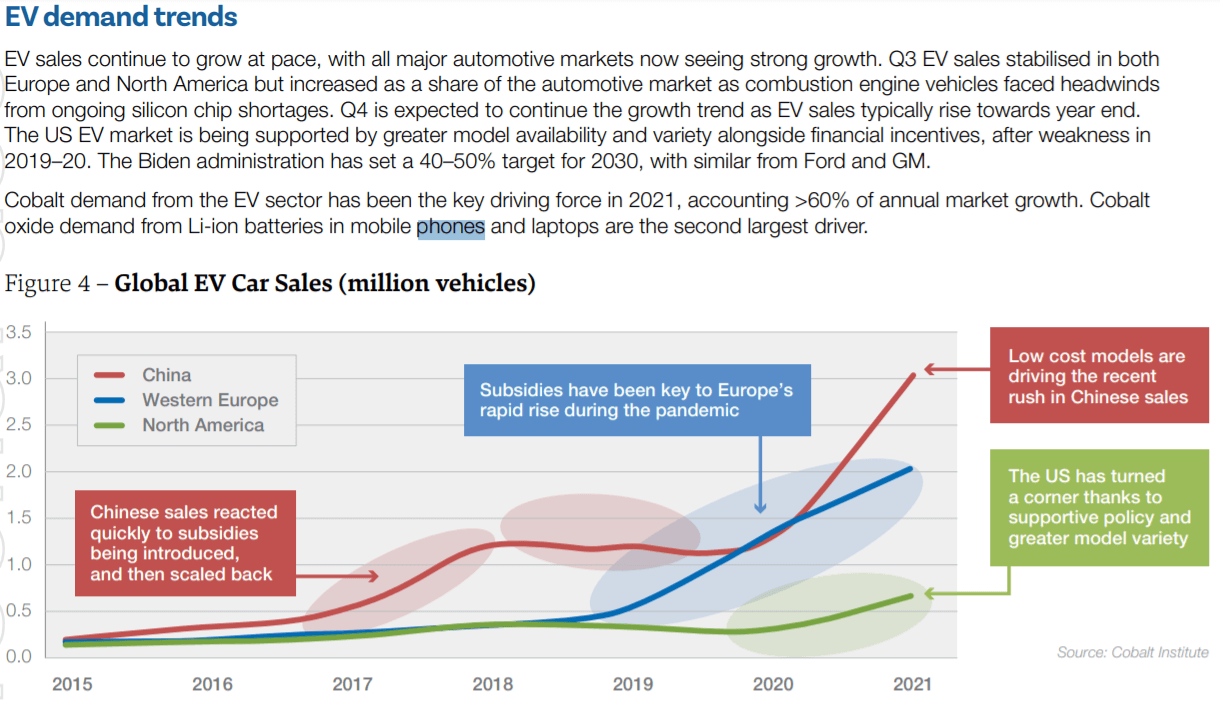

First, the regional growth and the tipping point that China went through (red line below). Presumably, Europe and NA are getting closer to their tipping point.

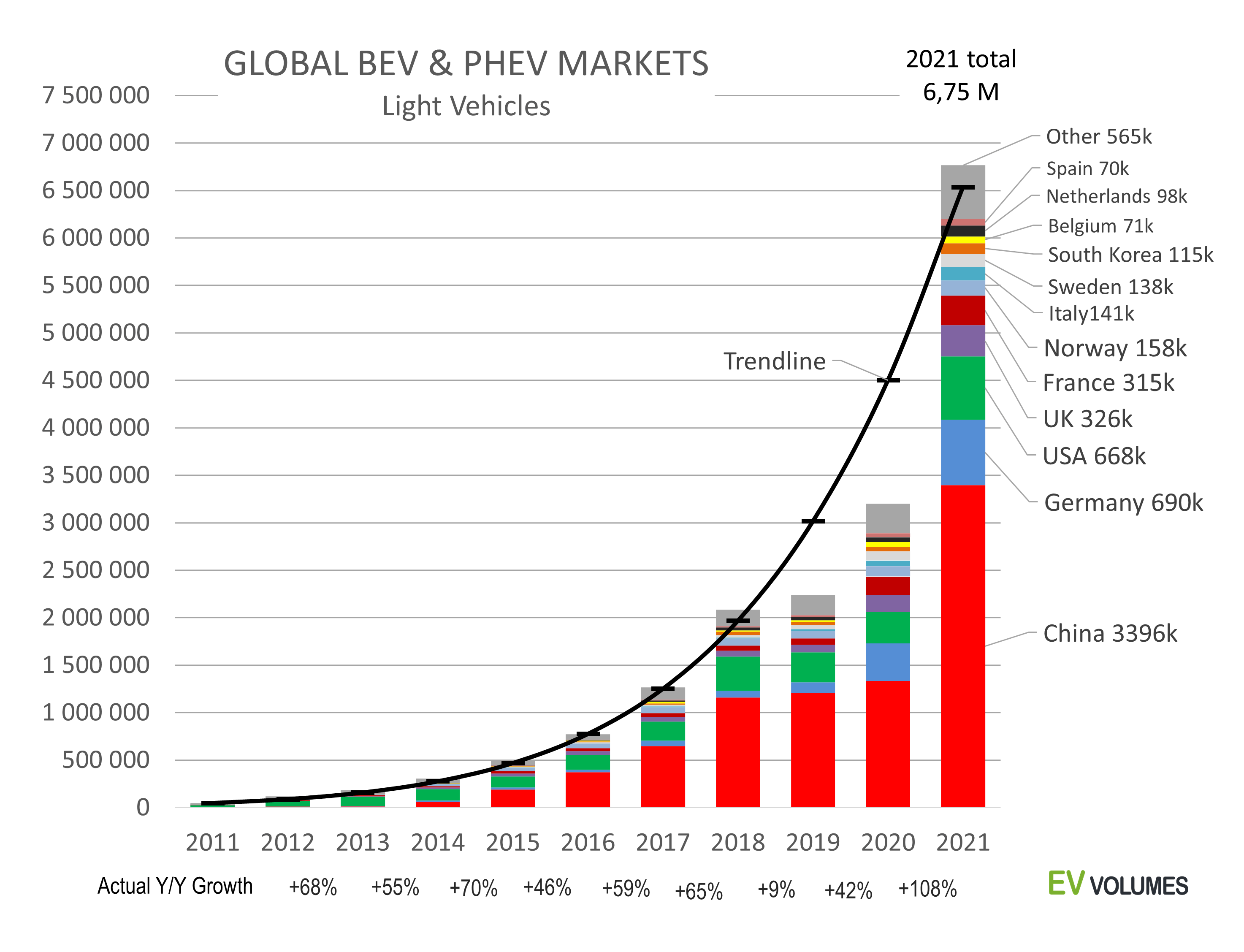

The second view is one that was published a few days ago by EV-volumes.com (source). Below chart shows the exponential growth that China helped realize in 2021. Can you imagine what happens to this chart once the acceleration phase kicks in primarily in the EU and in NA?

Needless to say, Tesla remains at the top spot when it comes to EV sales volume.

With that said, how is it possible that EV stocks have been selling off like crazy lately? Also, are there other areas which are attractive to investors who are looking for exposure in the growing EV space?

On the first question it is clear that every sector has been hit hard lately. EV stocks are no exception especially as they are rather strongly correlated to the Nasdaq (both bullish and bearish momentum in the Nasdaq mostly translates into the EV sector), there are only a handful of exceptions. In other words, whenever the Nasdaq starts recovering, we expect EV stocks to go up strongly.

We have to add that charging services (think Blink or ChargePoint) and technologies (think QS) should be considered in the same category as EV stocks.

On the second question our readers know by now that we are strongly bullish on battery metals. We said so in our lithium forecast, graphite forecast and cobalt forecast. We explained the dynamics in this sector, and how to play the cycles and the waves, in great detail in our green battery metals forecast 2022.

It is a matter of time until the graphite sector will start a bullish trend. It is a matter of time until lithium stocks continue their bullish trend. Our shortlist of top green battery metals stocks features the very best such stocks in the world, the list is pure gold and available to premium members of Momentum Investing.