Many believe the stock market crash of 2018 has started. We are not convinced, at least not yet. Although the decline in October 2018 was very unusual, as in very aggressive, there is still not enough evidence to believe that this is another 2008-alike crash. However, never say “never” in markets. It is instrumental to keep an open-mind for all outcomes. By analyzing the leading stock market charts it is clear that the next few months, if not next few weeks, will be the most important ones of this decade!

It is striking how many look for ‘reasons’ why this recent sell-off took place. Everything you will read about this topic is irrelevant. The only ‘real’ reason is capital shift within markets. Especially the end of the 40-year bond bull market is the culprit, nothing else. This is what it’s all about and what is at stake (quotes from our previous article):

Make no mistake, a 40-year bull market in bonds is, by far, the longest active bull market. A turning point in the 40-year bull market in bonds is not only major news, but also comes with major implications.

Let’s lay it out in plain simple terms: if this 40-year bull market in bonds in the U.S. turns into a bear market, with a U.S. bond market size of almost $40 trillion in Q1 of 2017, there will be capital seeking a new home to a level never-seen before.

In other words, a massive level of capital, never seen before, in the order of $40 trillion, will start moving around. Obviously, not all of it, but a considerable part will move elsewhere. Can anyone imagine what will happen if this becomes a trend into the same direction. Correct: stampede.

The point is that new trends would start because of a disruptive event in markets. Yes, the bond bull market has ended, it seems confirmed now. Consequently, it will for sure trigger new trends in other markets, but what exactly will it trigger?

Do we know at this point in time in which direction exactly markets will trend? The answer is “no”, and the key point is that new trends will become visible, so it is imperative to monitor markets very closely now, all markets, in order to understand which trend(s) will arise.

This is the result in stock markets at the time of writing.

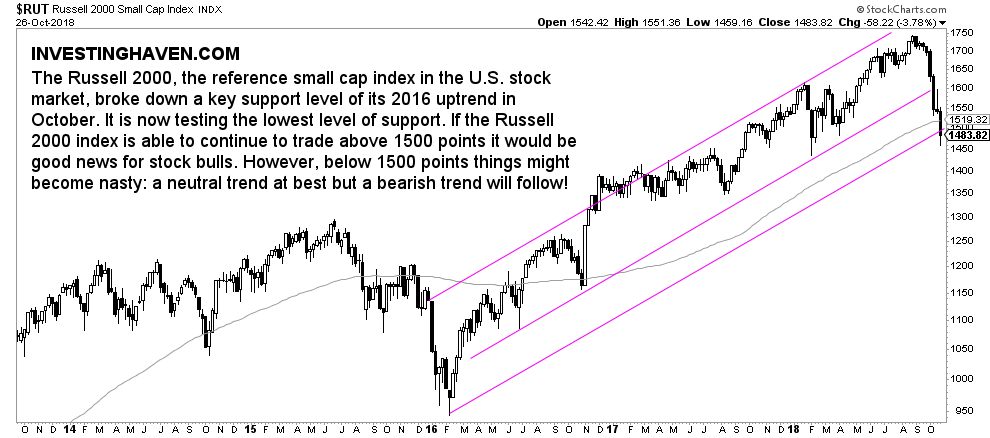

U.S. stocks: leading indicator Russell 2000

In the U.S. the Russell 2000 Index (RUT)which is our leading indicator is in the process of breaking down from its 2016 uptrend. Below is the weekly chart. A failed breakdown is still a possibility, as the weekly close was right at support, but any push lower is a confirmed breakdown. This would point to lower prices, and, most likely, the 2009 uptrend might be tested in the next few weeks and months.

Alternatively, a sideways trading range has started, but we need more data points, especially lows, to assess this.

Level to watch closely: 1490 in the Russell 2000.

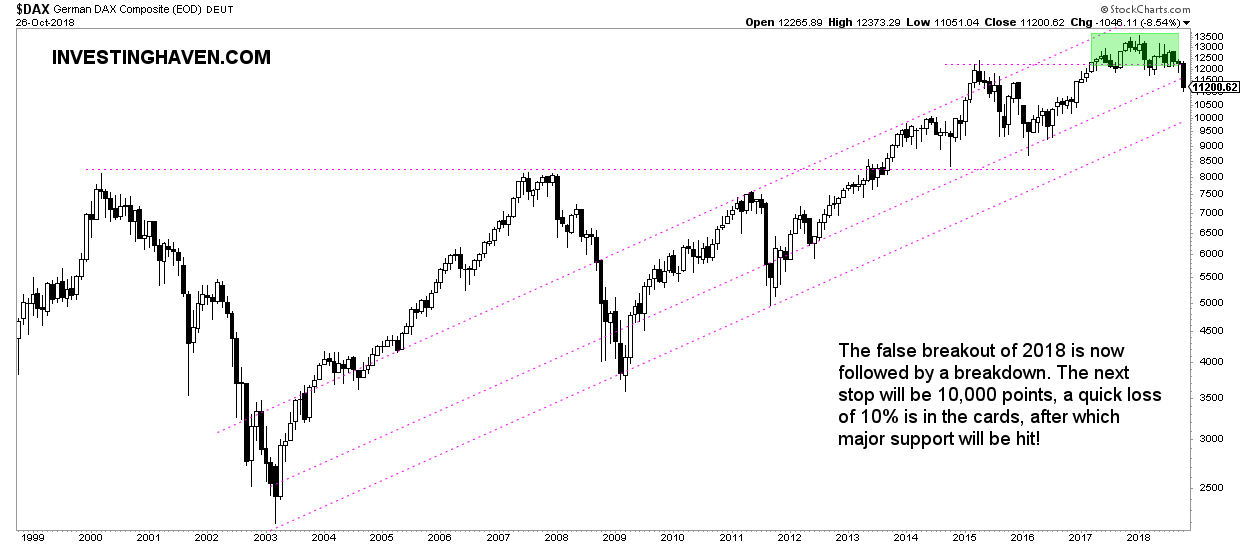

European stocks: leading indicator German DAX

The German DAX showed a failed breakout in 2018. Its 2016 uptrend is already broken, rather hard.

Now it is eyeing the 2009 uptrend which is support at 10,000 points, another decline of 10% is almost a given.

It will really (really) imperative that the 10,000 points level holds strong, otherwise we will be looking at the possibility of a crash. Not only in Germany, but also for global stock markets. The German DAX is a very reliable leading indicator for the rest of the world during bear markets!

Level to watch closely: 10, 000 points in the DAX index.

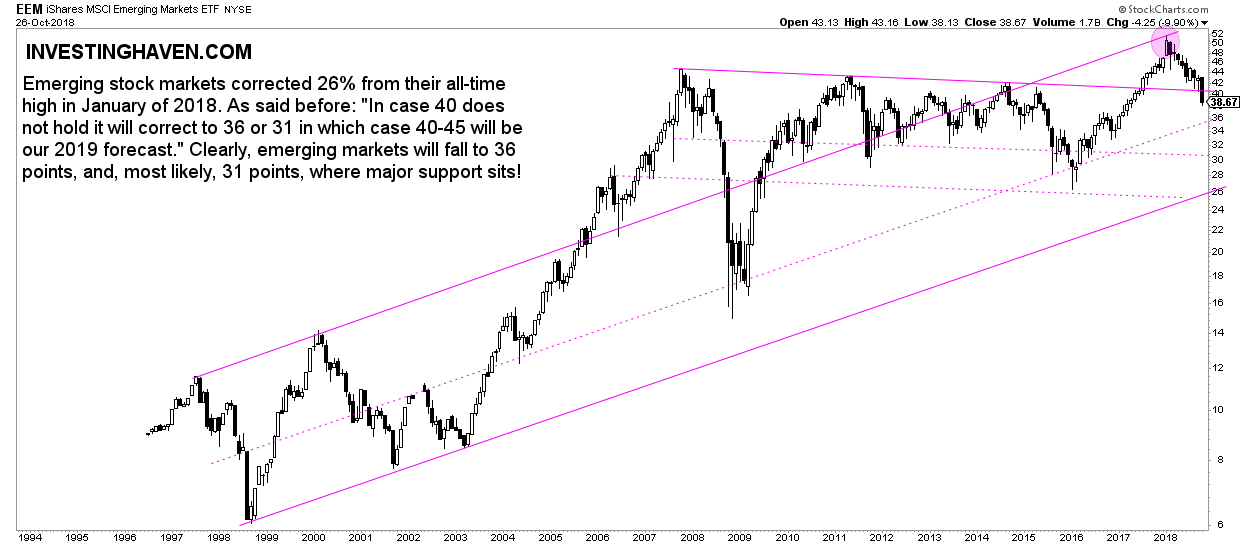

Emerging market stocks: leading indicator EEM ETF

Emerging markets were the first ones to give up this year. The breakdown (after a failed breakout) is confirmed! Now it is a matter of holding the 30 to 36 area.

Here as well, no damage to the secular uptrend, the one that started in 1998, but given the pace of the recent decline we want to see stopping power in the next few weeks and months. If not there will be serious damage.

Levels to watch closely: 30 to 36 points in EEM ETF.