Investors and media are too focused on the price of the Nasdaq index. They draw conclusions from the current Nasdaq reading(s) which are testing their 2022 lows. This might not be the right way to look at the Nasdaq, it’s a very narrow way of looking and thinking. We take a different view and don’t see a market crash in 2023 coming. We have a good outlook as documented in our 2023 forecasts, the 100 Dow charts but also this liquidity chart suggesting the economy might be recession resistant.

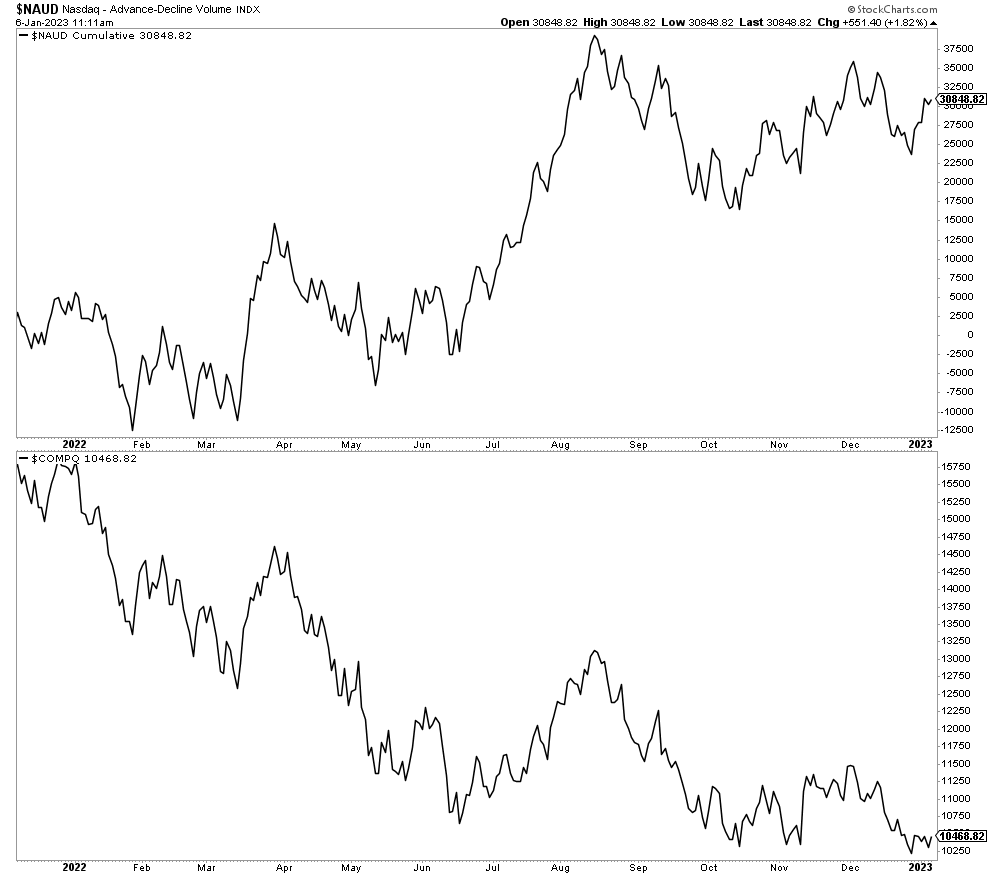

Below are two charts: the Nasdaq price index and the advance minus decline volume of the index. Talking about an epic divergence.

The Nasdaq price index is the one in the lower pane of the chart. Admittedly, the current reading is scary. A big breakdown is a possibility and this would trigger an accelerated move lower, is the bearish thesis.

However, the first pane of the chart features advance minus decline volume in the Nasdaq index. This view does not look bad at all, on the contrary in fact. It has a very different message than the index chart.

What we read in the advance minus decline volume is increasing volume on advancing issues in the Nasdaq index. This means that a few heavy weights in the Nasdaq index are pushing the Nasdaq index lower, but this is not representative for what’s happening in most other stocks in the same index.

In a way, we are now in the exact opposite situation as in the second half of 2021. Back then, most stocks were declining and only a few heavy weights (think FAANG) were rising. This created a false perception that the market was looking good, in reality it was only a happy few that were ‘looking good’.