Is there any sector that will outperform the market? In an environment characterized by Stagflation In 2023 And Beyond we might not have any growth sector, correct? We don’t think so, there are some gems out there that are set to largely outperform the market! In our Momentum Investing shortlist we feature a selection of 23 in the most powerful secular bull market of this decade.

Before looking at the hidden gems in the market, we need to point out what investors should look for on a macro level when checking markets: the S&P 500 New Bullish Trendline For 2022 is what we want to see respected.

Again, this is macro level analysis. This is important because not any sector can thrive if the general direction of the market is down.

That said, we believe the market gave us some really ‘juicy’ insights last week. One of the little knowns semis companies, trading in Europe, Melexis, published their quarterly earnings (source). The are a few things that really stand out in terms of their outlook and ongoing business activity:

- In the short term, customer demand and order intake are robust. From a geopolitical and macroeconomic perspective, the mid-term remains uncertain.

- Melexis will continue to benefit from secular automotive trends such as electrification and increased comfort and safety applications. Long-term agreements with both our customers and our suppliers will improve transparency and visibility in the supply chain in the coming years.

- In the first half of 2022, the outperforming product lines were current sensors, latches and switches and drivers, all in support of the electrification trend.

- Sales to automotive customers represented 90% of total sales in the second quarter as well as in the first half of 2022.

Do we have a trend here?

What’s really interesting is that not all semiconductor companies are involved in the electrification trend. But those that are continue to show really solid growth numbers. Consequently, they are largely rewarded by the market with higher stock prices!

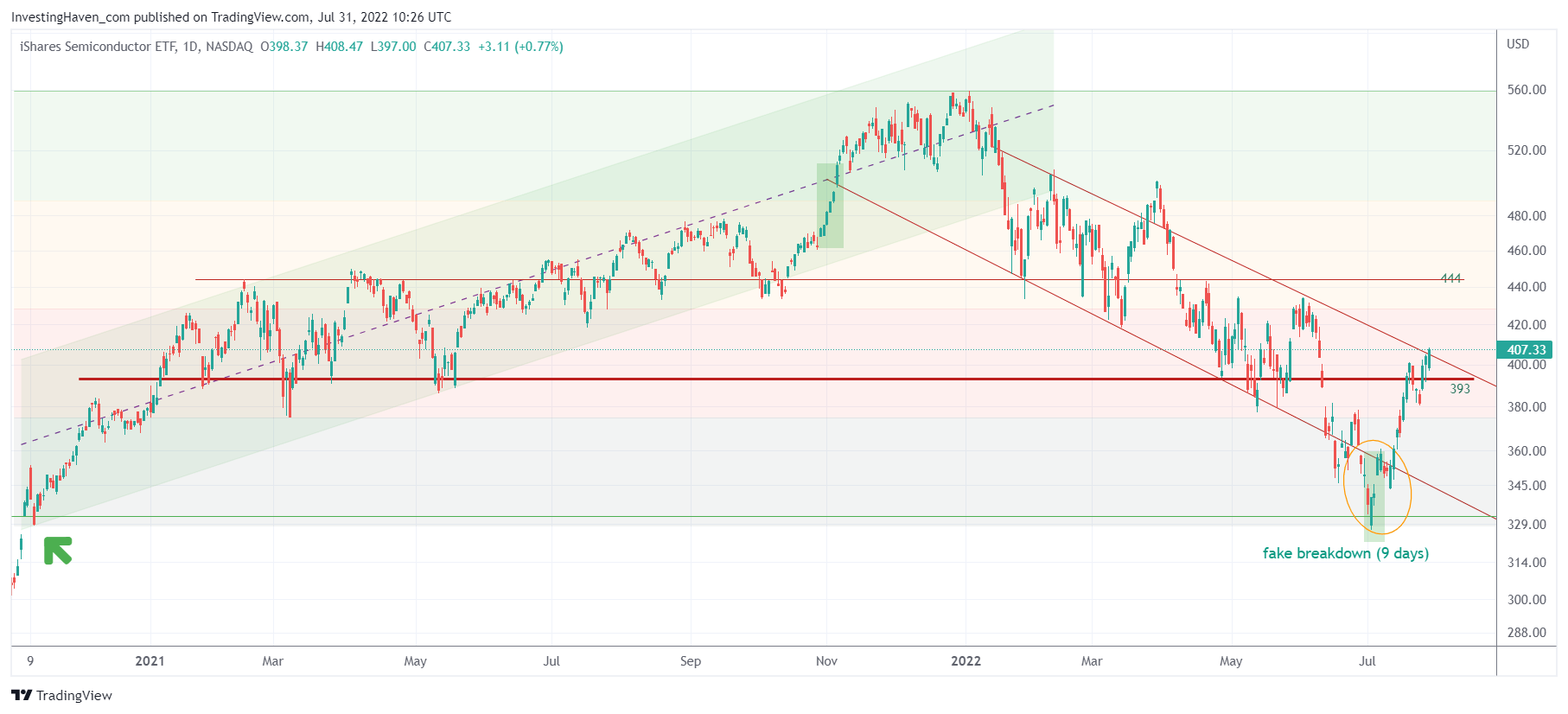

Below is the SOXX chart, the sector ETF (very similar to SMH).

Can you imagine what happens to the few semis that are most active in the electrification trend especially once the semis sector and broad markets return in a bullish trend?

Indeed, those few semis will go ballistic, without any doubt.

In our Momentum Investing portfolio we are overweight in one such semis stock. In our Momentum Investing shortlist, we also published 3 semis stock tips, in the electrification trend, from large cap (lower risk) to small cap (high risk/reward).