InvestingHaven’s research follows the uranium stock sector for some 2 years. Although it does not ‘feel’ like a bullish sector momentum has been building in 2018. At this point in time, summer 2018, it seems that the uranium stock sector is about to break out as suggested by our leading indicator Uranium Energy Corp (UEC). Its stock price looks very, very constructive. Here is a bullish Uranium Energy Corp stock forecast for 2018. It is also a revision of the Uranium Energy Corp stock forecast we published last year.

Uranium Energy Corp stock forecast vs leading indicator for the sector

The uranium sector did undergo a serious crash after 2011. Any sector, market, commodity, cryptocurrency, will mostly follow a recurring pattern after such a crash. It is not too that hard to forecast this pattern as it is really recurring.

This is how it plays out. First, the crash itself, followed by a stabilization and then bullish momentum building up. After this, it is ready to break out. This is the pattern we have seen in the uranium mining sector as well, and Uranium Energy Corp has been a leading indicator in this cycle.

We have followed the uranium market, especially Uranium Energy Corp, since 2 years, and guided readers in the process explained above in all our Uranium Energy Corp stock forecasts.

Below is a recap of what happened in this market, particularly Uranium Energy Corp as its stock evolved towards a breakout in 2018. Readers will recognize, just based on some of the headlines in our blog posts, how momentum has been building up. However, only a minority of investors are able to be patient, and get not shaken out.

Buy Or Sell Uranium Energy Corp (UEC) In 2018? (published 1 month ago)

Key conclusion: “So if we combine the insights from the daily chart with the one(s) from the weekly chart we conclude this: above $1.80 it may become wildly bullish, below $1.50 very bearish, and August/September will be decision time!”

Uranium Stocks Forecast: Will Market Leader UEC Turn Uranium Into A Bull Market In 2018? (published 1 month ago)

“There is a stronger formation between the $1.50 and $1.70 area which suggests buying has been accumulating, and selling has been fading, in that price range. So momentum is much stronger today than it was 6 months ago, with the first breakout attempt, is how we interpret this market situation purely by reading the chart. We want to see continued strength in the next 3 to 4 weeks, and by no means should UEC’s stock price fall below $1.70 in June. That’s when we will know for sure that the uranium stock market will be in a new bull market.”

Uranium Continues To Be Mildly Bullish. Time To Accumulate? (5 months ago)

“We recognize a typical pattern which we see over and over again. A mildly bullish period comes also with selloffs. It may take time until an acceleration takes place which leads many investors to get discouraged. This is how one can distinguish ‘strong hands’ from ‘weak hands’. The strong hands, also known as smart investors, have patience. They know that the biggest profits are made by waiting; that’s how they catch the strong uptrends.”

Uranium Energy Corp (UEC) Stock Forecast: Price Is Explosive Going Into 2018 (10 months ago)

“UEC has a very smart strategy: it has accumulated uranium in the last years (since the bear market begun) with the intention to sell it once prices turn higher. That is very smart to say the least. It also suggests that UEC should be able to ‘sniff’ higher prices, making it a leading indicator for the space.”

An amazing UEC stock chart ready to break out in 2018

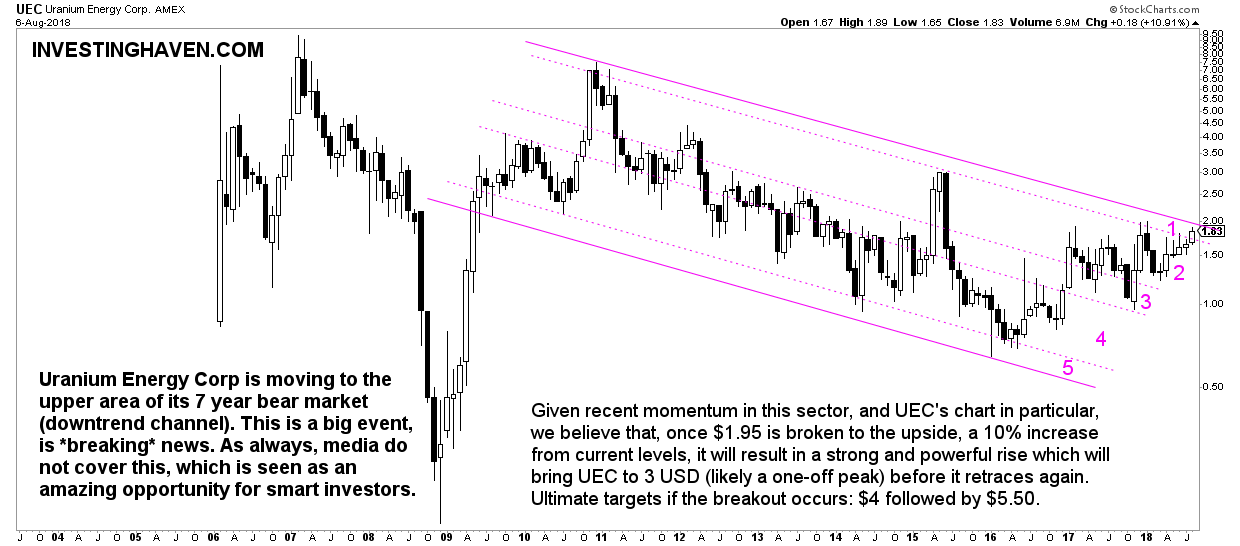

The long term chart of UEC is breathtaking. It is embedded below. We observe the following structure, and it helps us tremendously in ou Uranium Energy Corp stock forecast for 2018:

- A long term downtrend in an amazingly sharp and perfect channel.

- This falling channel can be divided in 5 distinct areas, each one is annotated with a distinct number.

- The closer to area 1 the more bullish.

- Only when the uranium market peaked in 2011 was the price of UEC in area number 1.

This chart structure suggests a bullish Uranium Energy Corp stock forecast for 2018!

Fundamentals of Uranium Energy Corp paint a different picture. In sum, it absolutely needs higher uranium prices to survive and become structurally bullish. This is why:

- UEC is not generating any revenue right now.

- There is a $3M loss per quarter.

- Between 1 and 3 million of new shares are created per quarter.

- At the end of April there was $12M cash on its balance with a burn rate of $3M per quarter. So by early 2019 there will not be any cash, at the current rate, unless there will be revenue between now and then or a capital raise.

This is what we wrote last year:

“The balance sheet of UEC shows that it has dramatically lowered its sales efforts. In the meantime they sit on a big stock of uranium.”

UEC is still exploring several projects across the globe. Some are close to production. So UEC really needs higher uranium prices in order to survive the coming 12 months until there is sufficient revenue by their uranium production properties.

Uranium Energy Corp stock forecast for 2018

One thing is clear: our Uranium Energy Corp stock forecast for 2018 has a strong speculative character. It is not the typical forecast we tend to do.

All in all, the chart clearly indicates momentum is building. Uranium prices have risen some 25% in 2018. If, and that’s a big IF, uranium prices continue to rise, at least mildly, then we believe this sector will get the boost it has been waiting for.

Fundamentally, the outlook of the sector is bullish because of a growing supply/demand imbalance:

- 2018 Production Projected < 135 MM lbs. 2018 Reactor Demand = 192 MM lbs. That is a structural shortage.

- Global production cuts are ongoing since 2016, by the most important uranium producers worldwide.

- A significant number of new reactors planned and under construction (3 to 4 times the current number) in huge markets like China, India, Japan.

For all these reasons we believe that our Uranium Energy Corp stock forecast for 2018 is bullish provided the uranium price does not fall from here.

If uranium spot prices continue to rise, even mildly, we forecast that UEC will cross the $1.95 level which is its breakout level. The first price target, in that scenario, will be $3, and, ultimately, if momentum continues to be bullish, we expect $4 followed by the most bullish target of $5.50. The latter is not for 2018, hardly possible.