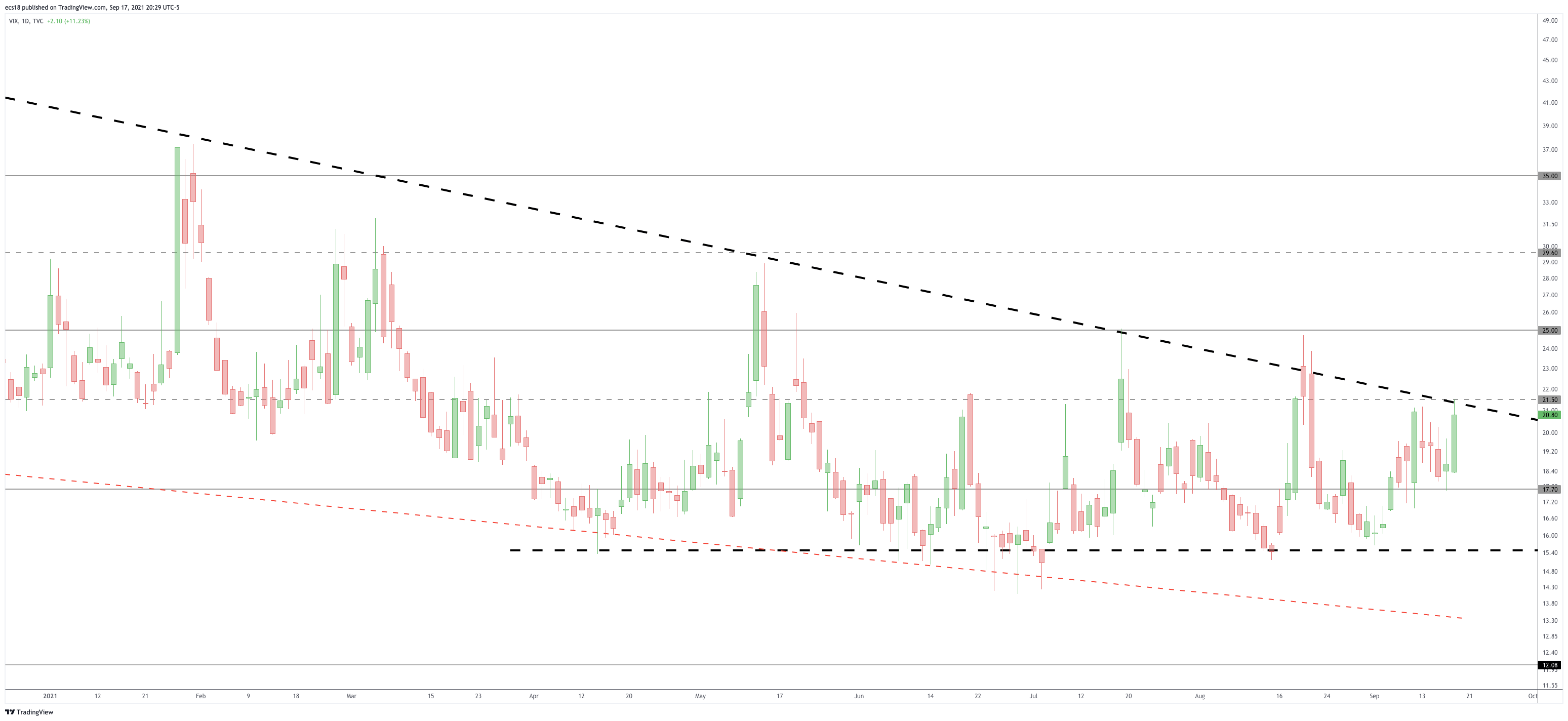

Last week was really rough for many stocks and sectors. Several commodities turned really weak, and a few of them crashed (think iron ore). Based on our findings we believe it is an USD driven thing. To make things worse, there is a potential scenario in which VIX is going to break out. The combination of a VIX breakout and a rising USD would create havoc in metals and markets.

In this short update we borrow a few quotes from our premium research service.

Presumably the most important development of the week was the reluctance of the USD to give up. Its chart is slowly but surely morphing into a constructive bullish reversal setup. However, it has to clear both 93.4 and 94.6 to create damage in markets and metals.

When the rounded pattern on this chart gave up back in July (red circle) we were convinced that it would result in USD weakness. Instead, we got two smaller micro reversals which took a few weeks (each) to complete.

In the last two trading days the USD showed strength, and it is back at the important 93.4 level which is now 10-month resistance. Note that the USD has equally important resistance just a little higher at 94.6 points. So even though a break above 93.4 would not be good news we can see that the really bad news would come once 94.6 is cleared (3 day closing prices).

Moreover, we can also see how VIX is about to test an important trendline. A move above this trendline would open the door for more selling in the S&P 500.