Stock markets might be entering a period in which many investors will be fooled. The rationale behind this thinking is based on the lack of sustained momentum. Markets may have entered a situation of short lived momentum. Although we still believe in a good outcome in stocks as per our Dow forecast and the 100 year Dow Jones chart. Note that we continue to believe that green battery metals will outperform (they will move in cycles though), especially graphite and cobalt plays in the short term.

Our thesis is based on the bond market.

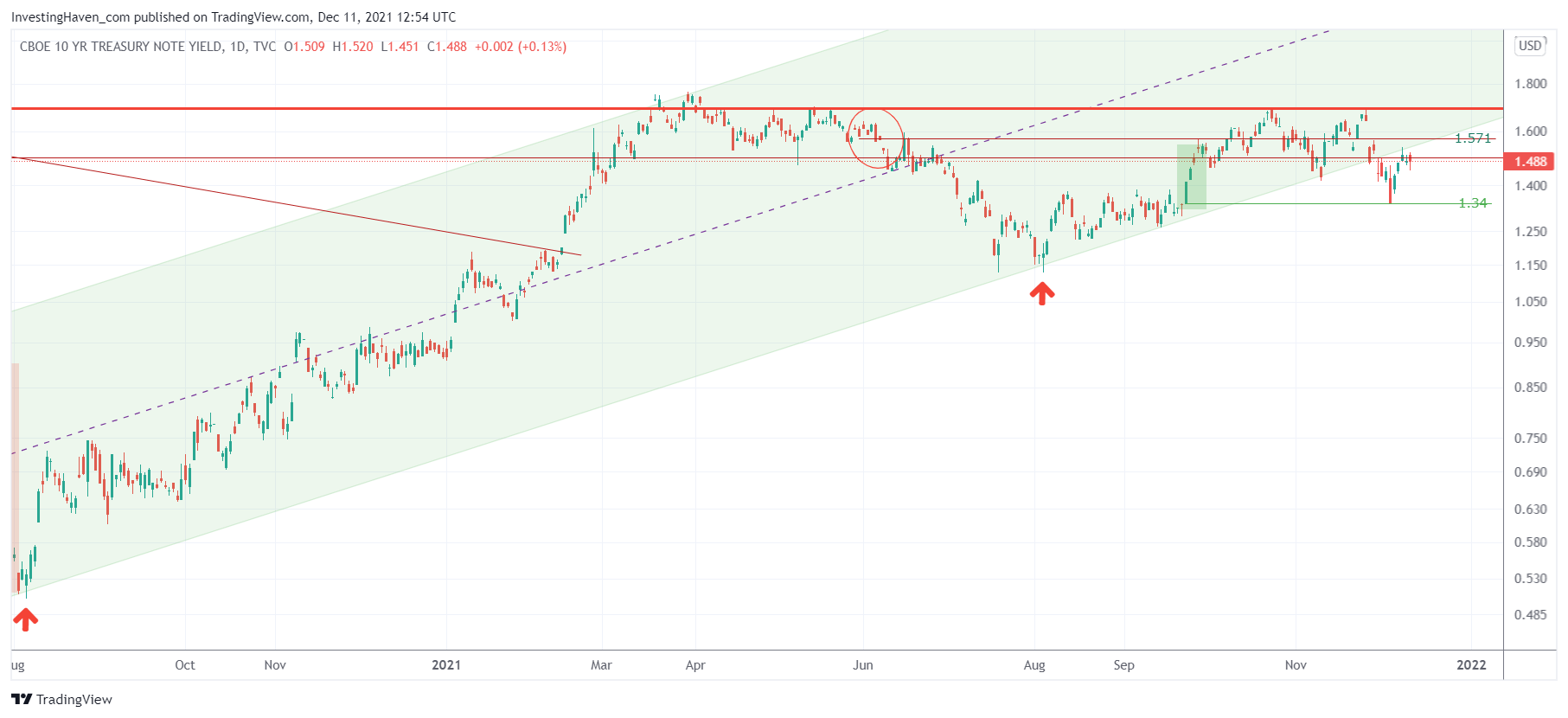

Bond yields, if anything, look to be in a sideways trend.

Looking at the 10 year bond yield chart one might too easily start looking at a bullish vs. a bearish thesis. Bullish bond yields implies good for risk assets (momentum driver) once above 1.80. Below 1.34, especially below 1.15, it will be really bad.

But as per the current setup of bond yields we would conclude that a sideways pattern is the most likely outcome.

What does this imply for stocks? Indecisiveness, short lived momentum, which will leave investors frustrated as they get confused.

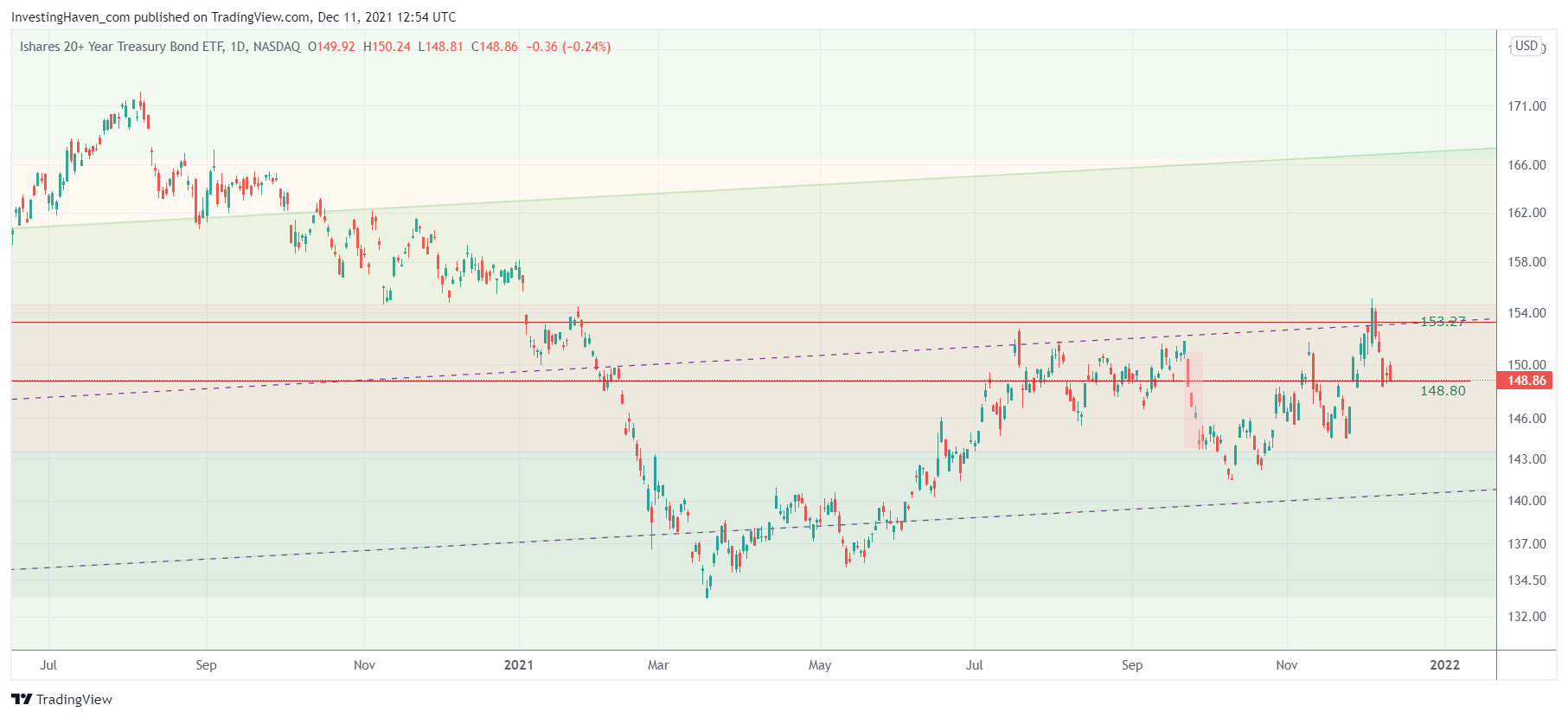

20 years Treasuries as per TLT ETF might be showing a very similar picture. The big breakout (bad for stocks) was invalidated last week , see the inability of TLT to move above 154 points. However, TLT was not able to get below 143 points neither.

Stuck, sideways, sucking momentum out of stocks. It is going to be interesting, as most stock market investors will get really frustrated.