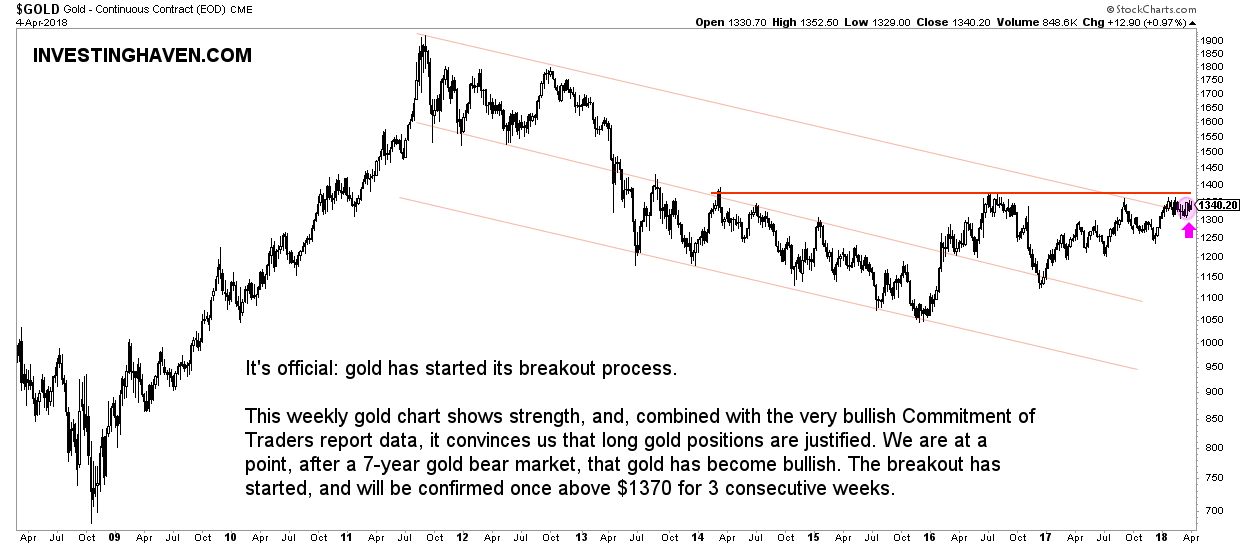

It is official: the price of gold breaks out. This implies that the gold bull market resumes, after a strong 7-year bear market, and it moves into a new bull market in 2018.

We quickly review the thoughts from these 3 articles which we wrote in the last couple of months.

The Gold And Silver Bull Market Of 2018 About To Start

Not only is the price of gold moving gradually to $1350 with a pattern of higher lows, which shows strength, but also do we see much more frequent attempts to test this level. The ultimate pattern which makes this point is the rounded bottom which we featured in this gold article.

Gold Bull Market To Start In 2018?

The likely path is, as per our latest gold article, that gold will trade sideways for a while. However, we anticipate it will be maximum a couple of months, and maybe around summer time in 2018 a new gold bull market may start.

Moreover, we referred to the CoT report in the same article, and came up with the following conclusion based on the level of short positions of commercial traders in the futures market:

Short positions of commercials provide stopping power to the gold price. In other words, every time gold comes close to the $1350 level there is increasingly less stopping power. This implies the gold price will sooner rather than later break through the Chinese wall of $1350, and break out of the 7-year bear market!

Admittedly, 6 months ago, we were still holding a bearish forecast as documented here: A Gold Price Forecast For 2018. However, we have learned one thing over time, and that’s NOT to be dogmatic. So once we discovered that our thesis outlined in our 2018 gold price forecast got invalidated we admitted ‘defeat’, and alerted our readers about this, in all openness.

The weekly gold chart looks great right now. The breakout is a fact, though it must be confirmed. We consider this confirmation is done once gold remains for 3 consecutive weeks above $1375.