The price of gold is about to start trending strongly, the million dollar question is in which direction. According to InvestingHaven’s research team the odds favor a ‘mega breakout’ to the upside, anytime soon, and the ultimate confirmation will be there once gold trades for 3 consecutive weeks above the $1300 to $1325 area.

After a 7-year bear market we started ‘sensing’ recently that Gold would break out, starting a bull market in 2018. More recently, we confirmed our viewpoint with this article: Gold And Silver Bull Market Of 2018 About To Start. The Commitment of Traders report is one of the reasons we believe that gold will break out to the upside as opposed to a breakdown, as explained in the article mentioned before.

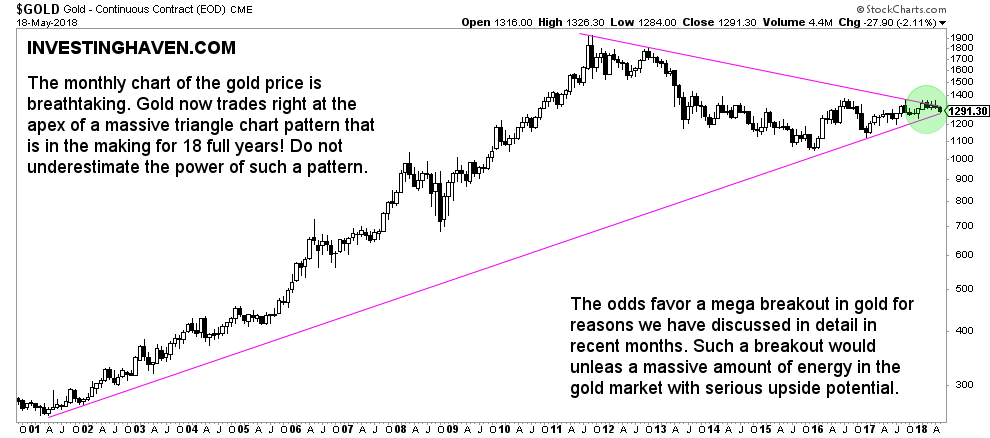

From a chart perspective we identified an amazing setup in gold: a massive triangle pattern that is in the making for 18 years!

This is huge, and it makes up for breaking news. Obviously, financial mainstream media will not bring this type of news, as it is categorized as ‘too technical’ or too much ‘focused on charts’. Regardless, we are 100% convinced that this IS the news, and we remain loyal to our conviction, so we keep on repeating this message to readers. Read our gold price forecast 2018 and silver price forecast 2018.

As we have found good evidence for a bullish breakout, and as the gold chart clearly is a ‘pressure cooker’, we can only conclude one thing: the gold market is going to be explosive once it breaks out. It will happen anytime soon because gold’s price has arrived right at the apex of this massive triangle.

When to know for sure that the bulls have beaten the bears? Very simple, once the gold price trades for at least 3 consecutive weeks above the $1300 to $1325 area.

What can investors do in case the gold price breaks out? Also very simple, pick up top gold miners, like the ones we tipped in 4 Gold Miners To Buy In 2018 Once Gold’s Breakout Is Confirmed. Moreover, as said before, silver looks even more spectactular, so silver miners should be on every investor’s watchlist.