Silver is now officially in a new secular bull market. In the initial phase of this new bull market, the silver bull will be quiet and volatile because explosive silver moves tends to occur in a later stage of the silver bull run.

RELATED – Will Silver Ever Hit $50 An Ounce? Here Is The Answer And Must-See Charts.

To be clear, we are talking about a secular bull run, not a tactical bull run.

History shows that secular bull runs in silver take a few years to complete.

History also shows that there are 3 waves higher (two corrective waves), with the 3d wave being the exponential phase.

History rhymes, it does not repeat. It might be that this silver bull run will only have 2 waves up.

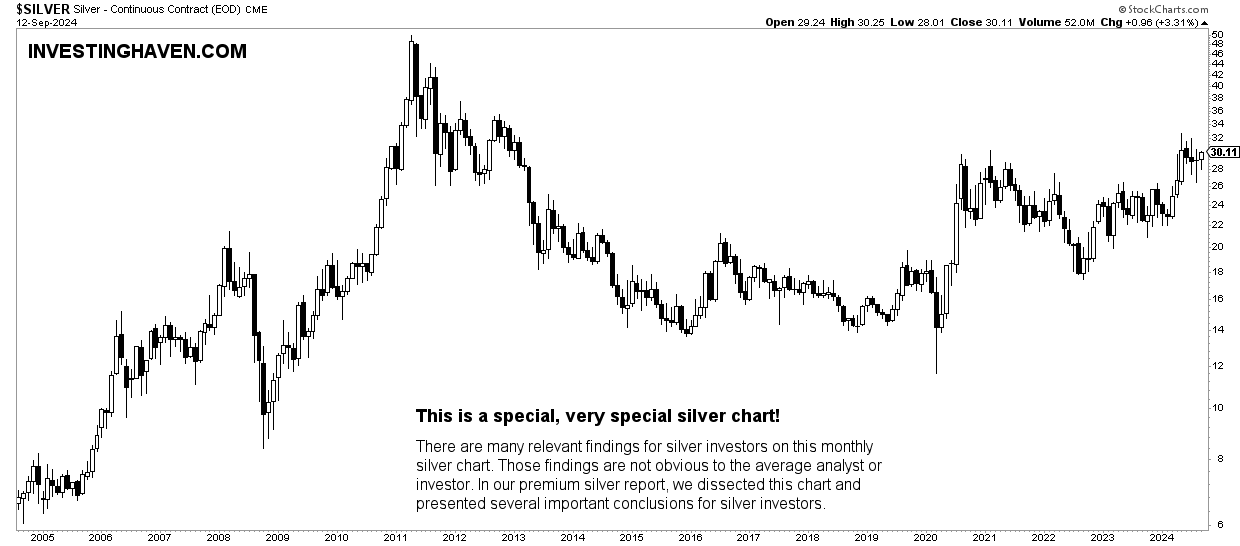

Silver secular uptrend – the chart

We explained the following in our long term silver price chart analysis:

- This long term chart pattern is a cup and handle formation.

- Those chart patterns are very powerful.

- The silver price chart is screaming ‘all-time highs’ (ATH).

Below is the silver price chart. We recommend to read our premium silver alert “[SPECIAL EDITION] The Most Comprehensive Silver Analysis You’ll Ever Read,” published on Aug 10th, 2024, available in our silver research section (instantly accessible after sign up).

Here is the point: This secular silver chart has a few really important messages. More importantly, if there is one, and only one, thing that silver investors need to know, going forward, it is an insight that is available on this chart.

Readers can also check the 12-month silver chart here as well daily silver price changes.

Silver now officially in a new secular bull market

Drivers of the silver bull run:

- The regional banking crisis resulted in a massive monetary liquidity injection by the Fed. Precious metals tend to rise on monetary easing.

- Gold & silver had no opportunity to adjust to the new reality of higher prices and wages. Precious metals had to wait for a delayed reaction, once market conditions were set right.

- The USD has been pushing higher in 2022 until mid-2023. Gold & silver cannot stage a bull market amid a rising USD. Once the USD started coming down, it created room for silver to stage its bull run.

- Above all, we mentioned that a silver shortage is brewing, characterized by physical silver tightness.

In other words, there are more reasons why silver staged a new bull market after underperforming in the period 2021 – 2023.

READ – Can The Silver Price Rise To $100?

Understanding the current silver bull

A silver bull market occurs when silver prices experience a prolonged increase, typically driven by strong demand and market sentiment.

This is not just a short-term spike but a secular silver uptrend where silver prices consistently rise over a significant period. The current silver bull is gaining traction due to several key drivers:

- Inflation and economic conditions: As inflation continues to rise, more investors are looking to precious metals like silver to hedge against declining purchasing power. Unlike fiat currencies, silver is seen as a tangible asset that retains value over time, making it a go-to choice for those seeking stability.

- Industrial demand: Silver is unique among precious metals because it serves a dual role—both as a store of value and a critical industrial commodity. From electronics to solar panels, the demand for silver is driven by its essential use in high-tech applications. As industries expand and technology advances, this industrial demand is expected to bolster the silver bull run.

- Geopolitical tensions: Global geopolitical instability often pushes investors towards safe-haven assets. Silver, along with gold, is considered a reliable store of value during times of uncertainty. As tensions rise globally, silver bulls find more reasons to back their bullish stance on the metal.

The momentum behind silver bulls

Silver bulls are investors who remain optimistic about silver’s long-term prospects.

As evidenced by long term silver price charts, silver bulls believe that the market conditions are ripe for a sustained silver bull run.

The bullish case for silver isn’t just about inflation or industrial demand—it’s also about the historical patterns of precious metals. Historically, when gold experiences a bull run, silver often follows, sometimes with even greater volatility and returns.

This dynamic creates an attractive scenario for silver bulls who are looking to capitalize on silver’s ability to outperform during precious metal rallies.

Why this silver bull run is different

This silver bull run is unique because of the convergence of multiple macroeconomic factors. Unlike previous cycles where one or two catalysts might have driven the price, this time, we are seeing a multi-pronged approach:

- Decarbonization and green energy: Silver’s essential role in photovoltaic cells makes it critical for solar energy, a rapidly growing sector. As nations worldwide push for greener energy solutions, the demand for silver is poised to rise, reinforcing the silver bull market.

- Monetary policies: With central banks around the world continuing to implement loose monetary policies, the value of fiat currencies remains under pressure. Silver bulls argue that these conditions set the stage for silver to shine as a store of value.

- Technological advances: Beyond just solar panels, silver is used in emerging technologies, including electric vehicles and 5G infrastructure. As these technologies gain traction, the industrial demand for silver adds another layer to the silver bull narrative.

These are mega trends for the coming years. The silver secular uptrend has a good foundation for several years to come.

How to ride the silver bull run

For those interested in riding this silver bull run, there are several strategies to consider:

- Physical silver: Buying physical silver, such as coins or bars, is a traditional approach to invest in the metal. This method allows investors to own tangible assets that can be stored and sold when prices peak.

- Silver ETFs: Exchange-traded funds (ETFs) provide a convenient way to gain exposure to silver without the need to store physical metal. They are particularly popular among silver bulls who want to participate in the silver bull run without the logistics of physical ownership.

- Silver mining stocks: Investing in silver mining companies can offer leveraged exposure to silver prices. When the price of silver increases, mining companies often see their stock prices rise at an even greater rate, making this a favored approach among aggressive silver bulls.

Are you ready to charge with the silver bulls?

As the silver bull run continues to gain momentum, the opportunities for investors are growing.

Whether you are a seasoned silver bull or just starting to consider the potential of silver as part of your portfolio, the current market conditions suggest a compelling case for silver.

With inflation mildly rising, technological advances, and increasing industrial demand driving the narrative, now might be the perfect time to align with the silver bulls and capitalize on this secular uptrend.