We recently started writing tips about ‘successful investing‘ and we kicked it off with this must-read article 7 Secrets of Successful Investing. One of the focus areas is the internal state of the investor which is most often the ‘place’ where success vs. failure is determined.

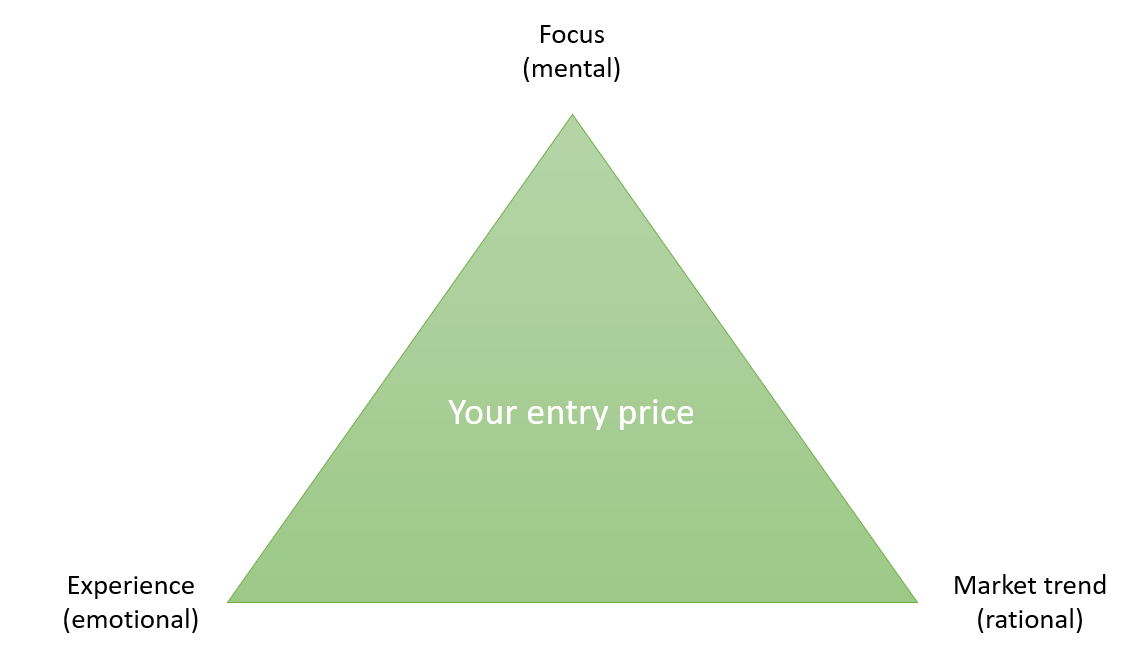

One practical tip to avoid a mental or emotional ‘hiccup’ is to focus on what we call the ‘investing triangle’: the mental state, the emotional state and the market trend. The probability of making a bad investing decision because of an emotional or mental mistake comes down considerably by explicitly taking the three aspects of the ‘investing triangle’ into account when making a decision. Moreover, once a position is initiated, the ‘investing triangle’ can help create the right focus.

Investors consider their entry price the center of the universe. It’s what we explained in Bad Habits: Investors Better Don’t Put Themselves At The Center Of The Universe.

In reality, the entry price of an individual position of an individual investor don’t matter. It does matter from a portfolio management perspective, but that’s not how most investors think about it. Once a position is initiated they tend to enter a different world, they start thinking and feeling very differently because of their specific entry in that specific position.

Investors should assess the difference between their entry price (which matters only to them, as said) and the relevant market information based on 3 factors:

Self-aware is what it’s all about: understanding yourself, your thinking and your emotions at the time you take an investing decision but also as you track how your position is doing.

The more self-aware you become the more you will realize how many ‘small things’ play in your head that may influence your decision.

Self-awareness in investing is one of the most underexposed topics. At InvestingHaven, we spend a lot of time and effort on this topic particularly in our research methodology.

You can take all three aspects of the ‘investing triangle’ explicitly into account when making an investing decision or after a decision was made:

- What are you focused on. You might find yourself checking your daily P/L status in your broker account every day, or tracking the news about the position, or chart analysis looking for support/resistance price points. It can also be your emotion (which is driven by expectation), your fear or frustration because of a big unrealized loss, etc. Not saying any of this is good or bad, just saying that FOCUS is key. Also saying that the wrong focus can lead to the wrong decision. After all, it’s a mental thing.

- How do you experience the difference between entry and market price. An entry triggers feelings, and as we know feelings might control ratio which results in disturbed focus.

- Did you read the market trend, which is the rational part of markets.

Ideally, these 3 factors are in balance and have the right focus. Balance is the opposite of tension, and we do know that tension when investing is a recipe for disaster.

However, if the balance is skewed it exponentially increases the probability of making a sub-optimal or even outright horrible investing decision.

For instance, if one gets too emotional about a position it is going to lead to wrong focus (unrealized losses, checking too often price changes missing out on the importance of closing prices and dominant trends). This ultimately creates too much tension, and trades will go bad.

This ‘investing triangle’ applies to individual positions, first and foremost. It might also apply to the entire portfolio, but the ‘investing triangle’ is useful when used per position and per investing decision. too early, and will be confronted with a missed opportunity further down the road.