‘It begins’. The stock market is finally starting a healthy pullback. Not an outright crash like in March of last year, but certainly one that will hurt if you ignore it. Our bullish Dow Jones forecast 2021 is still in play, and part of our 2021 target is already achieved. We believe stocks will march higher in 2021, not as of yet though. Our short term forecast for February is bearish, later in 2021 our forecast is bullish for stocks. Our longer term 20 year Dow Jones chart helps with insights for long term investors.

The Dow Jones, not our leading indicator for stock markets but just an interesting chart to analyze, clearly confirmed that a retracement started.

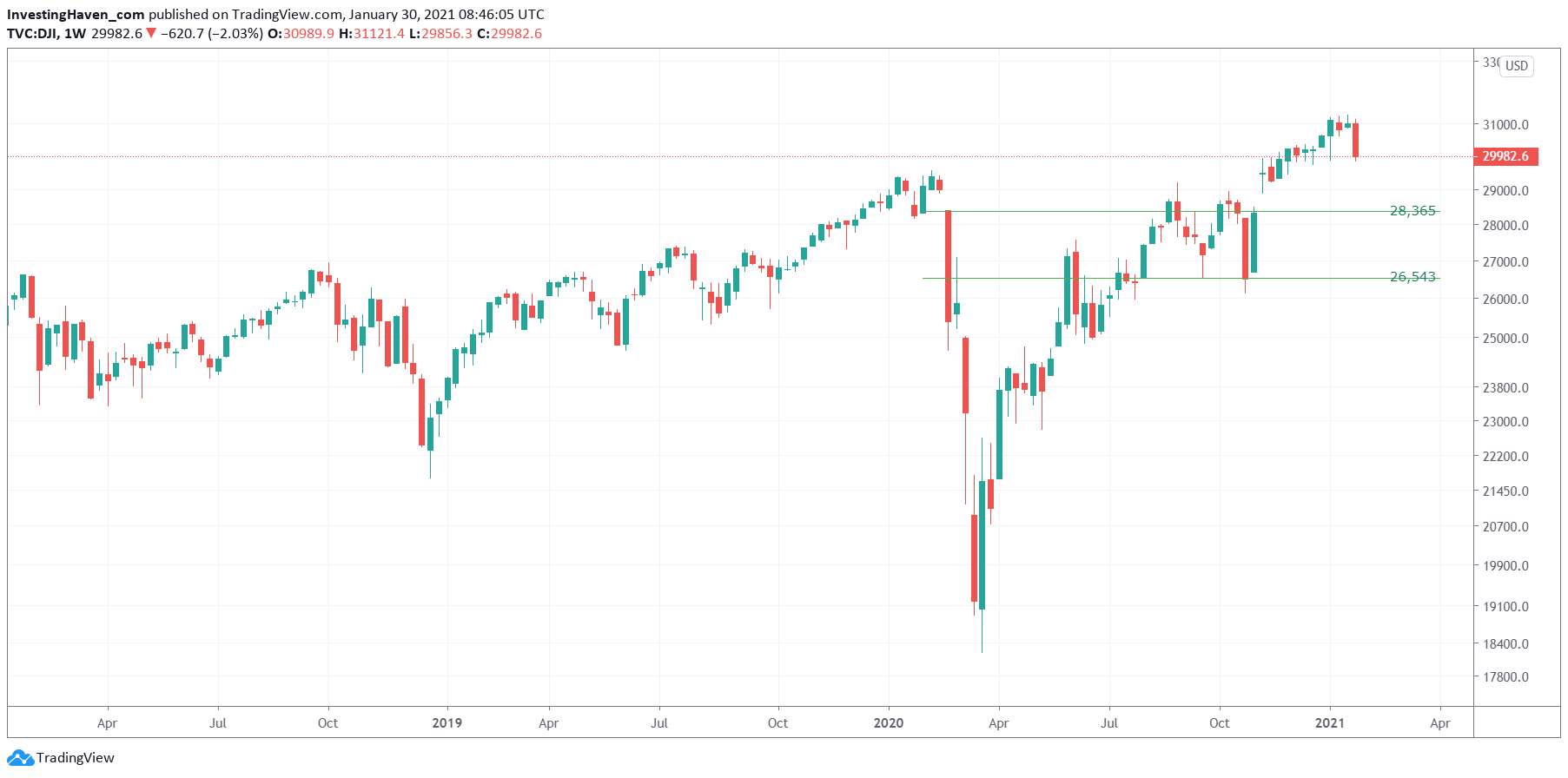

The weekly chart helps us understand longer term trends. And it’s clear from the weekly Dow Jones chart that this index is about to drop to either of the 2 levels indicated on the chart. The first one is pretty obvious, the second one *might* be reached, not clear yet.

Note that the above chart makes it very clear: the last red weekly candle is much larger than the previous weekly candles. This marks the start of a retracement in stocks, and it will last at least 4 weeks.

But can we have more refined insights than just ‘it will last at least 4 weeks‘? Yes, and we offer them in our research service(s). Continue reading to get a sense of the refined insights that come of our research work.

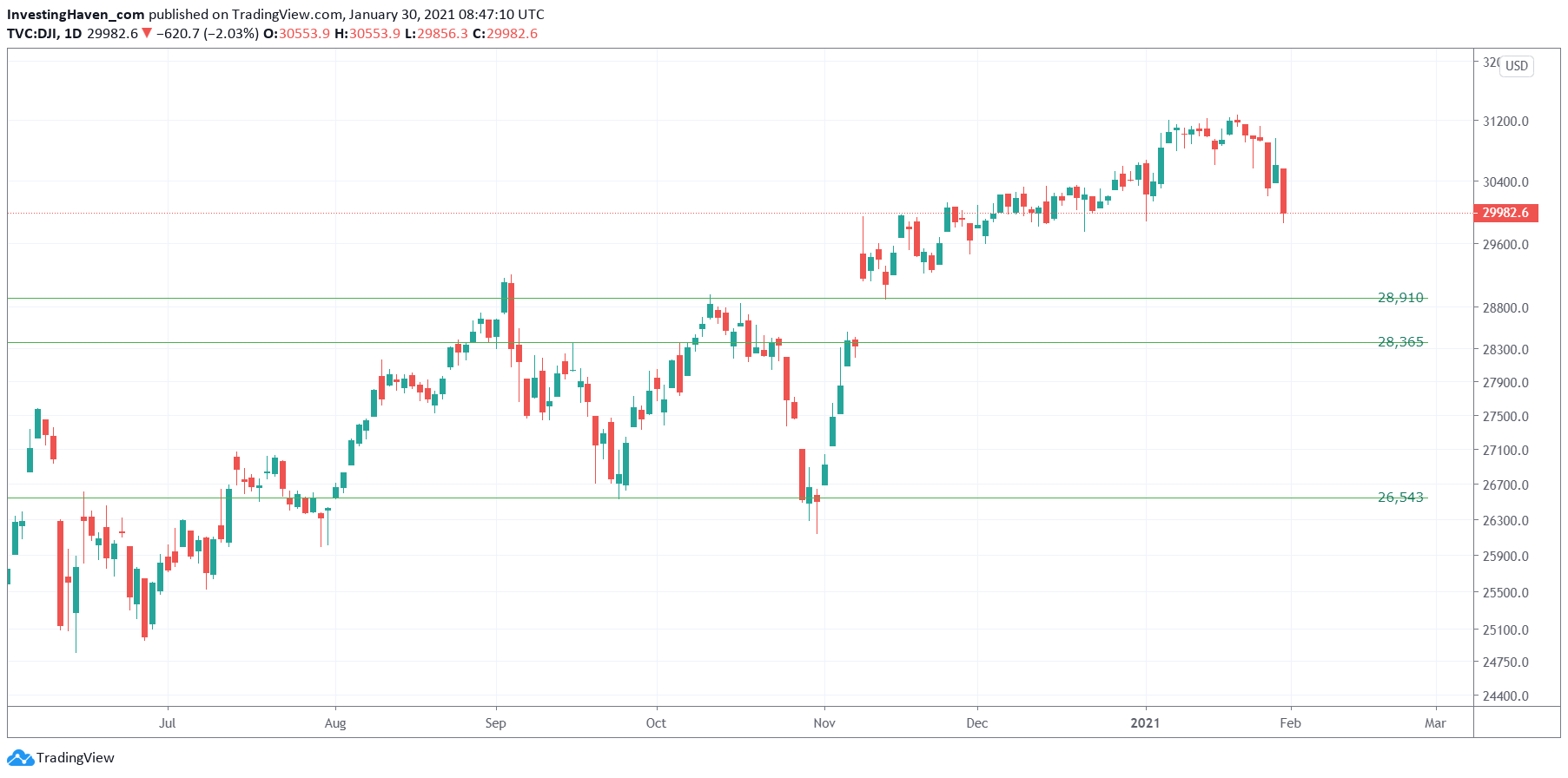

The daily chart gives us a bit more insight into the exact target prices.

E.g., our first target for the Dow Jones is more of a range than an exact price. The 28.9k to 28.3k area is the one that this index is eyeing. The second level is pretty straightforward, it’s a price level and not an area: 26.5k.

How will we know if the first or the 2nd level will be reached? In the end the difference between 26.5k and 28.3k is still 7.6% approx.

It’s very simple: we use our standard practice which we call ‘crash indicator analysis’ to understand downside potential and pressure for stock markets. This is a framework of leading indicators that push stocks lower. And the trick is to understand which of those leading ‘crash’ indicators (don’t take the word ‘crash’ too literally) is dominant.

We report on this in our weekend updates to premium members. Last weekend, we wrote Why February Might Be Ugly, When We Will Know And How We’ll Handle It (Jan 24th, 2021)

And we learned in the Corona crash year to stay focused on our crash indicators to try to understand when weakness shows up. In the end the Corona crash was visible in one chart, very much hidden, only visible for those that have an advanced crash indicator analysis method.

We already can see that two of our crash indicators will give us an answer THIS WEEK. Both have a short to medium term impact, and one of the two is the ‘xyz’ chart.

We will know, later this week, whether we expect February to start on a bullish or bearish note, suggesting that scenarios 2 or 3 of the ones outlined above are playing out.

Source: Momentum Investing research by InvestingHaven

And our analysis was really spot-on: the retracement in markets started on January 27th, 2021. The next trading day (Thursday) might have been bullish but it turned out to be a dead cat bounce.

We helped our members increase their cash position, and take profits one and two weeks ago. We welcome lower prices because we are always interested in buying quality with a discount.