Stocks continue to be ultra volatile. The ‘volatility beast’ is having a great time, stock market investors are not amused. The percentage of bulls is not far from hitting extremely low levels. We said many times that we do not expect a stock market crash, not yet in 2022, but it will start late 2023. Leading indicators are confirming this now: the USD is refusing to move higher, bond yields are breaking out (bullish for markets) but the volatility indexes are not following, not yet. In other words, stocks remain short term bearish but medium to long term bullish.

Investors are not having a lot of fun lately, and it’s not going to change in February (presumably only in March).

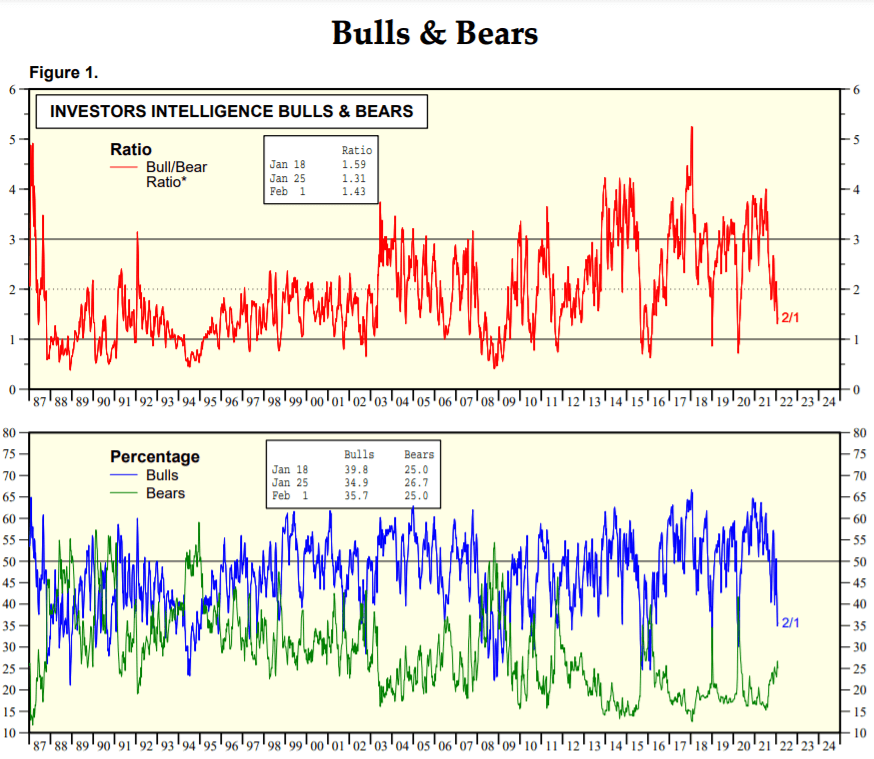

The percentage bulls is close to hitting extremely low levels which is what we can see on the lower pane of this first chart. The ratio bulls vs. bears has fallen dramatically, however it is also not yet at extremes.

(source: Yardeni.com)

Stated differently, it’s no fun in markets right now. Many portfolios got burned, and emotions and the morale has been burnt even more.

Not so for investors that had a balanced portfolio with some cash, sufficient green battery metals, and maybe some smaller allocations of promising though beaten down tech stocks. Members of Momentum Investing are among the few investors out there that fall in this category.

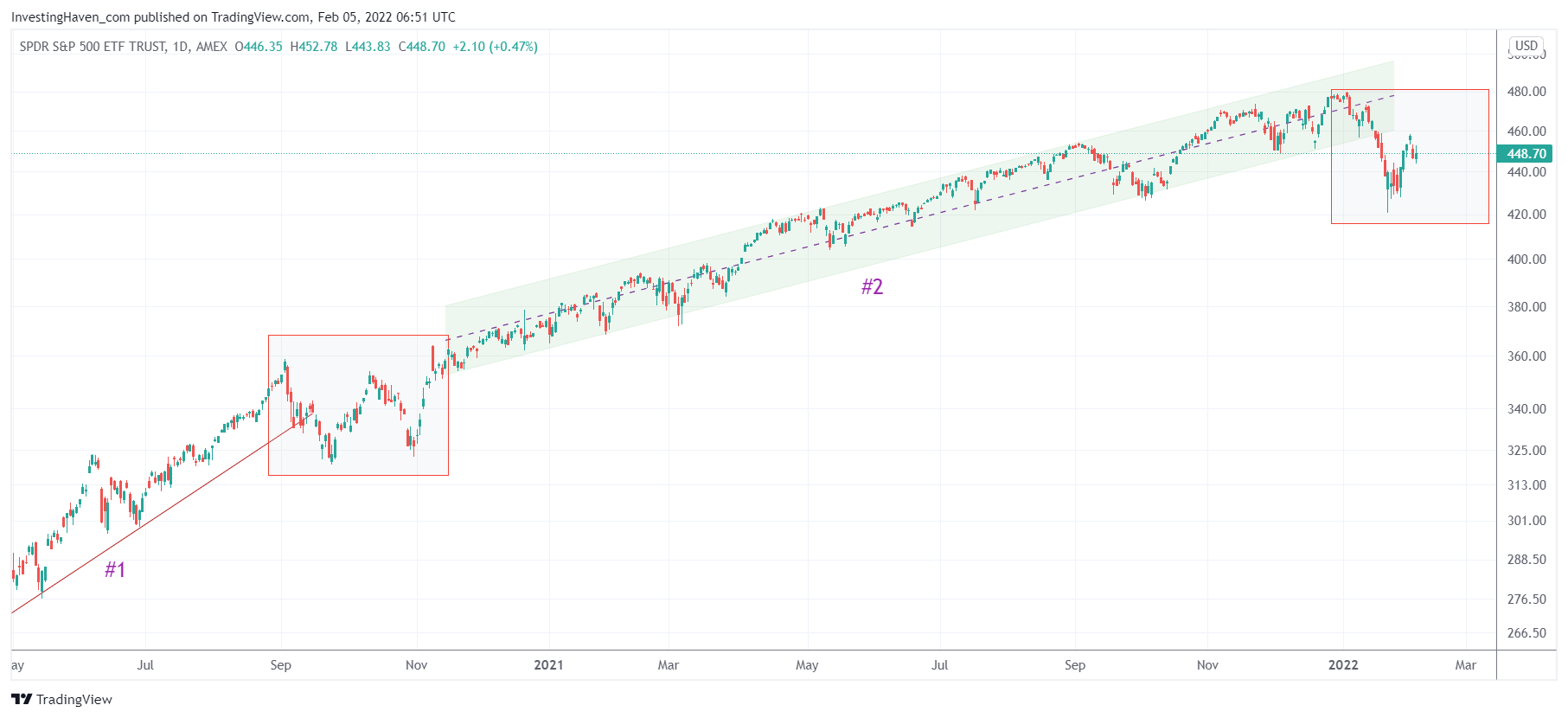

The S&P 500 chart as per SPY ETF shows that the bullish reversal is not complete, not yet. It is not hard to compare the Sept/Oct 2020 setup (grey box) with the current setup, there might be similarities but one thing is clear: the current structure is incomplete. In other words, we expect at least one more wave of selling.

In fact, the question remains whether this reversal will qualify as a bullish vs. bearish reversal.

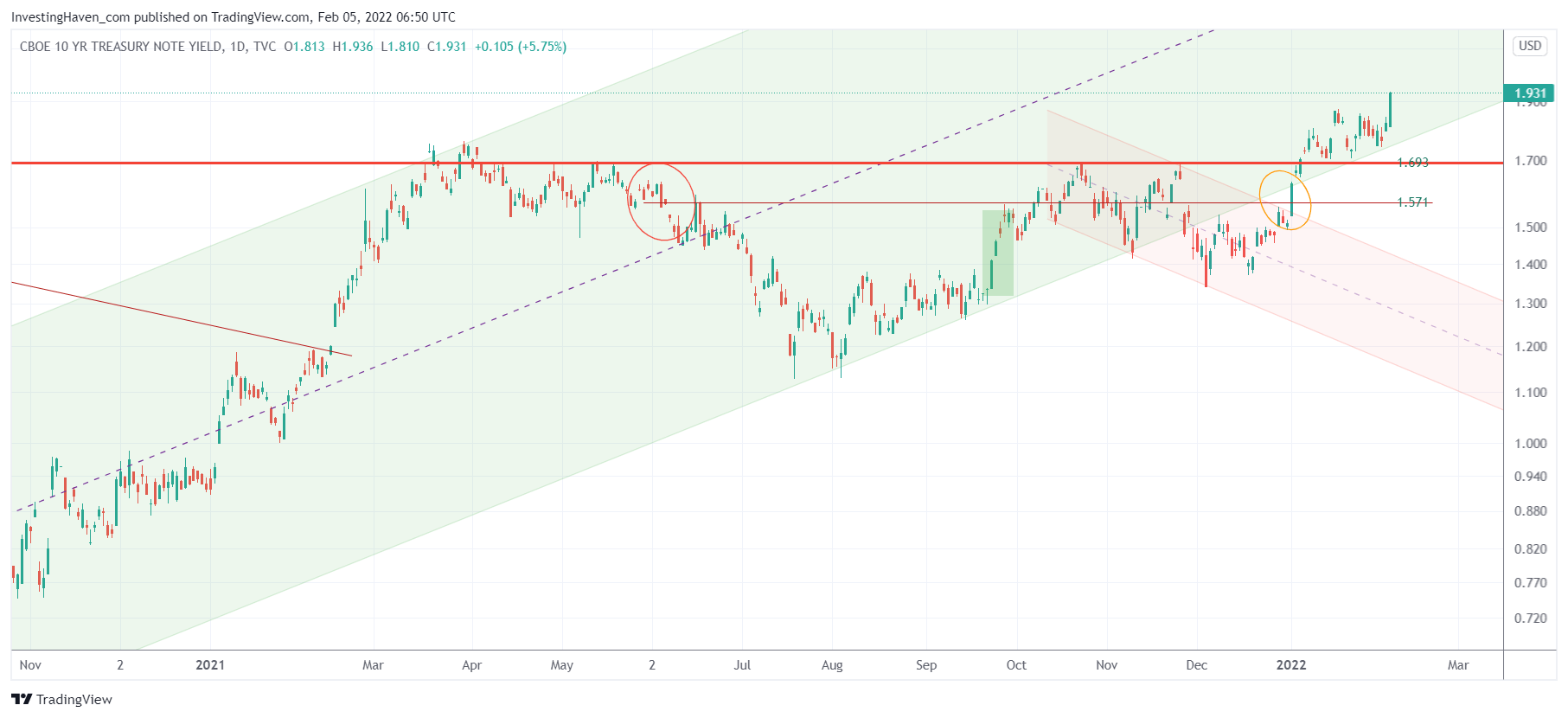

If we look at one of the most important (read: influential) leading indicators of stocks we see a bullish breakout. Below are 10 year bond yields, strongly bullish at the time of writing. This, combined with the USD rejection we discussed before, leads us to conclude that markets will eventually resolve higher. The ongoing volatility in markets is probably going to qualify as a bullish reversal. Between now and then, though, the market will thoroughly test the nerves and portfolios of its participants.