We started featuring VIX and the USD about a month ago, suggesting that both would bring volatility to markets. We featured a reversal pattern in both assets, and indicated that markets would stay volatile until both reversals would be broken. That’s what happened earlier this week on Thursday, and that’s when markets completed their bearish reversal. This qualifies as another illustration of how markets can be perfectly aligned, and why it makes sense to thoroughly intermarket dynamics combined with chart patterns, as per our 100 tips for investors.

Both the USD and VIX are part of the 5 key leading indicators we use to understand the direction of markets and sectors. Next to these 5 leading indicators we use a few dozens of sector specific leading indicators.

One month ago we wrote this article VIX + USD = An Ugly Cocktail For Markets In September

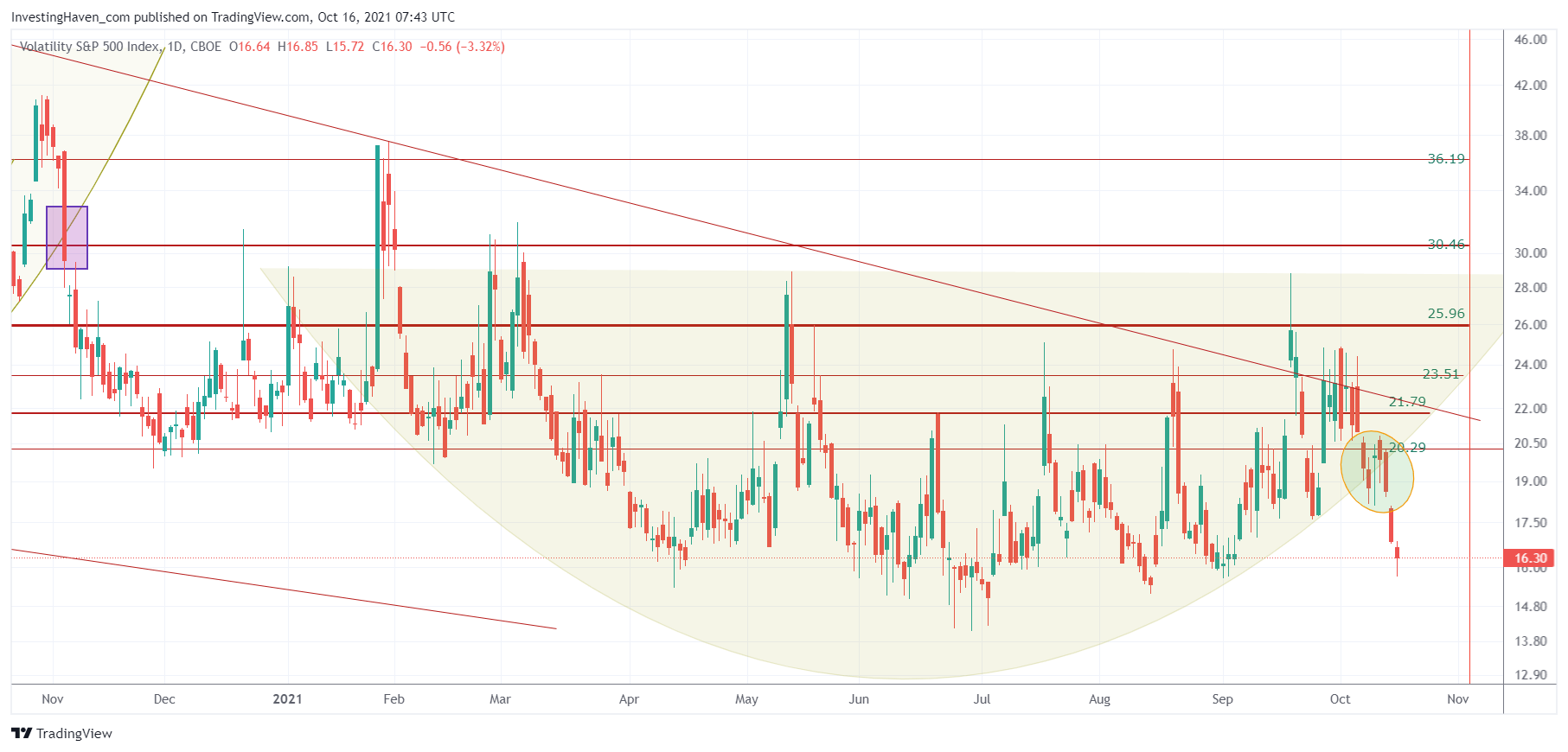

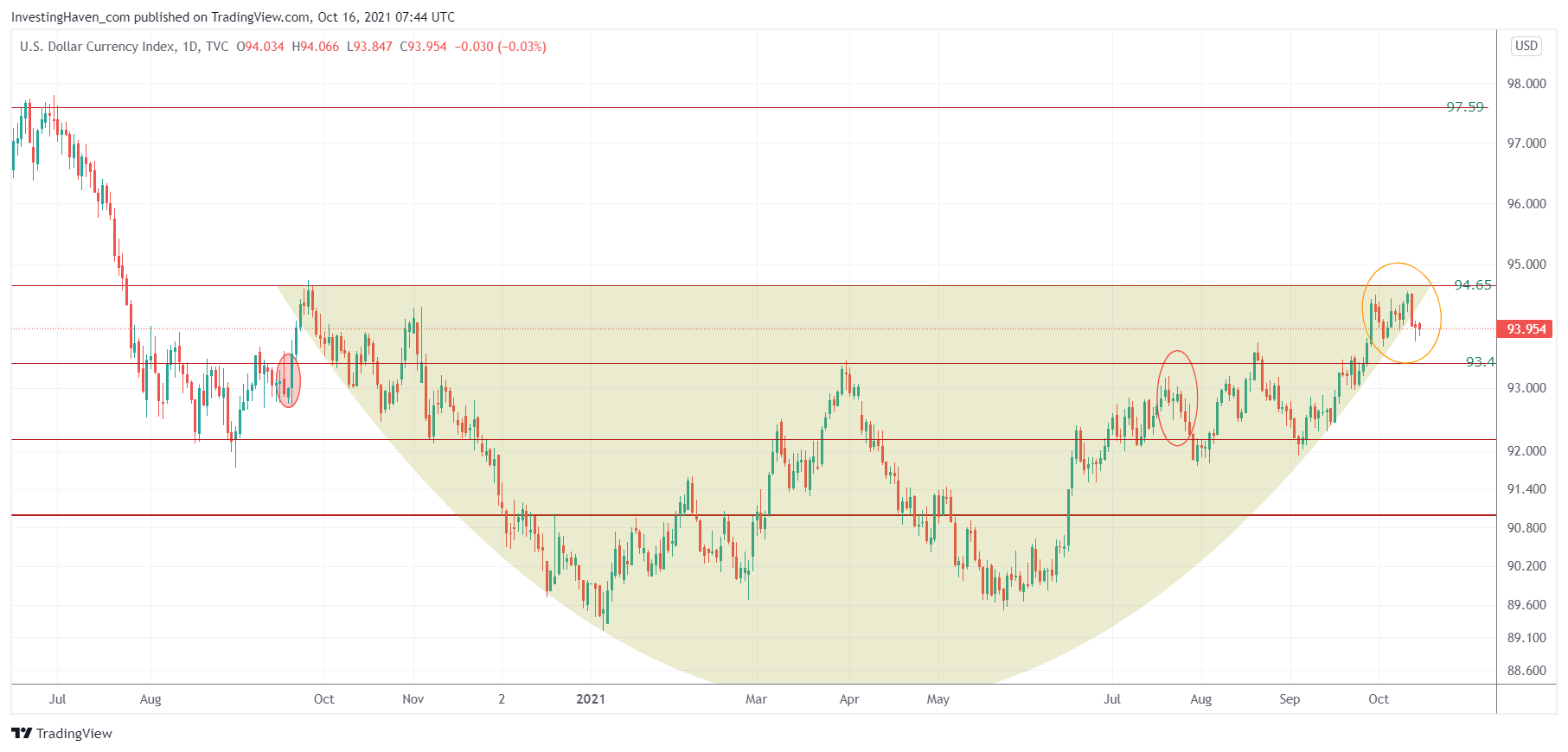

Presumably the most important development of the week was the reluctance of the USD to give up. Its chart is slowly but surely morphing into a constructive bullish reversal setup. However, it has to clear both 93.4 and 94.6 to create damage in markets and metals. Moreover, we can also see how VIX is about to test an important trendline. A move above this trendline would open the door for more selling in the S&P 500.

One week ago we published this in the public domain USD + VIX Will Make Or Break This Quarter

We believe that the coming trading week will be crucial for markets, and both the VIX + USD will bring clarity.

Our assessment based on accurate market readings could not have been more accurate. Markets decided mid-week to turn the tactical bearish trend into a bullish trend, is what we believe.

One the one hand VIX broke down the 9 month reversal pattern, on Wednesday/ Thursday this week. It could not have been more accurate, VIX on Thursday confirmed the solid green day in the S&P 500. Bullish VIX is bearish S&P 500.

The same day we saw the USD fall outside of its 12 month bullish reversal pattern. Bullish USD is bearish risk assets.

Are we in a runaway market now with stocks pushing higher like a year ago? We don’t think so. While we believe that stocks are now set to move higher we don’t see a 4 month bull run similar to a year ago. Why? Because the USD is not done, we believe it has a mission and it will clear 94.65 somewhere next year (presumably in Q1/2022 but that’s to be confirmed). This will certainly spoil the stock market party, the only question is WHEN exactly.