As per our gold forecast we expect precious metals to rise in the first part of 2019. This bullish setup is confirmed in our best 3 long term gold charts. Consequently, we expect precious metals stocks to outperform. With this in mind, can we identify best gold stocks for 2019? This article depicts our best 3 gold stocks for 2019. It may come as a surprise that we look at the senior gold stocks, but that really is the result of our research.

[Ed. note: This article about the 3 best gold stocks for 2019 was originally published on December 13th, last year. Readers can verify this by checking the dates on the charts. Throughout 2019 we will frequently update our best gold stocks article. The new updates will appear at the bottom of this top gold stocks article. It allows our followers to track the evolution of the gold stocks market as well as our best gold stocks picks. Last update of the best 3 gold stocks: February 17th, 2019.]

Before looking into our vision on the best gold stocks for 2019 we want to start with the market environment and conditions as 2019 kicks off.

We remain focused on this major market turning point which we identified several months ago: the End Of 40-Year Bull Market In Bonds. Our expectation is that a massive level of capital, never seen before, in the order of $40 trillion, will start moving around, because the bond bull market broke. We added: “Obviously, not all of the $40 trillion, but a considerable part will move elsewhere. Can anyone imagine what will happen if this becomes a trend into the same direction. Correct: stampede.”

We said we were not clear on the exact direction of markets. The key point we made is that new trends would become visible, pretty soon, so it is imperative to monitor markets very closely until new trend(s) are visible.

One of the beneficiaries might be gold stocks, at least in the short to medium term. The question is whether a bullish period of gold stocks in 2019 will also be bullish long term, it is a million dollar question for investors with a long term horizon.

Gold stocks in 2019 vs. gold price: the driver

In our gold forecast for 2019 we said we believe that gold is setting a major cup-and-handle on its chart. The breakdown in October marked the start of the handle. We also added that gold, in this formation, would go back up in 2019 to test the $1300 to $1375 area. As that will be the 3d attempt for gold to break out of its strong resistance there is a fair chance gold will succeed.

So our gold price forecast concluded saying:

That’s why our most bullish gold price forecast for 2019 is that gold will hit $1550 in 2019 (20% probability), but only if it succeeds breaking through the $1375. The $1375 test is a base case scenario (75% probability).

On the flipside, any failed attempt to stay above $1200 will be the bearish scenario, and it might take gold to $1050, though this is the least likely in our opinion (less than 5% probability).

The good news is that the bearish scenario did not play out, and, as things look now, will also not play out.

Below is an up-to-date gold price chart which shows the bear market since 2011. Visibly, this series of higher lows in the last 24 months looks very enticing. Momentum is building up, and that’s great for gold stocks as well.

Best gold stocks vs. relative strength: intermarket dynamics

From a totally different perspective we look at intermarket dynamics.

This is important because capital flows from one asset class to another one. That’s because capital trades within the ecosystem which is what markets are: a compilation of asset classes (stocks, bonds, commodities, gold, currencies). If the bond market outflow is a fact then the capital previously invested in bonds will have to find a new home. Will this partially flow to gold stocks?

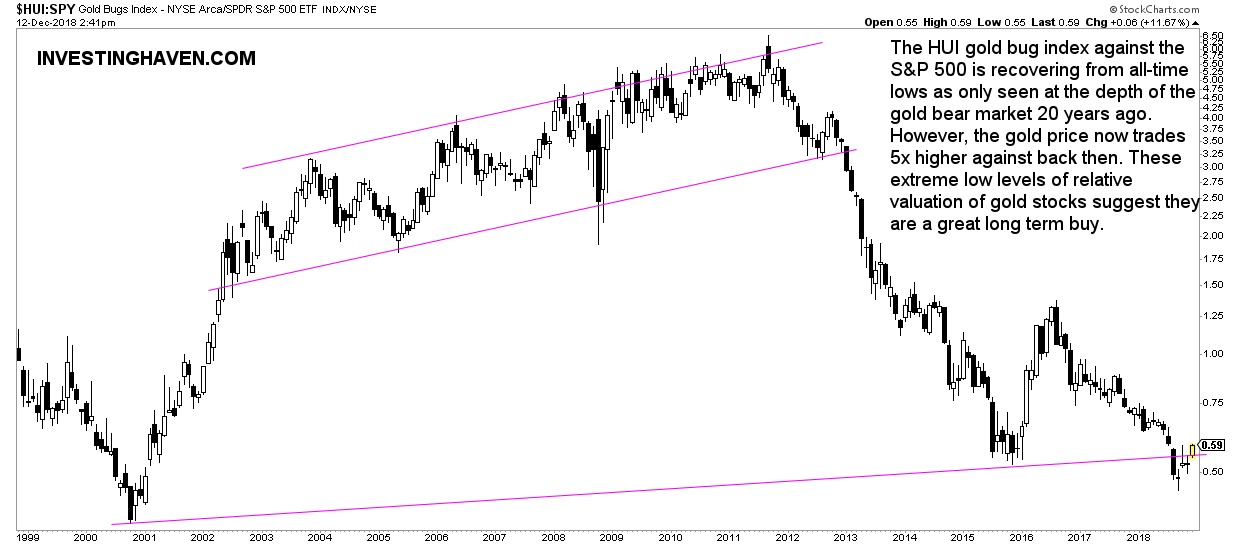

We get a pointer by looking at two ratios: gold stocks to the S&P 500 index as well as gold stocks to the 10 year bond price ratio.

First, the gold stocks to the S&P 500 index shown on the first chart shows an amazingly undervalued gold stock segment. Interestingly, this undervaluation is similar to the 2000 depth of the gold bear market but also even lower than the December 2015 gold stock crash.

In the meantime of course the gold price trades much higher.

So we derive the conclusion that gold stocks are seriously undervalued, regardless whether it is justified or not. It also implies that any sustained move higher in the price of gold will lead to leveraged returns in this oversold gold stock segment as there are no sellers left!

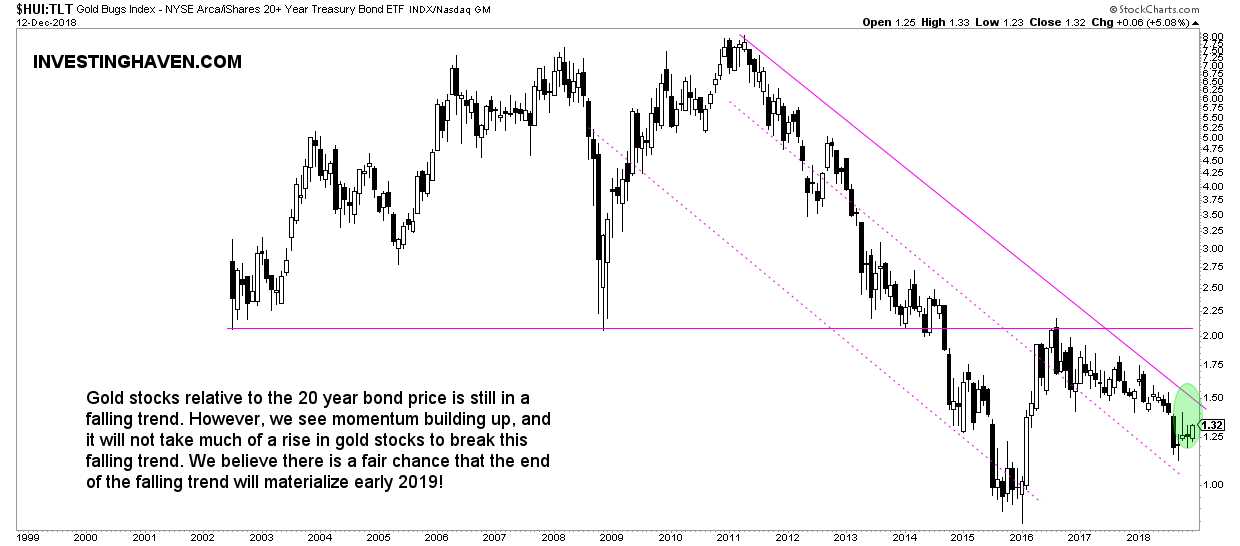

Second, the gold stocks to the 10 year bond price ratio is shown on the next chart. It is a relative strength of gold stocks against the bond price which, as said, has broken its 4-decade bull market.

Here, again, we don’t see strength yet in this ratio. In other words the bond market breakdown has not resulted in any sustained capital flow to the gold stock segment.

However, momentum is building, and we clearly see how this ratio is close to breaking out from its falling channel that started in 2011.

Best gold stocks for 2019

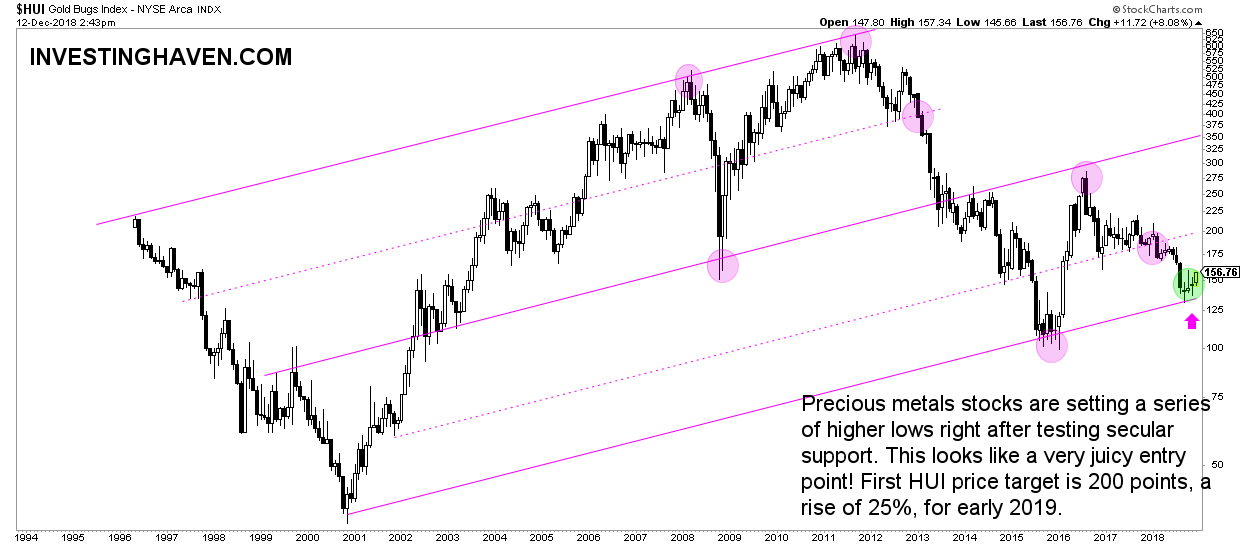

Moreover, when looking at the gold stocks chart, the HUI gold bug index in particular, we see a similar bottoming price level currently somehow comparable to the relative charts shown above.

The monthly gold miners index shows that from peak to trough gold stocks have corrected 79% since their peak in 2012. The time gold stocks will trade near their secular support is unknown, it may vary from a couple of weeks to a couple of months, depending on how fast the gold price moves back above $1300.

One thing is clear, if and when gold surges above $1300, and ultimately above $1375, we will see wild moves higher in top gold stocks as this really is an oversold stock market segment.

That said, we believe that gold stocks are near a once-in-a-decade buy opportunity, and it is worth considering top gold stocks for 2019.

So which are the best gold stocks to consider for 2019?

After looking at hundreds of gold stock charts, and looking into many financial results in recent weeks, we conclude that the best gold stocks to own are the major gold producers. Do not try to look for some exotic gold stock names by doing a search for gold stocks as you will get results that are not relevant.

The names we are looking at:

- Franco Nevada, symbol FNV;

- Royal Gold, symbol RGLD;

- Goldcorp, symbol GG.

We can do extensive financial and fundamental analysis on this, but the point is very simple. These are the names that have held up well, both in financial terms and also from a chart perspective. Most others have sold off heavily because of falling precious metals prices in the recent 18 months. Arguably, there is lots of value in some mid-tiers, but the risk is also elevated in the event that the gold price stabilizes for another 6 to 12 months. That’s why we believe the seniors mentioned above are top holdings for 2019.

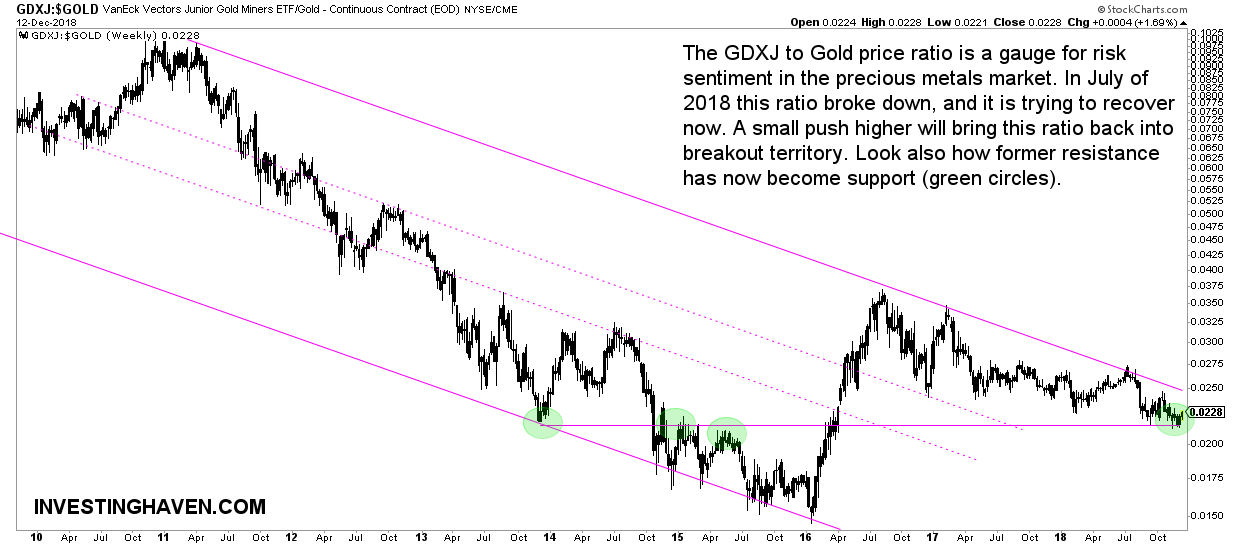

Bonus gold stocks chart: risk sentiment

As a bonus chart below is the junior gold stock index compared to the general (also more senior) gold stocks. This is a gauge for risk sentiment within gold stocks.

This pattern is beautiful as it also shows momentum is building, similar to the points we already made above. We would say that if and once the long term triangle pattern is broken to the upside it is time to buy the best gold stocks in an aggressive way. Based on the gold price trend we believe this will happen early 2019!

Best 3 gold stocks for 2019

** Update on January 13th 2019 **

This section was added in the 2nd week of 2019.

As said before we reviewed hundreds of gold stock charts. The key take-away of this exercise was that (1) most gold stocks have weakened over the course of the recent 24 months (2) the best gold stocks are the major gold producers (3) financial results of junior and mid tiers have dragged their stock prices even more down.

We identified 3 specific names as our best 3 gold stocks for 2019: Franco Nevada, symbol FNV, Royal Gold, symbol RGLD, Goldcorp, symbol GG.

In this newly added section at the start of 2019 we show up-to-date charts of all 3 best gold stocks, with manual annotations.

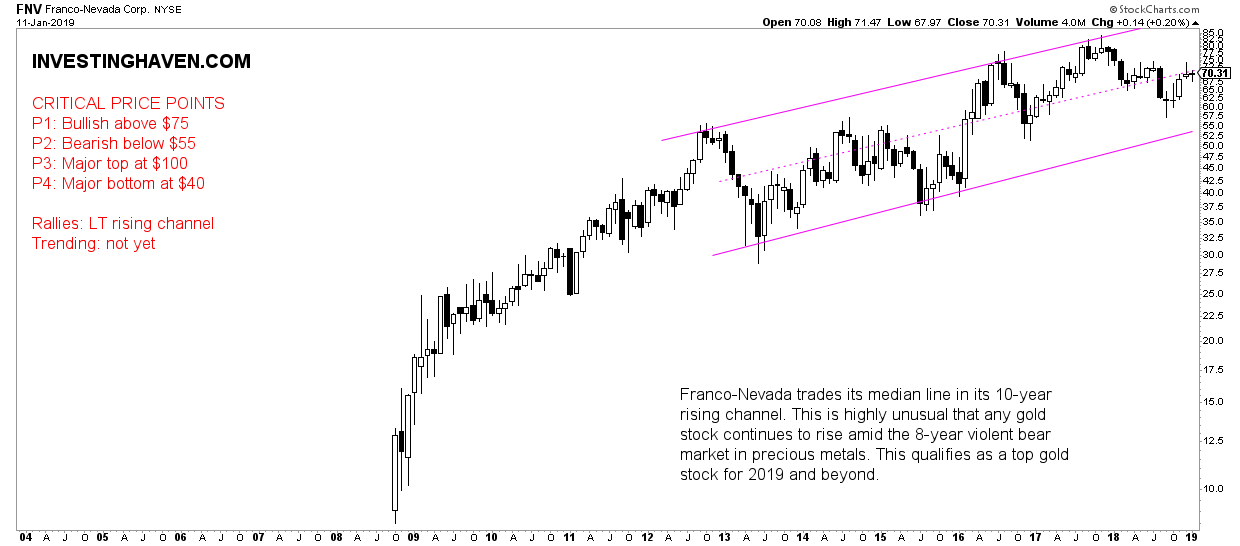

Best gold stocks 2019: Franco Nevada (symbol FNV)

Franco-Nevada trades its median line in its 10-year rising channel. This is highly unusual that any gold stock continues to rise amid the 8-year violent bear market in precious metals. This qualifies as a best gold stock for 2019 and beyond.

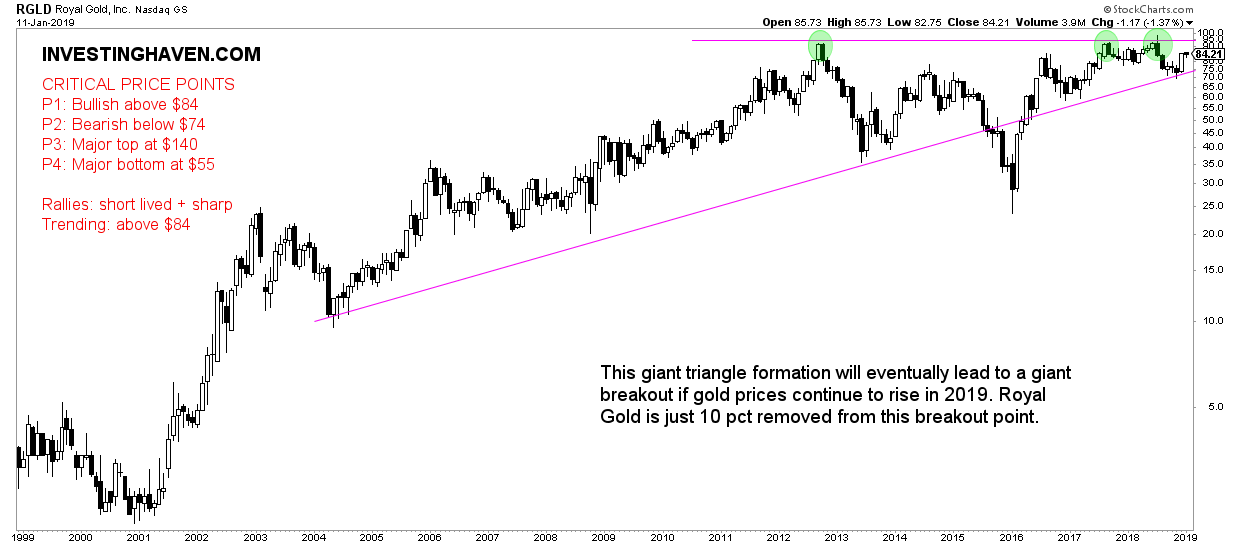

Best gold stocks 2019: Royal Gold (RGLD)

Royal Gold has a giant triangle formation on its chart. This will eventually lead to a breakout. If gold prices continue to rise in 2019, which we expect they do, the breakout will come sooner rather than later! Royal Gold is just 10 pct removed from this giant breakout point.

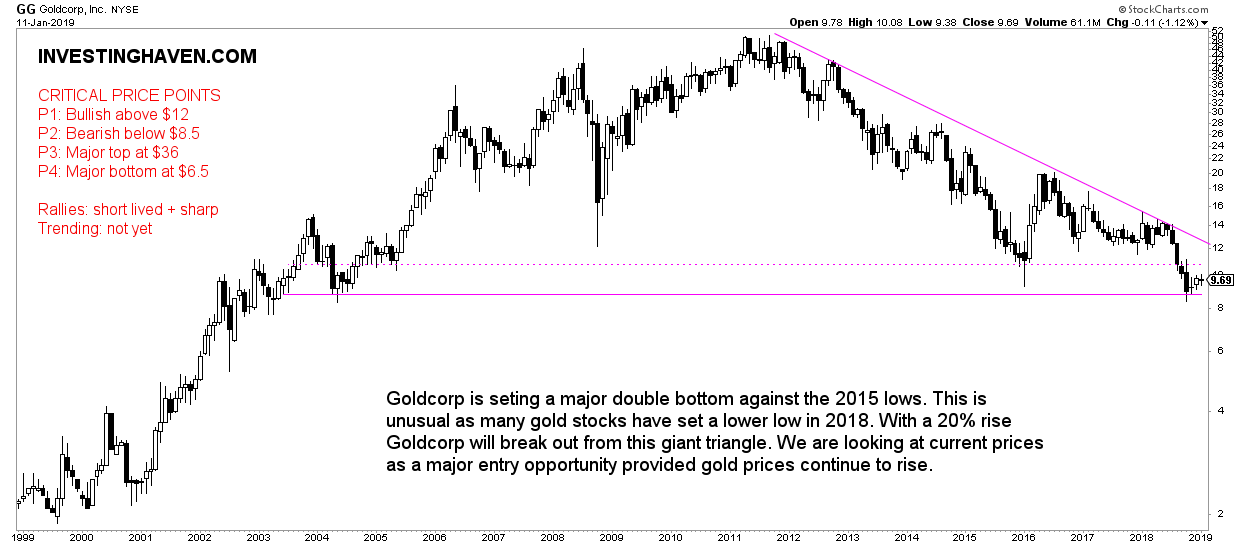

Best gold stocks 2019: Goldcorp (symbol GG)

Goldcorp is seting a major double bottom against the 2015 lows. This is unusual as many gold stocks have set a lower low in 2018. With a 20% rise Goldcorp will break out from this giant triangle. We are looking at current prices as a major entry opportunity provided gold prices continue to rise.

Review of the evolution of our 3 favorite gold stocks for 2019

** Update on February 17th 2019 **

The monhtly gold stocks chart below is the most up-to-date version.

On Dec 12th, 2019 the HUI index was trading at 156 points. The chart from back then is embedded above.

Right now the HUI index trades at 175 points, a rise of 12%. This may seem already a nice profit, but we can tell you that the ‘real deal’ in gold miners kicks in after they have doubled or tripled. That’s how volatile they can be, in both directions.

What’s the reason why not more investors are invested in gold stocks at this point in time, and why we believe the vast majority of investors will miss investing in the best gold stocks in 2019?

Very simple, emotions!

As per our 10 Tips To Master Investing Without Emotions investors get emotional as they frequently look at prices. In the last almost 8 years gold stocks, even the best gold stocks, were bearish. The screens showed red figures, continuously. The power of repetition leads to the conclusion for investors that a bearish state is ‘the truth’ in this sector!

That’s how emotions have a misleading effect, and destructive power on anyone’s portfolio.

InvestingHaven readers know better.

We have covered precious metals, especially top gold stocks, extensively.

What’s very interesting is the silent character of this nascent bull market. When it comes to gold stock news there is absolute silence! Barron’s mentioned gold stocks being bullish, that’s it. MarketWatch looks at a rising gold price because of trade talks, that’s it. Even GoldSeek which we consider the most niche gold site in the world has a gold news stream which is somehow neutral to mildly bullish.

Our charts signal something totally different!

In the meantime we notice that our selection of best 3 gold stocks (FNV, RGLD, GG) are doing pretty well. They have been rising steadily.

Note though that some smaller names (mid cap and small caps) have outperformed. However, there is no consistency in there, it’s a small selection of gold stocks that are outperforming. That’s why we believe sticking to the best 3 gold stocks we identified before is wise, and switching to smaller names may happen as soon as the precious metals space confirms its breakout.