It was a boring day in markets today. After the volatilty from yesterday caused by the Fed’s interest rate hike, which resulted in a clear winner being emerging stock markets, markets reacted totally different today. The day-after effect?

What we are interested in, primarily, is the week-after effect so to speak. It is important to watch the reaction of markets after a week in order to see which trends are arising, if any. As said before, one day does not make a market.

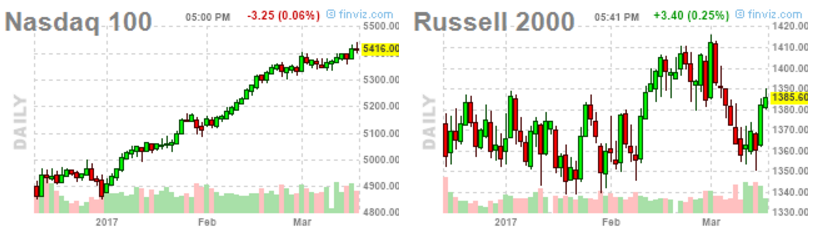

With that in mind, let’s review the short term trends. Below are daily charts from leading assets over a period of 3 months.

First, stock markets diverge, with small cap stocks (Russell 2000) (RUT) trading sideways while technology (Nasdaq) rallying. With the value stock market segment stabilizing, the small cap stock index seems to be going nowhere. When it comes to sectors, the Health Care Stock Market Sector remains among the stronger ones.

Second, bond markets, known as “risk off”, are going nowhere. After some attempts to break out this year, bond prices are trading right at the same point as 3 months ago. Boring? Yes, without any doubt … but maybe something is brewing so things could get much more exciting shortly.

Third, precious metals, being either an inflation hedge or risk asset, as explained in 10 Insights To Derive From Gold’s Price Chart, are trading between 5% (gold) and 8% (silver) higher, which is also not an amazing move. The short term trend is higher, but both assets seem to have lost their luster. They could be setting a pattern of higher lows, but at the same time the drop in March was meaningful. So the coming weeks will be telling.

All in all, we believe that the coming weeks will be crucial, as we still see that something is brewing given several Leading Markets At Major Inflection Points.