It was another choppy week in markets, not only stocks but also precious metals. One day stocks are sold and precious metals get a bid, the other day the opposite happens. As per our silver price forecast for 2019 combined with our silver stocks forecast 2019 we believe that bottom is set in silver (SILVER) as well as silver miners (SIL). Is the market proving us right or wrong? Based on the current trend it becomes clear that October 2018 is a decision month, as silver and especially silver stocks trade at a make-or-break level.

We reviewed the fundamentals in the articles we mentioned above. Fundamentals do not change overnight, so we do not see any need to revisit them again.

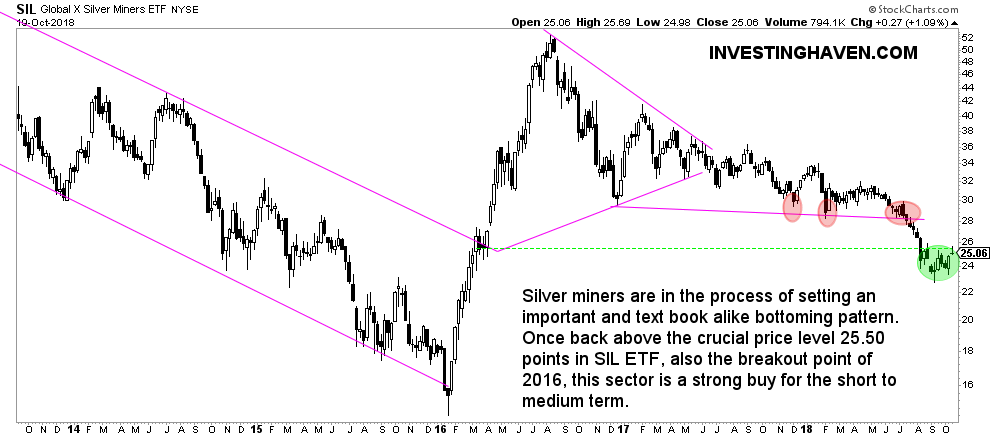

The chart, however, is important at this point in time.

We will see on the charts what the new trends will be because of this once-in-a-generation market event that is unfolding now, i.e. the End Of 40-Year Bull Market In Bonds and an associated exodus of capital out of the U.S. bond market. So far, there is lots of turmoil, but no decisive direction of major assets, at least not yet.

At the same time we keep a very close eye on gold and silver. We tend to believe that silver may see an inflow of the bond market outflow. If that will be the case especially silver miners will go ballistic.

In our previous forecasts we concluded that silver stocks (SIL ETF) would rise to 32.5 points, at a minimum, and potentially even to 42.50 if they would become the beneficiary of the bond market outflow. As a refresher this is what we wrote in our silver stocks forecast:

If, and that’s a big IF, the bond market starts crashing, in line with our expectation, and capital does not flow massively to the USD, then we expect silver miners to be a big beneficiary, and silver stocks may be wildly bullish in 2019 and beyond. The 52.50 level will be crushed in that scenario. Again, this scenario has a 20% probability.

Against Friday’s closing price our previous silver stocks forecast would mark a 28% rise (to meet 32.50 points) or even a 70% rise (for the 42.50 target).

The million dollar question is whether the market is on track to meet these targets, or if our forecast got invalidated.

Here is the answer: the next few weeks will bring a confirmation of our forecast. The point is that silver miners represented by SIL ETF seems in the process of setting an important bottom. As seen on below chart, green circle, a bottoming process is ongoing. In recent weeks there is a clear series of higher lows, which in and on itself is bullish. However, there is more, the resistance point of this bottoming process is the breakout point of the giant 2016 rally, see green dotted line.

If there are 2 reasons why a price point is important then you can be sure it is a make-or-break level. Smart investors are watching the same patterns, and take decisions based on those decisive price levels.

For now, it seems that global stock markets are weakening. Combined with the exodus out of bonds, and the fact that the U.S. dollar is not the big beneficiary (at least, not yet) we believe there is a fair chance that gold and silver will see a serious influx of money in the next few days and weeks. If that were to happen, as forecasted, we will see silver miners break out of the bottoming prices, and rise strongly to at least the 32.50 level, if not higher to 42.50.