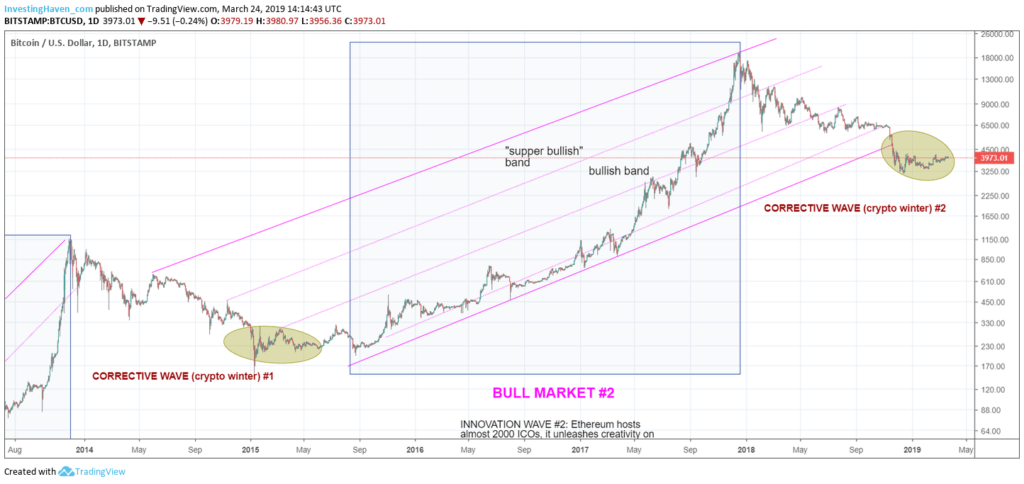

A few months ago we forecasted the end of the crypto winter. Some followers reached out to us asking if we are really sure because Bitcoin is not moving higher and our Bitcoin forecast or Ripple forecast did not materialize yet. Hold on, is our answer, if we are right with our cryptocurrency predictions we are moving towards a consolidation. In our 50 cryptocurrencies investing tips for 2019 and 2020 we explained what a consolidation looks like, and it certainly is not a situation in which prices explode. The long term Bitcoin chart makes this point. It takes time, it is a process, and now is the time to accumulate cryptocurrencies.

The intuitive reaction to think that cryptocurrency prices will explode because the bear market is ending (read: the crypto winter is over) is understandable.

However, it shows that crypto investors have no affinity with market cycles. Never before in history did a strong bear market result in a strong bull market without a consolidation phase.

The key point is this: knowing how to handle a consolidation phase is the key to success.

Followers and crypto investors should not mix up how a situation ‘feels’ versus the real facts. Perception can be extremely misleading. Always stick to the facts, first and foremost the charts, as per our investing tips for long term investors.

Tip 47 from our 50 cryptocurrency investing tips is the one that is most applicable in this situation:

Tracking your longlist and shortlist of cryptocurrency tokens is a long term process. It may take many months, even years, before you believe a position in a specific token is justified. Use the chart and the analysis on long term trends (crypto bull market, crypto consolidation, crypto bear market) together with your longlist and shortlist.

That said, what is the long term Bitcoin chart suggesting?

As seen below on our own annotated version of the Bitcoin chart we see a very high probability of a trend change which is in the making. This giant rounding bottom which is currently being formed (yellow circle) has a bullish potential.

Note the similarities with the yellow circle in the first months of 2015. When the decline stopped, it got followed by sideways trading. This does not feel bullish, but it is the pre-requisite for a new bull market.

As said before ‘bear markets beget bull markets‘. It is at the depth of the cryptocurrency bear market that all sellers leave, which makes place for a market to consolidate and set the basis to turn into a future bull market.

Ed. note: InvestingHaven’s researcy team is in the process of preparing a series of new crypto tips, both cryptocurrencies but also crypto stocks. Become a member now to receive this with an email alert >>