On Thursday Oct 13th we explained why The Market Will Not Move 50% Lower Contrary To What The Gurus Are Telling You. We followed up with an insight from our Nasdaq Leading Indicator Suggesting Selling Pressure Is Over, hinting that the start of an End of Year rally would not be far away. We wrote those articles in the public space, copied from our weekly market analysis, at a time when financial media was screaming ‘a stock market crash is underway’. Once again, our leading indicators work better forecasting markets than lagging indicators like financial media.

Charts don’t lie.

Leading indicators don’t lie.

Financial media does not lie but heavily misleads.

That’s the reality.

One week ago, we concluded in our premium research:

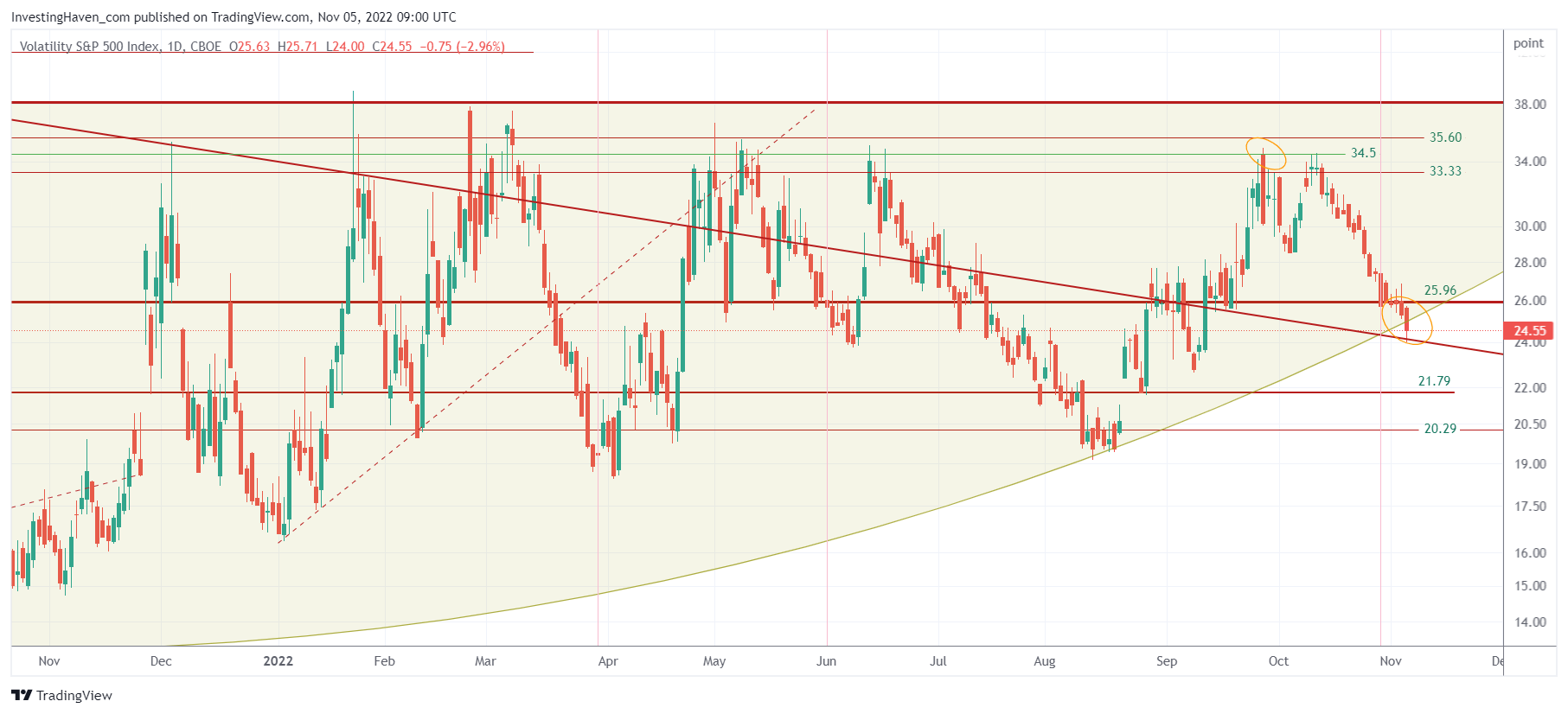

The S&P 500 volatility index got back near 25 points, down from 34-ish a month ago. You can see how Friday’s large candle was to be expected because Friday was a day with above average importance, see purple vertical line. Remember, the purple horizontal lines on our charts mark decisive days, we derive them from our chart analysis.

As seen on below chart, there is a purple vertical line which we derive from our timeline analysis. While 99% of analysts and investors are focused on price, we look at time separately and combine it with price. If the market prints a large candle on a decisive day, you know that it comes with an above average importance.

We review, in detail, 6 distinct volatility indexes, every weekend. They help us tremendously as they offer readings complementary to stock index charts. This is the conclusion, one week ago, from reading all 6 volatility indexes:

The volatility indexes a structurally changing trend.

And what it meant for markets:

We expect markets to continue to move higher before taking a break.

That’s exactly what the market did: after 4 volatile days it resolved higher.

Astute readers would argue that stock indexes are not trading above their closing prices from one week ago. But one of our leading indicators is painting a different picture. Particularly, VIX is breaking down, even though not visible to the average analyst. The next chart says it all.

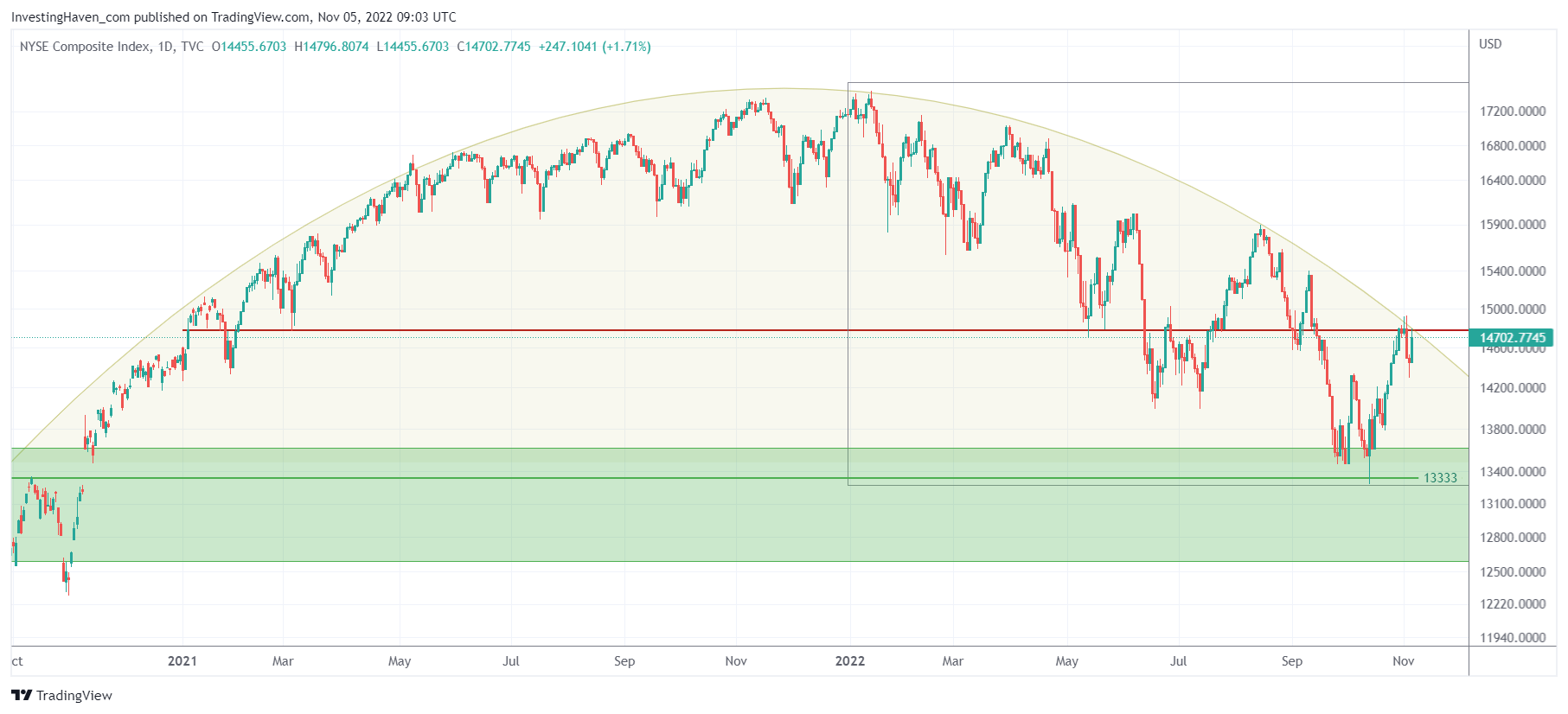

Looking at one of the leading stock indexes, the NYSE Composite Index, we can see the third touch of a 24 month pattern. Investors better pay attention at test number three, of any trendline and any pattern. A move higher in NYSE would come with a breakout.

Given the volatility indexes, we believe there is a high probability that ‘this time is different’.

Are you sure that markets have one way which is down? Watch out, the consensus trade is most often the wrong trade. That’s what history learns, you can ignore it, please do so at your own peril.