Ripple is our top favorite crypto company, that is not a secret. How high can the price of Ripple’s cryptocurrency, the XRP token, rise? In a discovery-like fashion we come to the answer in this Ripple forecast for 2019. In sum, we are convinced that the (XRP) token will move to $20. Our base case Ripple price forecast for 2019 is $20. We consider this our baseline Ripple forecast.

[Ed. note: on April 2nd, 2019 the new crypto bull market started. It is a fact now, with a giant breakout taking place in Bitcoin (BTC). Sign up for InvestingHaven’s blockchain & cryptocurrency investing service to get access to how to play the new crypto bull market, a selection of 10 best cryptocurrencies to invest in as well as blockchain stocks to consider.]

[Ed. note: This article about Ripple’s XRP price forecast for 2019 was originally published on September 21st, last year. Readers can verify this by checking the dates on the charts. Throughout 2019 we will frequently update our Ripple price forecast. The new updates will appear at the bottom of the current forecast. It allows our followers to track the evolution of the XRP market, Ripple’s evolution but also how our initial Ripple price forecast 2019 performs. Last update of Ripple’s forecast: April 14th, 2019.]

Relative strength during the crypto winter

The price of Ripple’s XRP token (Ripple’s cryptocurrency) broke out from its 8 month downtrend in Sept 2018. We are convinced this is the end of Ripple’s bear market, it is a bold statement not only for our Ripple price prediction but also the whole crypto market. Our Ripple price forecast for 2019, or to just a different term, our Ripple price prediction, is based on our market call that the crypto winter has ended (published in Feb 2019).

There is so much to say about Ripple, but it can all be summarized with this one sentence. Ripple is the blockchain or crypto company with the highest potential in the world. That’s a big statement, and we are convinced of what we are saying for reasons laid out in this article.

Note that the type of detailed insights from this Ripple price forecast is normally reserved for our premium subscribers of our premium blockchain & crypto investing research service. It is really exceptional that we publicly release this type of exclusive research insights.

Ripple price low until recently, is any excitement justified?

With so much content living on the internet, and so many charts with short term focus, it is really easy to get lost. Losing the big picture is one of the most important pitfalls: the very short term focused attention span. Doing a Ripple price forecast for 2019 or beyond requires taking a step back and focusing on the big picture.

When we read headlines like this one (on CNBC this week) XRP rose 80 percent Friday after struggling as one of the worst performing top cryptocurrencies this year it really does not help crypto investors that are struggling with the kind of volatility they have never seen before.

As said many times before “less is more”. This applies especially in the crypto space where trading less will result in significantly higher profits. However, the vast majority of crypto investors tend to get shaken out of their positions because they tend to get too emotional resulting in transacting way too often.

What really is misleading in the above headline is the “worst performing top cryptocurrency” keyphrase. While this is not incorrect considering the last 8 months it certainly is useless and horribly wrong in the bigger scheme of things!

Want to see why? Check out Ripple’s long term price chart. Scroll down to the bottom of this article. You got our point, right?

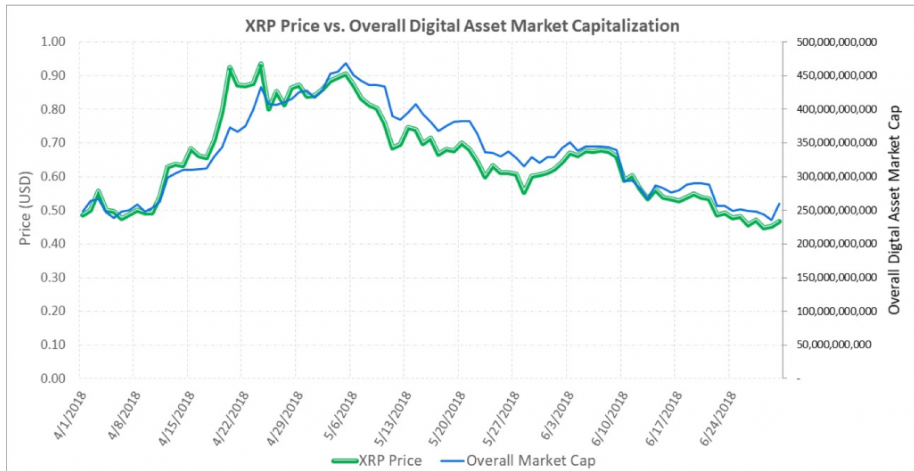

As per Ripple’s quarterly market report the price of XRP declined in a similar fashion and at a similar pace as the whole crypto market which can be seen on this chart.

In other words, the crypto market is cyclical in nature, and during a downtrend any cryptocurrency will fall victim of falling prices. Ripple’s token is no exception to this.

Why a Ripple price forecast should be based on lean startup principles

Many crypto investors started doubting the potential of Ripple, not only because of falling prices (as discussed above) but also because an increasing number of lawsuits against Ripple. What made things worse is this type of “research” that forecasted Ripple’s price to fall to $0.01.

How can anyone be serious about such a Ripple price forecast (XRP)? The method they used for their forecast may be legitimate and well thought through, but if the output is nonsense then you have to revise your framework. The fact that Ripple is the most mature and most advanced crypto company in the world can simply not be neglected, if you ignore this (as the above mentioned research did) you are doing something seriously wrong.

We are no crypto perma bulls, certainly no Ripple perma bulls. We are factual and as unbiased as possible investors that have learned the hard way over time. Yes, we can look at facts, further than just charts and article headlines. That’s what we will prove with this Ripple price forecast for 2019, so keep on reading, it will only get more interesting.

As per Tsaklanos in his 1/99 Investing Principles it is only 1% of news that matters to investors. The rest is noise and even dangerous for your portfolio and mental / emotional health. In other words, 99% of news will damage your wealth and health!

Lean startup principles vs. investing opportunities

Anyone understanding lean startup principles, how companies grow and become successful, combined with technology and its adoption will see lots of relevant news about Ripple. It really is not only this news that came out early this week that is relevant: Ripple about to launch xRapid. If you search the web today everyone talks about xRapid being the reason for Ripple’s price explosion. However, there is more, much more, that preceded this.

We will look at many of these very relevant news items about Ripple in the next section. It is clear that they all together point out the following. Ripple has technology with an amazing potential and a proven track record. They have also shown the ability to leverage their technology. They solve a real life problem. As part of their customer discovery phase they show their ability to scale. No other blockchain or crypto company today is this far advanced. This of course is crucial input for our Ripple price forecast 2019.

Ripple price prediction vs. untapped crypto potential

Anyone talking about Ripple’s clients and Ripple’s technology usage mostly refers to RippleNet. This is a bank-to-bank settlement service. It has a unique characteristic that its cross border payments are instant. Moreover, transaction costs are ridiculously low. As per Ripple’s insights corner:

RippleNet is active in over 40 countries across six continents. New payment corridors have opened up in North America, Asia, Africa, Europe and South America. This provides new access to better international payment services in markets where remitters and SMEs are in the most need. What’s more, RippleNet’s newest corridors have a combined potential market that totals over $2 Billion in inflows over the last year.

This is impressive. Although it is a short quote there is plenty of data that suggests how quickly Ripple is growing, and how much potential they have to be profitable.

Just to illustrate the number and type of clients that Ripple currently has (from Wikipedia):

The other product of Ripple is xRapid which will actively use Ripple’s token. This is a more generic settlement service that any payment service provider or payment processing provider can leverage, in settling a payment to any receiver, in the same country or abroad.

The potential of xRapid can be illustrated by this recent announcement of the partnership between Fleetcor and Ripple. Fleetcor, a $19 billion payment services firm in the US, announced earlier this year they are piloting with Ripple’s xRapid software. Fleetcor processes many billions of dollars annually, and help many thousands of business clients make international payments to suppliers and employees.

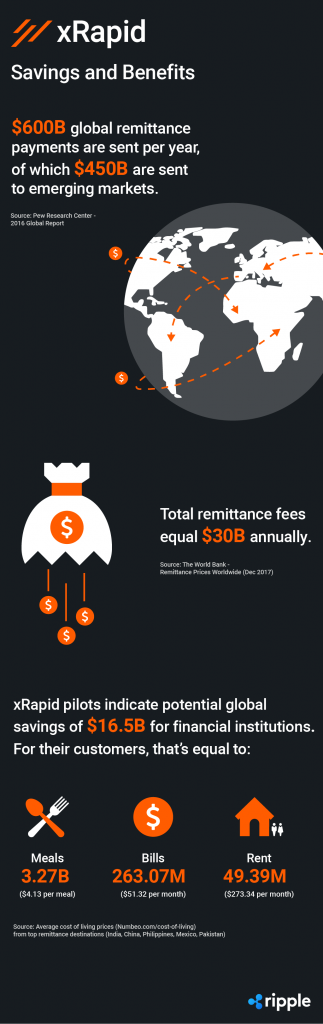

The potential of the remittance payments markets is huge. Remittances are big business today. The total global payments are close to $600 billion annually. The fees associated with these payments total nearly $30 billion per year. Yet, the majority of them are small, according to the World Bank, averaging about $500 each, according to this source.

We believe this visualization helps with understanding the potential:

When it comes to xRapid it is difficult to find official data on how many companies are experimenting with this solution. The reason why this is important information is because it could give us a pointer on the potential once xRapid goes to production (it is currently in beta as a proof of concept with a small group of partners/clients).

One site, however, provides information on Ripple’s current client base: rppl.info. Although it is quite hard to verify the source and legitimacy of the info it seems to be in line with the info that Ripple provides on their site (in general). Pay special attention to the column ‘testing xRapid‘. This list is already impressive, which suggests to us that we can easily expect a very successful and fast growing xRapid product.

There is even more potential. Ripple is also working on its Xpring solution.

At Ripple, we will continue to use XRP to make it perfect for entrepreneurs looking to solve problems across identity, trade finance, gaming and virtual goods, provenance, real estate, insurance, digital media and many other industries. Xpring’s entrepreneurs and companies will leverage XRP for use cases like these, among others.

There is a huge potential, and the red line throughout all these factual data points is that Ripple knows how to create value. That’s what sets future successful companies apart from the 90% of startups that fail miserably!

It is fair to say that Ripple is a company that is brilliant in solving real life problems.

Moreover, more generally, a number of the largest firms in finance made a series of announcements about moving into the space:

- Goldman Sachs announced plans to start a digital asset trading desk.

- JP Morgan named a head of “crypto-asset strategy.”

- Nasdaq’s CEO Adena Friedman said it would consider becoming a crypto exchange.

- Fidelity said it was building a digital asset exchange.

- Nomura became the first bank to offer custody services for digital assets.

This suggests the huge untapped potential in the crypto market, and, similarly, the potential for Ripple.

Why our Ripple price forecast for 2019 is ultra-bullish

Given everything discussed so far in this Ripple price forecast 2019 article we believe there is one underlying dynamic, combined with 3 catalysts, which justify a super-bullish outlook.

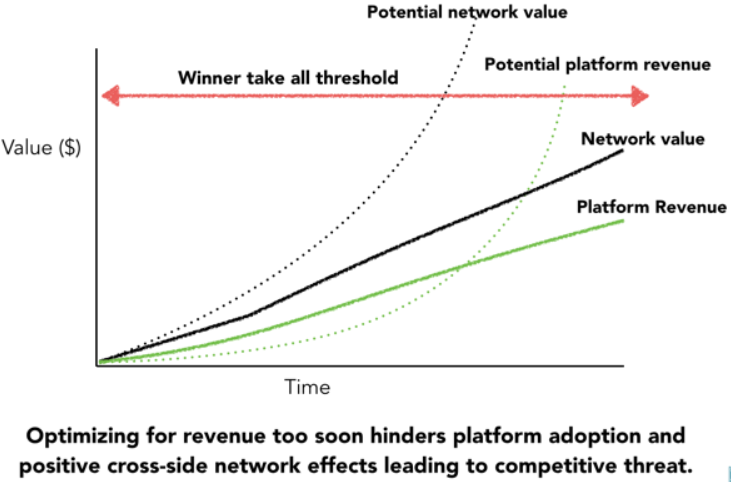

Shout out to Chris Smith on Medium.com who published this picture which is exactly what we were looking for: network effects! Mind the difference between the ‘right path’ (black lines) vs. the pitfall (green lines).

The point about network effects is that they build up slowly, but accelerate very fast in a very short period of time.

Any similarity with Ripple’s growth path? All the data points discussed so far perfectly fit in phase one (before acceleration), in general. Per solution, however, it seems that Ripplenet is in the acceleration phase and xRapid still in early stages (Xpring as well).

What plays a critical role here is that Ripple probably is not short on capital. This sets Ripple apart from almost any other startup. The millions of XRP tokens they created themselves probably will help to fund their growth. They also have funding from companies like Google. Our interpretation is that they are not in a rush to generate revenue. If that’s correct it suggests they will not make the mistake of being on the green path on the chart above, most likely they will remain on the black line. Note: the black line is the right path to achieve network effects.

Network effects as an indicator for our Ripple price forecast

The network effect is one major underlying force at work but we see 3 more fundamental catalysts underpinning our super-bullish Ripple price forecast 2019.

- “Convergence“: Ripple announced plans recently that their different technology solutions will converge over time into one stack. They also said the XRP token will play a functional role in there. This news went under the radar because it came out when the crypto markets was declining. However, it is this 1% of relevant news as per InvestingHaven’s 1/99 rules. This may not occur this year, but starting 2019 we will hear more about this.

- Institutional money will flow primarily into Ripple’s XRP token. Think of the Bakkt platform as well as the Nasdaq offering cryptocurrency investing to institutions. If you were an institution with millions of dollars to invest which cryptocurrency would you choose with a ‘low risk high reward’ perspective? In the first place: Ripple is the ONLY crypto company with so many respected clients. Would you put money into Bitcoin cash (what added value does it deliver)? Or in EOS (with typical Chinese nontransparency)? Tether (what are they doing) or Litecoin (its founder selling all its holdings last year)? The serious money will flow into Ripple’s XRP first, is our forecast, then Bitcoin and Ethereum and Stellar Lumens.

- Ripple has no futures to short sell. The big issue with Bitcoin is that its astronomical returns will be capped, going forward, because of Bitcoin futures. However, money will still flow into crypto assets that do not have short selling so they can aim for astronomical returns. We believe the XRP token is best positioned for this. In other words, futures will limit Bitcoin’s future potential, but will help XRP rise to levels nobody believes in today!

With this rich set of data points and insights we believe it is about time to do our Ripple price forecast for 2019 (XRP)!

Our Ripple price forecast for 2019: 20 USD XRP

We went back into our archives and found our analysis from a year ago in which we rightfully stated that XRP $0.26 was the most important price point. Like clockwork XRP hit the same $0.26 level end of August / early September this year where it bottomed. The breakout point from the previous bull run has now become support.

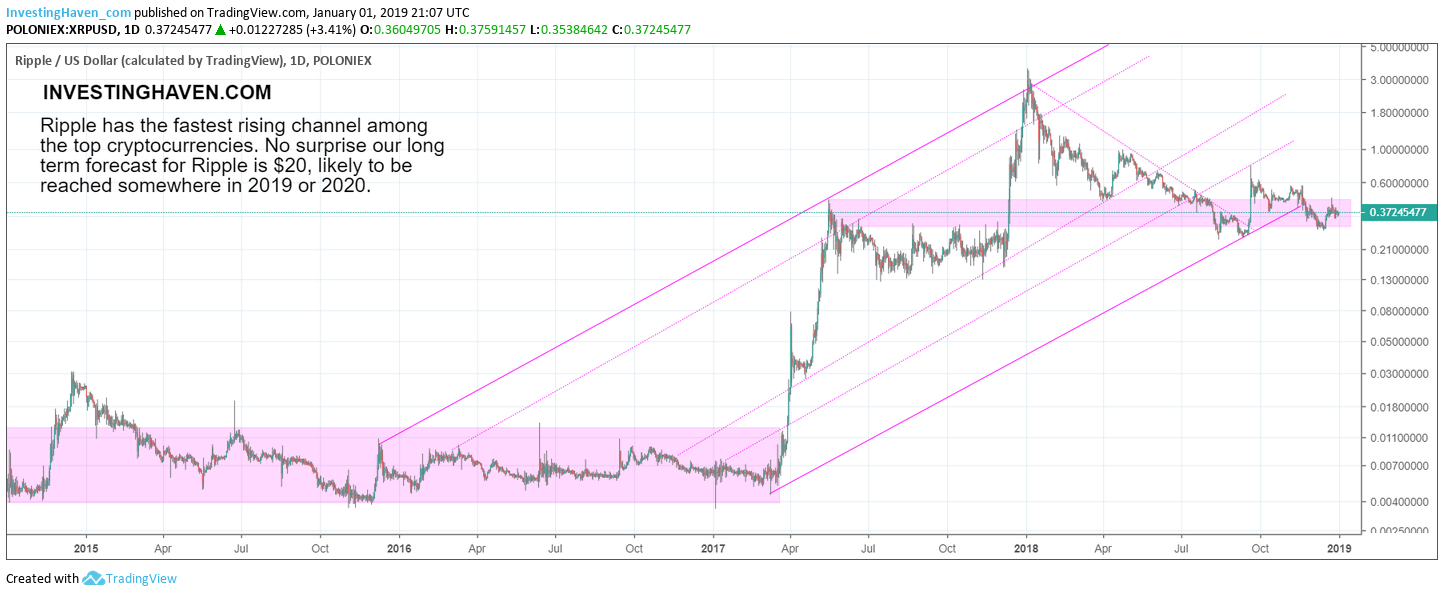

This confirms Ripple’s new bull market. The chart below confirms it as well by the way.

Ripple’s long term chart shows a perfectly rising channel. Our forecast is that Ripple will hit the top of this channel at least once more. Depending on how much of the above discussed potential is realized it may happen twice.

What happens if all assumptions above materialize? We are talking institutional money flowing to Ripple’s token, Ripple’s tech solutions converging making use of XRP. Add to this Ripple’s continued growth without chasing revenue to reach network effects. What happens is that XRP will hit the higher side of this channel twice in the next few years.

What is our base case forecast for Ripple? We see one touch to the upper side of Ripple’s long term rising channel. That’s presumably around the $20 level. We are confident that our Ripple price forecast of $20 for 2019 will materialize. It may happen in 2020 though. Regardless, we consider this the base case scenario.

** January 6th, 2019 **

Ripple price chart as 2019 kicks off

It was a rough ride at end of the previous year, for all global markets including cryptocurrencies.

That’s why it is worth revising Ripple’s price chart in this article which was originally written 3 months ago as part of our Ripple price forecast 2019!

Below is an up-to-date chart of Ripple’s price. As 2019 kicks off XRP has fallen through its long term rising channel. There are a couple of developments on this chart which cause us to maintain our very bullish opinion. First, it has held up strongly as few in the crypto space have, and it has set a higher low at the end of last year. Second, it is trading above the highs of 2017, above a horizontal band which is a characteristic of XRP (similar to 2015 and 2016).

** February 17th, 2019 **

2 Questions on our Ripple price forecast of 20 USD

Many readers have reached out to us asking questions about our Ripple forecast of 20 USD. We pick out the 2 most important questions, and provide the answer we have shared only to our premium crypto subscribers!

Note that the 2 answers on our Ripple forecast outlined below were only sent to members of our blockchain & crypto investing research service. This happens only very rarely. Readers of this article should consider it a sneak preview that is very exceptional.

Ripple forecast question #1: Ripple’s XRP has so much good news. Yet, prices go down. Are you really convinced that your 20 USD price forecast is reasonable?

Our answer, published in the protected crypto research area: Ripple is amazing. Its growth will go really, really hard. Here are a couple of points to consider:

- They are about to revolutionize a giant market. This is a process that takes years, Ripple in its current form exists less than 7y. How does anyone reasonably expect a world changing disruption, once in a generation, to accomplish in such a short time period.

- Patience is required.

- We feel really strong about the 20 USD forecast, if not 2019 then 2020.

- With the Nov 2018 breakdown the repair time will take some 9 additional months until proven otherwise.

- We are pretty sure that your XRP holdings will make up for all other non-quality cryptos you may have bought in the past.

- Don’t get trapped by the market and your virtual loss. Many smart investors are waiting to buy low.

- Things can only get better, even if we go lower from here in the next few weeks or months.

Ripple forecast question #2: What in your opinion is the best case price by the year end 2019. I keep reading about Ripple being passed by other coins. It’s not decentralized or scalable. People like Marius Kramer on Quora are very negative on Ripple. It’s all just confusing to a novice like me. You are bullish and positive, some other guys are negative and bearish.

Our answer, published in the protected crypto research area: Great point! Indeed confusing if you are a novice.

The technical answers to most of these questions are here in an article that we published in the public domain, because it was based on publicly available information: 10 Facts about Ripple for investors. We analyzed several documents and listened to in-depth interviews with executives of Ripple.

What you have to know about Ripple is that there are many proponents, but also a small group of opponents which tend to be vocal about their viewpoint. Very strange, but also very striking. No criticism, just an observation.

We have analyzed the counterarguments of the opponents, and don’t see lots of value in it when looking at things over time (with the timing dimension in mind). Some arguments may be somehow relevant at present day, but not taking into account the evolution that we see in Ripple’s value proposition and tech stack. Don’t forget these are relatively new technologies, they need time to evolve and comply with legal, banking systems, blockchain principles, and so on and so forth.

In sum, we don’t attach too much value as the arguments of opponents are pretty weak at best, if not at present day then over time.

Once you start focusing on what Ripple is establishing and accomplishing you can only conclude that this is truly amazing. Not any other cryptocurrency comes close to their accomplishments. That’s OUR focus to assess cryptos: value creation in the real world, and evolution in terms of progress over time.

2 Must-See Ripple price charts in Feb 2019

It was a rough ride at end of the previous year, for all global markets including cryptocurrencies.

However, the tide is turning, especially in cryptocurrencies and Ripple’s XRP. We are about to complete the crypto winter, and start a transition period. Yes, this is great news for our Ripple price forecast for 2019 and beyond.

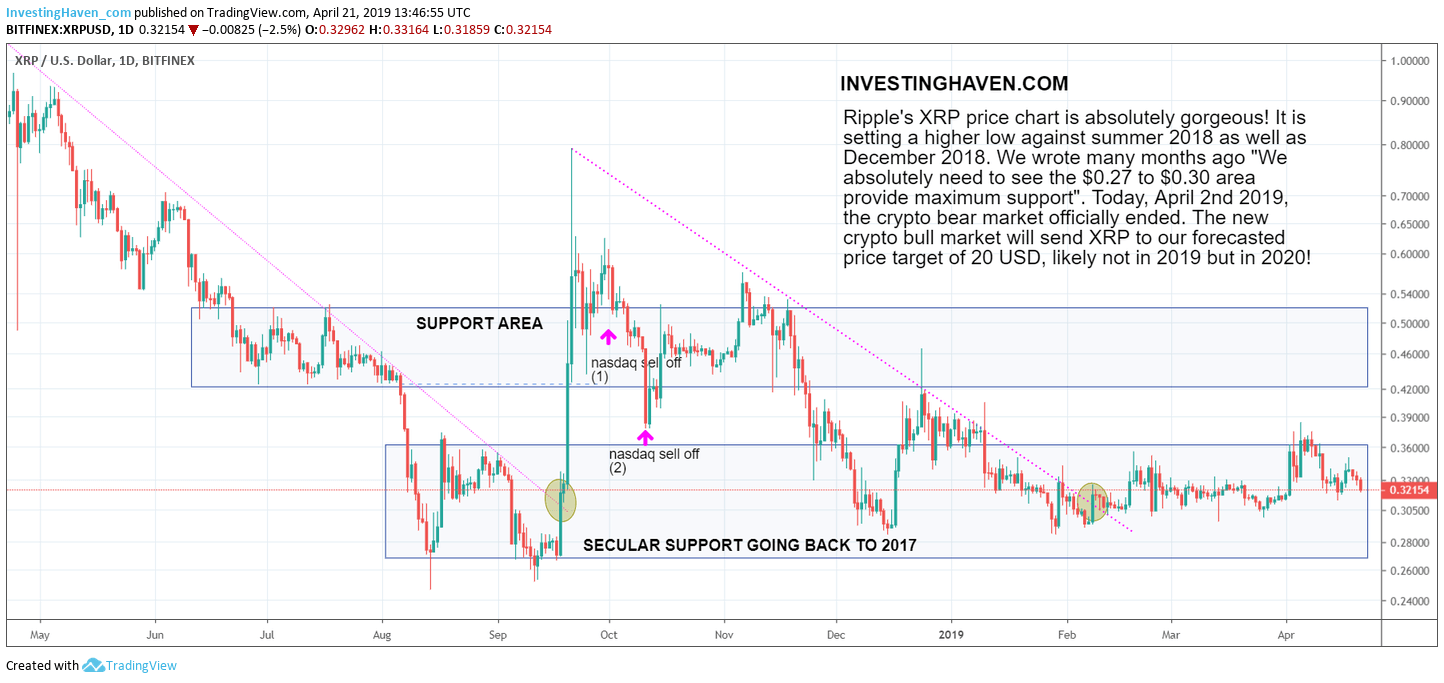

XRP is setting a higher low against summer 2018 as well as December 2018. We wrote many months ago “We absolutely need to see the $0.27 to $0.30 area provide maximum support” and guess what … it did!

XRP is now breaking out and starting its move it its higher support area, the one in the $0.42 to $0.52 area.

Moreover, and more interestingly, when zooming out we see an even more interesting pattern. Needless to say this makes us very exciting. It provides additional confirmation that our Ripple price forecast of 20 USD will come true.

Pessimism against cryptocurrencies peaked. Combine this with disinterest from the public and media, which gain momentum. At the same time we see the opposite on Ripple’s price chart. XRP prices start rising. That’s what happens if you are focused on the chart, you start seeing great patterns. That’s the only way to get past the noise of news on financial media or social media.

This finding comes from a recent article we wrote: Ripple’s XRP the Longer the Base, the Higher in Space. Essentially, what this sayings means is explained in the next paragraphs. Find also more in our 100 investing tips in which we dedicated a whole section to the principle ‘the bigger the base, the higher in space’.

- When prices reach the upper end of the range sellers take action. When prices get down to the bottom of the range buyers step up. This goes on for a longer than average period of time until it resolves itself in one direction or another.

- During sideways trading, sellers tend to leave the market with every new peak. A long consolidation scares away every seller. That’s the ideal market condition to create a new bullish trend.

- The psychology behind this has to do with the fact that participants are just worn out. They recognize the opportunity cost they’ve had to endure while waiting for a resolution. By the time the market breaks out, it’s just been too painful to remain in the trade. And that’s when Mr. Market resolves in an explosive move.

There is one cryptocurrency that has followed the rule ‘the bigger the base, the higher in space.’ It really is XRP.

It is pretty easy to recognize this pattern. Below is the weekly chart of XRP since its inception. Essentially, the majority of time XRP has been moving in a sideways pattern. For 18 months between summer 2014 and April 2017 it moved in a range between $0.0035 and $0.011.

As the saying goes ‘the bigger the base, the higher in space’: the base was big so the subsequent space was high. That’s why we believe that according to this principle Ripple’s XRP will break out strongly at a certain point, and move aggressively higher to our projected target of $20. If and when this breakout starts the subsequent rally will be violent.

** March 13th, 2019 **

More Confirmation of our Ripple Forecast: A Stream of Amazing News

If any cryptocurrency beats all records on great news in 2019 it must be Ripple. In the first 2 months of 2019 we saw a stream of amazing news. Interestingly, both the quality and meaningfulness of Ripple related news only improves.

Note that this is a characteristic not any other cryptocurrency has!

Below is a list of news items which appeared in the last weeks (February 2019 primarily). They classify as news that really matters’. The number of confirmations suggesting that our Ripple price forecast of 20 USD is underway continues to grow. This is strong evidence, fundamentally sound, based on solid value creation.

Ripple as a company keeps on expanding, fast, very fast

Ripple is the only company that has a cryptocurrency that is growing that fast. They are opening multiple offices in Asia, inaugurated a new London office, an have a breathtaking track record of cases with European companies helping them with their global expansion.

On the last point, these are some testimonials officially released by Ripple clients.

- Euro Exim Bank sees an increase velocity, volume, veracity and value of cross-border payments. Ripple helpled Euro Exim Bank develop key growth markets quickly and efficiently.

- Mercury FX has to offer faster and cheaper transactions around the world for its clients. Ripple is able to offer faster and cheaper services than SWIFT.

- Ripple is helping TransferGo in India which serves the largest global cross-border remittance market. With Ripple’s help it aims to become a global real-time payments company. The company officially says: “We see Ripple as a strategic partner moving forward.”

Ripple is all about the ‘internet of value’ proposition. It is important to note that Ripple offers innovation in how value moves across the globe. Moreover, it does so with 3 amazing differentiators: fast, reliable and cheap! That’s still a different type of service than just ‘payments’.

Japan’s SBI Bank works towards “mass crypto adoption” in Japan with Ripple and XRP

SBI Bank is an official partner of Ripple. The bank has a market cap in between $5B and $6B. Mr Yoshitaka Kitao, their chief officer, aims to leverage XRP in a way that will create mass crypto adoption in Japan. Listen to the details in this video on twitter.

That’s a very, very ambitious plan. The fact that Ripple is the partner that SBI Bank has chosen for this cannot be any coincidence!

Mr Yoshitaka Kitao is an influential in Japan’s banking and business world. He sees no functional value in Bitcoin, but only in XRP. He has a strong belief in the use cases and value that XRP can unlock. SBI will provide “investment instruments incorporating virtual currencies into institutional investors,” he said.

Mainstream financial media are confused, a great contrarian sign

Forbes, one of the giant financial media, writes about Ripple’s XRP listing on Coinbase:

“First, XRP has been plagued by negative press this year and as a result, the token has been lagging the broader market all year,” he stated. Second, while the first announcement did coincide with a modest rally, “those gains were quickly erased when the people who bought before the news sold into those buying after the news.”

Interestingly, this quote does not reflect the chart.

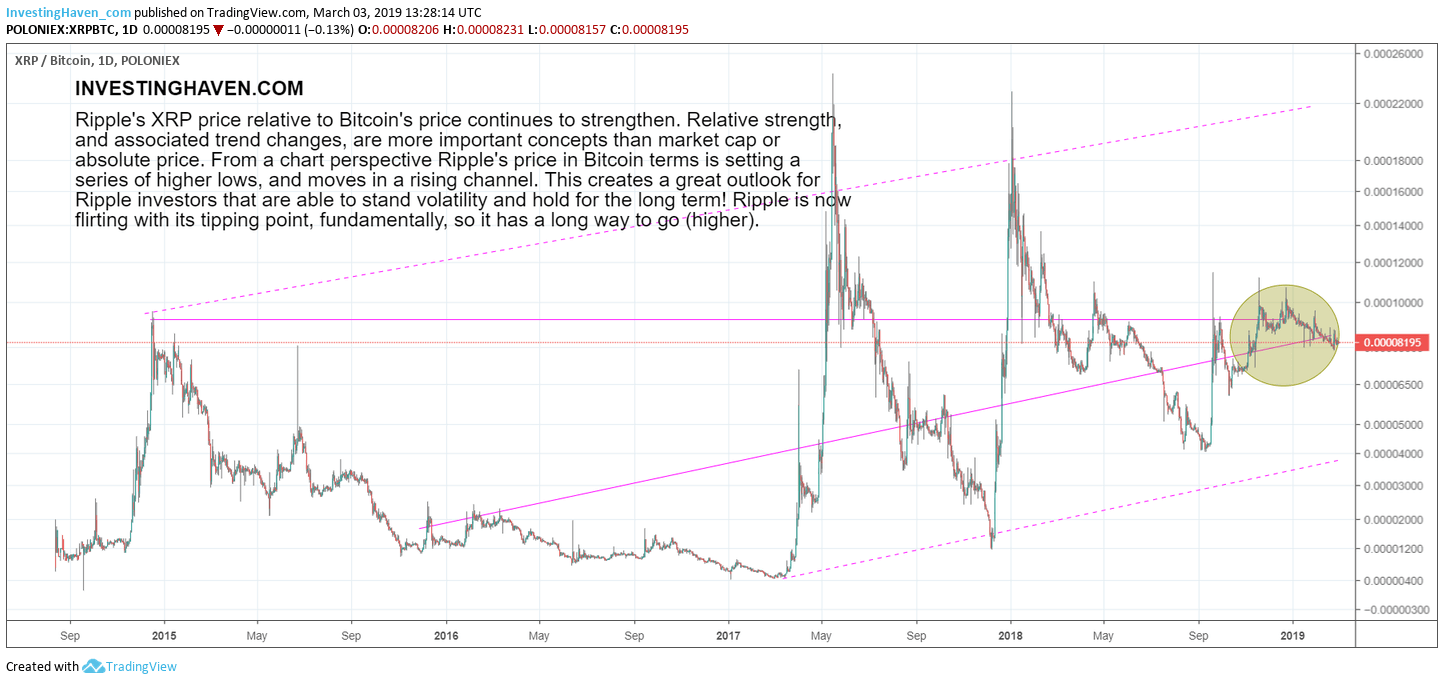

Below is the relative strength chart. It shows Ripple’s XRP against BTC. It is pretty simple: Ripple continues to gain in value against BTC over the long run. A series of higher lows over the last 3 years is a sign of strength, not weakness. The consolidation indicated with the yellow oval on this chart is meaningless in the bigger scheme of things.

This chart is certainly not in line with what Forbes writes. From a contrarian perspective this is great, because in the end news items and stories are meaningless compared with real life buy/sell action (which is what charts reflect).

And this brings us to our last and most essential point. The vast majority of people do NOT understand Ripple, especially not XRP. Their viewpoint is not the right one from an investment perspective.

This is what we wrote to our premium cryptocurrency investing members early March 2019:

In our crypto investing assessment framework it is ADOPTION that matters for future growth and stimulus of XRP prices. All XRP opponents talk about ‘crypto internals’ like market cap or technical features. Just to be clear: their point might technically be accurate, but it is irrelevant from a crypto investing perspective! The arguments of opponents are weak at best, and destructive for a portfolio at worst.

Obviously, cryptocurrencies will move higher on liquidity, which comes after adoption.

Confusion among media when the chart solidifies and adoption grows, what does it mean? It means the best imaginable situation for investors. It’s the best kept secret!

From a contrarian perspective this is a dream!

From our perspective it is a confirmation that our Ripple price forecast of 20 USD is underway!

** April 14th, 2019 **

XRP Buy Signal Officially Triggered: Bearish Sentiment Peaks

As unrealistic as it may sound InvestingHaven’s research team becomes amazingly bullish when it reads articles like the one that appeared last month on Forbes: Is Ripple a scam?

This is how markets work. When negative press increases on a fundamentally sound asset it is bullish. The prerequisite is that there is a strong fundamental case.

This is one simple trick to assess any criticism on Ripple or XRP, which we shared in our Ripple and XRP FAQ in the restricted area of the blockchain investing research section:

This is the rule of thumb that you may use: if at a minimum the one time the writer uses the word ADOPTION then there is reason to be concerned. If not, it’s worthless at best, and destructive for your portfolio at worst. Go back to this article we wrote Ripple Price Forecast For 2019 and study the chart in the “Why our Ripple price forecast for 2019 (XRP) is ultra-bullish” section. You see that Ripple is focused on creating network effects now. That’s the smartest thing they can do, and it’s based on ADOPTION.

How many times did you find a reference to “adoption” in the Forbes article? Exactly, none. The only thing that the author mentioned was that Western Union did not continue with Ripple after a trial period. The author ignored the 2 to 3 new customers that Ripple is signing up per week, up from 1 on average a year ago.

The underlying rationale is simple: when there is consensus on a certain direction of a stock, market or cryptocurrency, the opposite is likely going to happen.

The New Crypto Bull Market Is A Fact !

Ripple’s latest and greatest XRP price chart is absolutely gorgeous!

It is setting a higher low against the summer as well as December of 2018. We wrote many months ago “We absolutely need to see the $0.27 to $0.30 area provide maximum support”.

On April 2nd 2019, the crypto bear market officially ended with a giant Bitcoin breakout. The new crypto bull market will send XRP to our forecasted price target of 20 USD, likely not in 2019 but in 2020!

Why do we think so?

Very simple, because not one time did XRP break below support during the crypto winter. It did stay strongly above the previous highs of 2015 / 2016 / 2017. This is an incredibly powerful signal. It confirms the buy signal when combined with the lagging sentiment indicator and strong fundamental indicator.

We can’t help to accept the buy signal that XRP flashed in April of 2019.

[Ed. note: on April 2nd, 2019 the new crypto bull market started. Read Bitcoin & Crypto Bear Market Officially Ends, Bull Market Officially Starts. Sign up for InvestingHaven’s blockchain & cryptocurrency investing service to get access to how to play the new crypto bull market, a selection of 10 best cryptocurrencies to invest in as well as blockchain stocks to consider.]